Accounting Equation

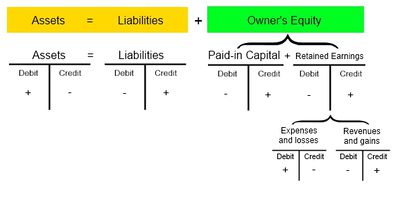

The basic accounting equation also called the balance sheet equation, represents the relationship between the assets, liabilities, and owner's equity of a business. It is the foundation for a double-entry bookkeeping system. For each transaction, the total debits equal the total credits.[1]

From the large, multi-national corporation down to the corner beauty salon, every business transaction will have an effect on a company's financial position. The financial position of a company is measured by the following items:[2]

- Assets (what it owns)

- Liabilities (what it owes to others)

- Owner's Equity (the difference between assets and liabilities)

The accounting equation (or basic accounting equation) offers us a simple way to understand how these three amounts relate to each other.

source: CommercePk

Nonprofit Accounting Equation[3]

The equation differs for a nonprofit entity since a nonprofit does not record any shareholders' equity. Instead, the equation for a nonprofit is as follows:

Assets = Liabilities + Net Assets

The net assets part of this equation is comprised of unrestricted net assets, temporarily restricted net assets, and permanently restricted net assets.

Additional Accounting Equation Issues[4]

What if you print the balance sheet and the total of all assets do not match the total of all liabilities and shareholders' equity? There may be one of three underlying causes of this problem:

- Rounding error. If your accounting software is rounding to the nearest dollar or thousand dollars, the rounding function may result in a presentation that appears to be unbalanced.

- Unbalanced starting numbers. If you have just started using the software, you may have entered beginning balances for the various accounts that do not balance under the accounting equation. The accounting software should flag this problem when you are entering the beginning balances.

- Unbalanced transactions. You may have made a journal entry where the debits do not match the credits. This should be impossible if you are using accounting software, but is entirely possible (if not likely) if you are recording accounting transactions manually.

See Also

References