Employee Benefits

Employee Benefits are any kind of tangible or intangible compensation given to employees apart from base wages or base salaries. Employee benefits are defined as indirect, non-cash, or cash compensation paid to an employee above and beyond regular salary or wages. It is important for organizations to offer benefits to employees as it shows that they are invested in not only their overall health, but their future. A solid employee benefits package can help to attract and retain talent. Benefits can help companies differentiate themselves from competitors.

Employee Benefits Definition[1]

Employee benefits are non-financial compensation provided to an employee as part of the employment contract. Employee benefits may be required by law (depending on the risk associated with the job or industry and the laws of the country where the job is held) or provided voluntarily by the employer. From an employee’s point of view, a good package of benefits increase the value they receive from their working life and contribute to their own health and that of their family. From an employer’s point of view, benefits help staff remain happy and committed, reducing the chance of them leaving to work elsewhere. In some instances staff swap a proportion of their pre-tax salary for a benefit, known as salary sacrifice – the [Cycle2Work scheme] is a good example of this, whereby companies buy a bike and the employee loans it from them until the initial purchase amount has been paid off. Benefits can be taxable or non-taxable. Private medical insurance is one of the most common taxed benefits. In the last ten years, employers have increasingly provided less traditional employee benefits that provide benefit to the employee’s life as a whole rather than just their working life – examples of these are childcare, healthy foods in the office and subsidized gym memberships. Due to increased competition for good candidates, the benefits an employer provides for a particular position will be an important factor in attracting applicants.

Ways to Structure Employee Benefits[2]

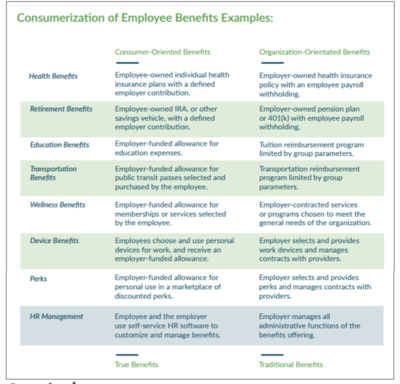

In addition to the different types of employee benefits, companies must evaluate how to structure the benefit. Employers have two different ways to structure, contribute, and offer employee benefits:

- Organizationally: These are benefits structured in “traditionally” They are generally employer-owned and employer-selected. Examples include a traditional health insurance policy, retirement pension or 401(k), or formal wellness program.

- Employee-oriented: This benefit structure focuses on the employee as an individual. With this approach. With this type of benefit employees use employer-funded dollars to customize their benefits using technology.

To help clarify these definitions, here is a chart showing examples of common employee benefits using these two approaches.

While organizational-oriented benefits are more traditional structures for benefits, many small employers are finding consumer-oriented benefits are of equally high value to employees, are typically more flexible, and also more affordable. Whereas organizational-oriented benefits have historically been the way to offer benefits, many employers are turning to consumer-oriented benefits to better meet the expectations of employees and to better control cost.

Employee Benefits Plans[3]

Depending on the type of organization and the job, employee benefits may be quite different. For example, government employee benefit packages for full-time employees look very different from the packages offered to part-time employees. Employee benefits packages are typically discussed during the final interview or at the time an offer is extended. The right benefits package can give you a distinct advantage in competitive recruiting situations.

Each state in the USA is different; however, there are some basic benefit laws all employers must follow. Required benefits include:

- Provide employees time off to vote, serve on a jury and perform military service

- Comply with all workers’ compensation requirements

- Pay state and federal unemployment taxes

- Contribute to state short-term disability programs in states where such programs exist

- Comply with the Federal Family and Medical Leave (FMLA)

Employers are not required to provide:

- Retirement plans

- Health plans (except in Hawaii)

- Dental or vision plans

- Life insurance plans

- Paid vacations, holidays or sick leave

Types of Employee Benefits[4]

In its 2019 Employee Happiness Index, HR tech company Benify distinguishes 4 categories of employee benefits:

- Benefits at work: This includes working hours & leave, skills development, food & beverage, and employee clubs, activities & gifts.

- Working hours & leave: Think of flextime here for instance. Flextime gives your employees the possibility to decide about their working hours and/or the location they want to work from. Other examples include additional holidays and, one of the other benefits employees value most, paid parental leave.

- Skills development: Rapid technological developments and the fact that people change jobs more often make skills development more important too. Skills development, however, is not just an important benefit for (younger) employees, it’s also essential for organizations if they want to remain competitive.

- Food & Beverage: France offers meal vouchers. Other benefits that fall into this category include free lunches, fruit, and coffee. Employees of companies such as Yahoo, Robinhood, Sendgrid and many others get to enjoy a free lunch every day and it’s something that’s very much appreciated by the team. As an added bonus, free lunch and fruit are also a good way to promote healthy eating habits at work.

