Acid Test Ratio

The acid test ratio is similar to the current ratio except that Inventory, Supplies, and Prepaid Expenses are excluded. In other words, the acid test ratio compares the total of the cash, temporary marketable securities, and accounts receivable to the amount of current liabilities. The larger the acid test ratio, the more easily will the company be able to meet its current obligations.The acid test ratio is also known as the quick ratio. [1]

Formula[2]

The acid-test ratio can be calculated as follows:

Acid-Test Ratio = (Cash + Marketable Securities + Accounts Receivable) / Current Liabilities

A common alternative formula is:

Acid-Test Ratio = (Current assets – Inventory) / Current Liabilities

Example[3]

Let's assume Carole's Clothing Store is applying for a loan to remodel the storefront. The bank asks Carole for a detailed balance sheet, so it can compute the quick ratio. Carole's balance sheet included the following accounts:

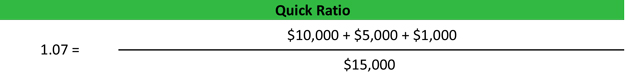

Cash: $10,000 Accounts Receivable: $5,000 Inventory: $5,000 Stock Investments: $1,000 Prepaid taxes: $500 Current Liabilities: $15,000 The bank can compute Carole's quick ratio like this.

source: My Accounting Course

As you can see Carole's quick ratio is 1.07. This means that Carole can pay off all of her current liabilities with quick assets and still have some quick assets left over.

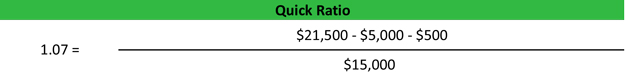

Now let's assume the same scenario except Carole did not provide the bank with a detailed balance sheet. Instead Carole's balance sheet only included these accounts:

Inventory: $5,000 Prepaid taxes: $500 Total Current Assets: $21,500 Current Liabilities: $15,000 Since Carole's balance sheet doesn't include the breakdown of quick assets, the bank can compute her quick ratio like this:

source: My Accounting Course

Why it Matters[4]

It is vital that a company have enough cash on hand to meet accounts payable, interest expenses, and other bills when they become due. The higher the ratio, the more financially secure a company is in the short term. A common rule of thumb is that companies with a Acid-Test or quick ratio of greater than 1.0 are sufficiently able to meet their short-term liabilities.

In general, low or decreasing acid- test ratios generally suggest that a company is over-leveraged, struggling to maintain or grow sales, paying bills too quickly, or collecting receivables too slowly. On the other hand, a high or increasing acid-test ratio generally indicates that a company is experiencing solid top-line growth, quickly converting receivables into cash, and easily able to cover its financial obligations. Such companies often have faster inventory turnover and cash conversion cycles.

Like most other measures, acid-test ratio does have its potential drawbacks. To begin, analysts commonly point out that it provides no information about the level and timing of cash flows, which are what really determine a company's ability to pay liabilities when due. The acid-test ratio also assumes that accounts receivable are readily available for collection, which may not be the case for many companies. Finally, the formula assumes that a company would liquidate its current assets to pay current liabilities, which is not always realistic, considering some level of working capital is needed to maintain operations.

It is also important to understand that the timing of asset purchases, payment and collection policies, allowances for bad debt, and even capital-raising efforts can all impact the calculation and can result in different acid-test ratios for similar companies. Capital needs that vary from industry to industry can also have an effect on acid-test ratios. For these reasons, liquidity comparisons are generally most meaningful among companies within the same industry.

References

- ↑ What is the Acid Test Ratio Accounting Coach

- ↑ The Acid Test Ratio Formula Investing Answers

- ↑ Example of The Acid Test Ratio My Accounting Course

- ↑ Why does the Acid Test Ratio Matter Investing Answers

See Also

Accounting Equation!Accounting Equation Accountable Care Organization (ACO) Accounts Receivable Factoring (FACTORING) Accounts Receivable Financing IT Strategic Planning e-Business Strategic Planning Governance of Information Technology (ICT) What is Enterprise Architecture Planning Information Technology Sourcing (IT Sourcing) Information Technology Operations (IT Operations) Chief Information Officer (CIO) Leadership