Employee Benefits

Employee Benefits are any kind of tangible or intangible compensation given to employees apart from base wages or base salaries. Employee benefits are defined as indirect, non-cash, or cash compensation paid to an employee above and beyond regular salary or wages.

Employee Benefits Definition[1]

Employee benefits are non-financial compensation provided to an employee as part of the employment contract. Employee benefits may be required by law (depending on the risk associated with the job or industry and the laws of the country where the job is held) or provided voluntarily by the employer. From an employee’s point of view, a good package of benefits increase the value they receive from their working life and contribute to their own health and that of their family. From an employer’s point of view, benefits help staff remain happy and committed, reducing the chance of them leaving to work elsewhere. In some instances staff swap a proportion of their pre-tax salary for a benefit, known as salary sacrifice – the [Cycle2Work scheme] is a good example of this, whereby companies buy a bike and the employee loans it from them until the initial purchase amount has been paid off. Benefits can be taxable or non-taxable. Private medical insurance is one of the most common taxed benefits. In the last ten years, employers have increasingly provided less traditional employee benefits that provide benefit to the employee’s life as a whole rather than just their working life – examples of these are childcare, healthy foods in the office and subsidized gym memberships. Due to increased competition for good candidates, the benefits an employer provides for a particular position will be an important factor in attracting applicants.

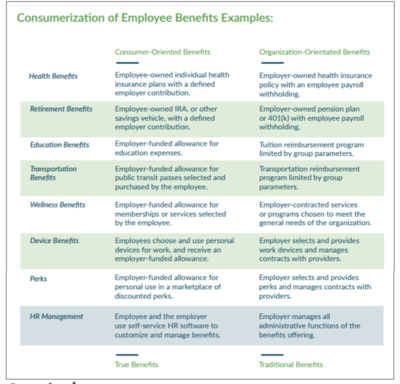

Ways to structure employee benefits[2]

In addition to the different types of employee benefits, companies must evaluate how to structure the benefit. Employers have two different ways to structure, contribute, and offer employee benefits:

- Organizationally: These are benefits structured in “traditionally” They are generally employer-owned and employer-selected. Examples include a traditional health insurance policy, retirement pension or 401(k), or formal wellness program.

- Employee-oriented: This benefit structure focuses on the employee as an individual. With this approach. With this type of benefit employees use employer-funded dollars to customize their benefits using technology.

To help clarify these definitions, here is a chart showing examples of common employee benefits using these two approaches.

While organizational-oriented benefits are more traditional structures for benefits, many small employers are finding consumer-oriented benefits are of equally high value to employees, are typically more flexible, and also more affordable. Whereas organizational-oriented benefits have historically been the way to offer benefits, many employers are turning to consumer-oriented benefits to better meet the expectations of employees and to better control cost.

Employee Benefits Plans[3]

Depending on the type of organization and the job, employee benefits may be quite different. For example, government employee benefit packages for full-time employees look very different from the packages offered to part-time employees. Employee benefits packages are typically discussed during the final interview or at the time an offer is extended. The right benefits package can give you a distinct advantage in competitive recruiting situations.

Each state in the USA is different; however, there are some basic benefit laws all employers must follow. Required benefits include:

- Provide employees time off to vote, serve on a jury and perform military service

- Comply with all workers’ compensation requirements

- Pay state and federal unemployment taxes

- Contribute to state short-term disability programs in states where such programs exist

- Comply with the Federal Family and Medical Leave (FMLA)

Employers are not required to provide:

- Retirement plans

- Health plans (except in Hawaii)

- Dental or vision plans

- Life insurance plans

- Paid vacations, holidays or sick leave

- ↑ What are Employee Benefits? HR Zone

- ↑ What are the Different Ways Employee Benefits can be Structured? Peoplekeep

- ↑ Employee Benefits Plans Virgin Pulse