Economic Impact Analysis

Economic Impact Analysis is a methodology used to measure the effects of a project, policy or program on the economy. This can include factors such as jobs, income, productivity and competitiveness. EIA is often used in conjunction with other forms of analysis, such as benefit-cost analysis and financial feasibility.

Economic impact analyses usually employ one of two methods for determining impacts. The first is an input-output model (I/O model) for analyzing the regional economy. These models rely on inter-industry data to determine how effects in one industry will impact other sectors. In addition, I/O models also estimate the share of each industry's purchases that are supplied by local firms (versus those outside the study area). Based on this data, multipliers are calculated and used to estimate economic impacts. Examples of I/O models used for economic impact analyses are IMPLAN, RIMS-II, Chmura, and Emsi.

Another method used for economic impact analyses are economic simulation models. These are more complex econometric and general equilibrium models. They account for everything the I/O model does, plus they forecast the impacts caused by future economic and demographic changes. One such an example is the REMI Model

The Importance of Economic Impact Analysis[1]

An economic impact analysis (EIA) helps communities understand how local economies work. An EIA will help you and your community understand questions like:

- How important is a business or industry to your local economy?

- What kind of investment should you make in your local economy?

- How many jobs will be affected by a change in the economy?

- How will a change affect the amount of money that comes to your economy?

Types of Economic Impact[2]

The economic impact is the financial effect that an event, program, project, or policy has on an entity. That entity could be a person, a neighborhood, a city, an industry, or an entire country.

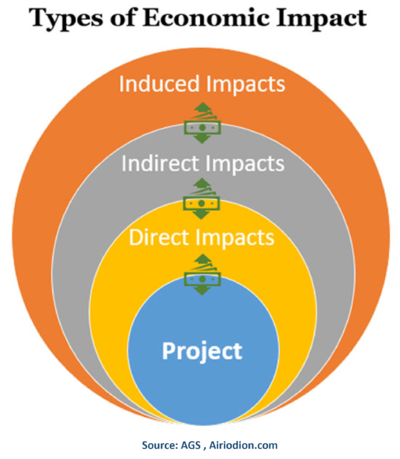

There are typically three key types of economic impacts being analyzed when doing an economic impact study.

- Direct Economic Impacts: Direct economic impacts would be the employment and income generated directly by a project. For example, if you were building a new distribution center in a city, you would need to hire labor, buy materials from suppliers, and contract services for technology infrastructure.

The income that generates for the businesses and contractors you work with would be counted as a direct economic impact.

- Indirect Economic Impacts: The indirect impacts used for an economic impact analysis would include employment and income generated through secondary sources. For example, if you’ve hired a technology firm to add an IT infrastructure to your new distribution center, the money you pay that firm is a direct impact. But when that firm buys IT hardware from a supplier to fulfill the project, the revenue the supplier generates from the purchase is considered an indirect economic impact.

- Induced Economic Impacts: The spending that is a result of income generated from direct and indirect economic impacts is considered induced economic impacts. An example of this would be the increased spending on consumer products, entertainment, food, etc. by employees that found themselves with more disposable income as a result of getting a job due to the new distribution center project. Induced economic impacts are one of the more difficult variables to estimate when doing economic impact analysis.

Sources of Economic Impact[3]

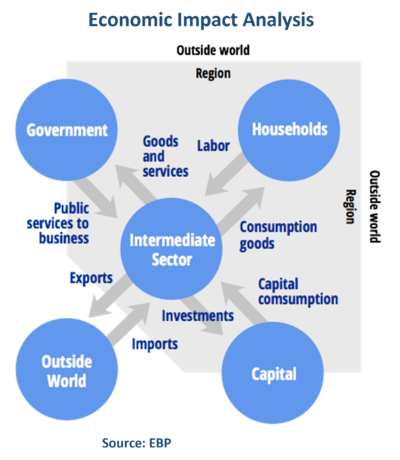

In addition to the types of impacts, economic impact analyses often estimate the sources of the impacts. Each impact can be decomposed into different components, depending on the effect that caused the impact. Direct effects are the results of the money initially spent in the study region by the business or organization being studied. This includes money spent to pay for salaries, supplies, raw materials, and operating expenses.

