Above the Line

Above the Line refers to all revenue generated and expenses incurred by a business that have a direct impact on reported profits. In effect, the term includes all activity reported on an organization's income statement. The term does not refer to other activity that only impacts the financing or cash flows of the business. For example, the receipt of funds from the sale of company stock is not considered to be above the line. Conversely, the sale of goods and the associated cost of goods sold are considered to be above the line. A different interpretation of the concept is that "above the line" refers to the gross margin earned by a business. Under this interpretation, revenues and the cost of goods sold are considered to be above the line, while all other expenses (including operating expenses), interest and taxes) are considered to be below the line.[1]

Example of Above-the-Line Costs[2]

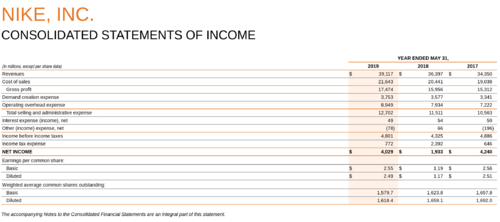

As an example, Nike Inc. reported $39.1 billion in sales in its fiscal year 2019. Gross profits were $17.5 billion. Therefore, Nike's above-the-line costs for the quarter were $21.6 billion, which the company labels cost of sales on its income statement

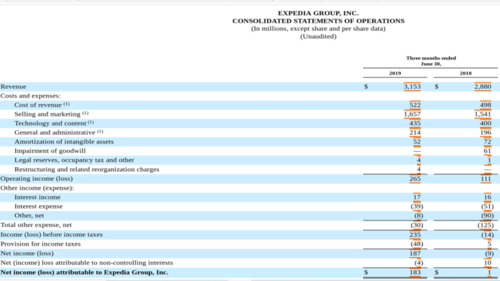

Also consider Expedia Inc., the travel website, which reported $3.2 billion in revenue in its second quarter of 2019 and an operating income of $265 million. The company is not involved in the production of goods so the company does not use gross profit as a metric in its income statement.

All expenses before operating income are considered above-the-line costs for Expedia, including the cost of revenue and selling and marketing expenses, among others.

Above-the-line Vs. Below-the-line[3]

The key difference between above and below the line is that Above the Line represents items which are shown above the value of the gross profit of the company in its statement of income during the period under consideration, whereas, Below the Line represents items which are shown below the value of the gross profit of the company in its statement of income during the period under consideration.

- Above-the-line

- It refers to as costs above the line that separates operating income from other expenses. It also refers to the costs above the line that separates gross profit from other operating expenses.

- The expenses incurred by COGS are wages to labor, manufacturing cost, cost of raw material, and all expenses other than interest, tax, and operating expenses.

- Companies that are in the service industry and utility companies consider expenses above operating income line as Above the Line cost. We can call it a cost before operating expenses incurred while [[Manufacturing|manufacturing].

- Anything above the operating income line is ATL cost. It is COGS or equivalent accounts that we subtract from sales done by the company to compute profit.

- Below-the-line

- Below the Line does not affect profit and loss account of the company; hence it tells about real the real financial health of the company without artificial inflating.

- Below the Line in accounting terms describes items other than the dividend paid or received by the company and retained profit of the company. It describes items like operating expenses, interest, and tax.

- ↑ Definition - What Does Above the Line Mean? Accounting Tools

- ↑ Example of Above-the-Line Costs Investopedia

- ↑ Above-the-line Vs. Below-the-line WallStreetMojo