Difference between revisions of "Employee Benefits"

| Line 1: | Line 1: | ||

'''Employee Benefits''' are any kind of tangible or intangible compensation given to [[Employee|employees]] apart from base wages or base salaries. Employee benefits are defined as indirect, non-cash, or cash compensation paid to an employee above and beyond regular salary or wages. | '''Employee Benefits''' are any kind of tangible or intangible compensation given to [[Employee|employees]] apart from base wages or base salaries. Employee benefits are defined as indirect, non-cash, or cash compensation paid to an employee above and beyond regular salary or wages. | ||

| + | |||

== Employee Benefits Definition<ref>What are Employee Benefits? [https://www.hrzone.com/hr-glossary/what-are-employee-benefits HR Zone]</ref> == | == Employee Benefits Definition<ref>What are Employee Benefits? [https://www.hrzone.com/hr-glossary/what-are-employee-benefits HR Zone]</ref> == | ||

| − | Employee benefits are non-financial compensation provided to an employee as part of the employment contract. Employee benefits may be required by law (depending on the risk associated with the job or industry and the laws of the country where the job is held) or provided voluntarily by the employer. From an employee’s point of view, a good package of benefits increase the value they receive from their working life and contribute to their own health and that of their family. From an employer’s point of view, benefits help staff remain happy and committed, reducing the chance of them leaving to work elsewhere. In some instances staff swap a proportion of their pre-tax salary for a benefit, known as salary sacrifice – the Cycle2Work scheme is a good example of this, whereby companies buy a bike and the employee loans it from them until the initial purchase amount has been paid off. Benefits can be taxable or non-taxable. Private medical insurance is one of the most common taxed benefits. In the last ten years, employers have increasingly provided less traditional employee benefits that provide benefit to the employee’s life as a whole rather than just their working life – examples of these are childcare, healthy foods in the office and subsidized gym memberships. Due to increased competition for good candidates, the benefits an employer provides for a particular position will be an important factor in attracting applicants. | + | Employee benefits are non-financial compensation provided to an employee as part of the employment contract. Employee benefits may be required by law (depending on the risk associated with the job or industry and the laws of the country where the job is held) or provided voluntarily by the employer. From an employee’s point of view, a good package of benefits increase the value they receive from their working life and contribute to their own health and that of their family. From an employer’s point of view, benefits help staff remain happy and committed, reducing the chance of them leaving to work elsewhere. In some instances staff swap a proportion of their pre-tax salary for a benefit, known as salary sacrifice – the [[https://www.cycle2work.info/ Cycle2Work scheme]] is a good example of this, whereby companies buy a bike and the employee loans it from them until the initial purchase amount has been paid off. Benefits can be taxable or non-taxable. Private medical insurance is one of the most common taxed benefits. In the last ten years, employers have increasingly provided less traditional employee benefits that provide benefit to the employee’s life as a whole rather than just their working life – examples of these are childcare, healthy foods in the office and subsidized gym memberships. Due to increased competition for good candidates, the benefits an employer provides for a particular position will be an important factor in attracting applicants. |

| + | |||

| + | |||

| + | == Ways to structure employee benefits<ref>What are the Different Ways Employee Benefits can be Structured? [https://www.peoplekeep.com/blog/small-business-101-the-definition-of-employee-benefits Peoplekeep]</ref> == | ||

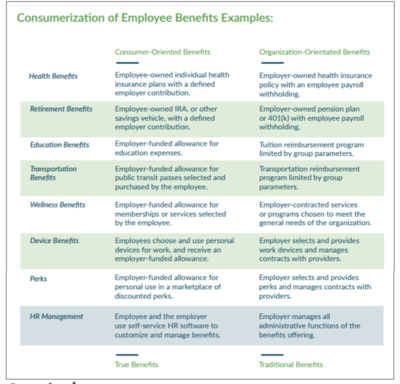

| + | In addition to the different types of employee benefits, companies must evaluate how to structure the benefit. Employers have two different ways to structure, contribute, and offer employee benefits: | ||

| + | *Organizationally: These are benefits structured in “traditionally” They are generally employer-owned and employer-selected. Examples include a traditional health insurance policy, retirement pension or 401(k), or formal wellness program. | ||

| + | *Employee-oriented: This benefit structure focuses on the employee as an individual. With this approach. With this type of benefit employees use employer-funded dollars to customize their benefits using technology. | ||

| + | To help clarify these definitions, here is a chart showing examples of common employee benefits using these two approaches. | ||

| + | |||

| + | |||

| + | [[File:Employee Benefits.png|400px|Employee Benefits]]<br /> | ||

| + | source: Peoplekeep | ||

Revision as of 18:25, 6 March 2021

Employee Benefits are any kind of tangible or intangible compensation given to employees apart from base wages or base salaries. Employee benefits are defined as indirect, non-cash, or cash compensation paid to an employee above and beyond regular salary or wages.

Employee Benefits Definition[1]

Employee benefits are non-financial compensation provided to an employee as part of the employment contract. Employee benefits may be required by law (depending on the risk associated with the job or industry and the laws of the country where the job is held) or provided voluntarily by the employer. From an employee’s point of view, a good package of benefits increase the value they receive from their working life and contribute to their own health and that of their family. From an employer’s point of view, benefits help staff remain happy and committed, reducing the chance of them leaving to work elsewhere. In some instances staff swap a proportion of their pre-tax salary for a benefit, known as salary sacrifice – the [Cycle2Work scheme] is a good example of this, whereby companies buy a bike and the employee loans it from them until the initial purchase amount has been paid off. Benefits can be taxable or non-taxable. Private medical insurance is one of the most common taxed benefits. In the last ten years, employers have increasingly provided less traditional employee benefits that provide benefit to the employee’s life as a whole rather than just their working life – examples of these are childcare, healthy foods in the office and subsidized gym memberships. Due to increased competition for good candidates, the benefits an employer provides for a particular position will be an important factor in attracting applicants.

Ways to structure employee benefits[2]

In addition to the different types of employee benefits, companies must evaluate how to structure the benefit. Employers have two different ways to structure, contribute, and offer employee benefits:

- Organizationally: These are benefits structured in “traditionally” They are generally employer-owned and employer-selected. Examples include a traditional health insurance policy, retirement pension or 401(k), or formal wellness program.

- Employee-oriented: This benefit structure focuses on the employee as an individual. With this approach. With this type of benefit employees use employer-funded dollars to customize their benefits using technology.

To help clarify these definitions, here is a chart showing examples of common employee benefits using these two approaches.

- ↑ What are Employee Benefits? HR Zone

- ↑ What are the Different Ways Employee Benefits can be Structured? Peoplekeep