The direct effects from the initial spending creates additional activity in the local economy. Indirect effects are the results of business-to-business transactions indirectly caused by the direct effects. Businesses initially benefiting from the direct effects will subsequently increase spending at other local businesses. The indirect effect is a measure of this increase in business-to-business activity (not including the initial round of spending, which is included in the direct effects).

Induced effects are the results of increased personal income caused by the direct and indirect effects. Businesses experiencing increased revenue from the direct and indirect effects will subsequently increase payroll expenditures (by hiring more employees, increasing payroll hours, raising salaries, etc.). Households will, in turn, increase spending at local businesses. The induced effect is a measure of this increase in household-to-business activity. Finally, dynamic effects are caused by geographic shifts over time in populations and businesses.

Measuring Economic Impact[4]

Economic impact is typically measured using four metrics;

- Employment: Employment (or jobs) is probably the easiest one. Typically, employment impact is reported as a headcount of jobs—not in terms of full-time equivalents. So, employment consists of a count of jobs that include both full-time and part-time workers. In this way, 10 full-time workers and 10 part-time workers would be reported as 20 jobs. Studies may vary in how this is reported, but most models take this headcount approach.

- Household earnings: Household earnings (or workers’ earnings or labor income) is the total amount of income paid to all workers and owners, including wages and salaries, employer provided benefits, and business owner profits. Some studies might report salaries which, depending on how things were calculated, could be correct too.

- Economic output: Economic output (or gross output or output) is the total dollar amount of all sales made or the value of goods and services created in the activity under analysis. Economic output represents the money spent to purchase all of the inputs to a product as well as the money received when the product is sold. This measure is a duplicative total because the value of inputs are counted multiple times when those products are used in the production of other goods and services. Consider a wood furniture manufacturer who buys raw lumber for $50, cuts, sands and stains the wood to create a chair that sells for $200. Economic output in this example would be $250. If this sounds problematic, and you’d rather focus just on the value added at each step, you’re in luck.

- Value added: Value added is the total dollar amount of only new sales made. Therefore, it is output minus the value of anything that was already sold in the market. In our wood furniture example, value added is $200.

Alternatives or Complements to Economic Impact[5]

There are several other useful economic evaluation tools that aid in the decision making process. Often, these analyses follow similar steps and may be add-ons to an economic impact study; however, they do not examine the economic impact of an intervention.

- Economic Contribution Study: Contribution studies are frequently confused with economic impact studies. This analysis looks at the total dollar, jobs, incomes, taxes and other economic activity a particular policy, program, business or project generates. However, when conducting a contribution study an analyst does not ask the question “would this money be in the economy without the subject of study?” As such, all or part of the final dollars stated in this study could be attributed to other economic activities in the region, not just the intervention, leading to double or triple counting of dollars within the economy. However, contribution studies may also account for money that does not leave the region as a result of the activity (e.g. spending by residents).

- Cost-Benefit Analysis: This form of analysis is able to evaluate a large range of projects that encompass more than direct economic activity while accounting for the costs associated with that activity. While it may use an I/O model to account for economic benefits, it will add other methods to assess other benefits and costs of the activity. For instance, a community development project looking to enrich a downtown area with an art installation may not generate economic activity. However, there are several tangible societal and community benefits derived from the installation that have economic value.

See Also

Direct Economic Impact

Economic Impact Assessment (EIA)

Business Impact Analysis (BIA)

Total Economic Value (TEV)

References

- ↑ Why is Economic Impact Analysis Important? University of Minnesota Extension

- ↑ Types of Economic Impact AGS

- ↑ Sources of economic impacts Wikipedia

- ↑ Economic Impact Metrics Impact Data Source

- ↑ Alternatives or Complements to Economic Impact CECE Virginia Tech