- Employee clubs, activities & gifts: There are heaps of possibilities when it comes to this category of the employee benefits package: knitting clubs, running groups, (video) game nights, Secret Santas, anniversary gifts, you name it.

- Benefits for health: Think of health and wellness and healthcare here.

- Health and wellness: More and more companies have employee wellness programs. The possibilities are endless and examples of employee wellness programs vary from a simple gym membership to full suite solutions that include physical, mental and financial wellness.

- Healthcare: Healthcare benefits also come in different shapes and sizes. Think of physiotherapy and chiropractic sessions, for instance, but sometimes fertility treatments and psychological support can also be included.

- Benefits for financial security: The number one thing here are pension plans. Other benefits for financial security are insurances, financial benefits for employees, and personal finance benefits.

- Pension plans: Interestingly, according to the research study, pension plans are considered as a very important benefit by every generation, but they’re not among the top ten most appreciated benefits.

- Insurances: In some countries health insurance is something that comes with the simple fact of being an employee. Other types of insurance benefits for employees cover parental leave or injury.

- Financial benefits: Think of commissions, bonuses and the possibility for employees to buy shares of the company they work for.

- Personal finance benefits: The Benify report also shows that stress about personal finances has grown bigger over the past years. Yet another reason for employers to seriously start thinking of benefits such as advice about loans and savings. In other words: employee financial wellness.

- Lifestyle benefits: Lifestyle benefits consist of work-life balance and mobility.

- Work-life balance: As employees increasingly attach importance to their work-life balance, it’s no surprise that benefits in this area become more popular too. Examples are childcare, grocery delivery, and legal services.

- Mobility: Mobility benefits can make your employees’ life a lot easier. Because even if they can work from home or elsewhere, they’ll still have to come into the office – or workplace – regularly. This category covers things like public transport and cars but also bicycles and carpooling.

Benefits Can Vary By Country[5]

Note that the most popular benefits vary per location and there are also benefits that are exclusive to certain areas. Below are described benefits in three English speaking countries.

Canada

Employee benefits in Canada usually refer to employer sponsored life, disability, health, and dental plans. Such group insurance plans are a top-up to existing provincial coverage. An employer provided group insurance plan is coordinated with the provincial plan in the respective province or territory, therefore an employee covered by such a plan must be covered by the provincial plan first. The life, accidental death and dismemberment and disability insurance component is an employee benefit only. Some plans provide a minimal dependent life insurance benefit as well. The healthcare plan may include any of the following: hospital room upgrades (Semi-Private or Private), medical services/supplies and equipment, travel medical (60 or 90 days per trip), registered therapists and practitioners (i.e. physiotherapists, acupuncturists, chiropractors, etc.), prescription requiring drugs, vision (eye exams, contacts/lenses), and Employee Assistance Programs. The dental plan usually includes Basic Dental (cleanings, fillings, root canals), Major Dental (crowns, bridges, dentures) or Orthodontics (braces).

Other than the employer sponsored health benefits described above, the next most common employee benefits are group savings plans (Group RRSPs and Group Profit Sharing Plans), which have tax and growth advantages to individual saving plans.

United States

Employee benefits in the United States include relocation assistance; medical, prescription, vision and dental plans; health and dependent care flexible spending accounts; retirement benefit plans (pension, 401(k), 403(b)); group term life and long-term care insurance plans; legal assistance plans; medical second opinion programs, adoption assistance; child care benefits and transportation benefits; paid time off (PTO) in the form of vacation and sick pay. Benefits may also include formal or informal employee discount programs that grant workers access to specialized offerings from local and regional vendors (like movies and theme park tickets, wellness programs, discounted shopping, hotels and resorts, and so on).

Employers that offer these types of work-life perks seek to raise employee satisfaction, corporate loyalty, and worker retention by providing valuable benefits that go beyond a base salary figure. Fringe benefits are also thought of as the costs of retaining employees other than base salary. The term "fringe benefits" was coined by the War Labor Board during World War II to describe the various indirect benefits which industry had devised to attract and retain labor when direct wage increases were prohibited.

Some fringe benefits (for example, accident and health plans, and group-term life insurance coverage up to $50,000) may be excluded from the employee's gross income and, therefore, are not subject to federal income tax in the United States. Some function as tax shelters (for example, flexible spending, 401(k), or 403(b) accounts). These benefit rates often change from year to year and are typically calculated using fixed percentages that vary depending on the employee’s classification.

Normally, employer-provided benefits are tax-deductible to the employer and non-taxable to the employee. The exception to the general rule includes certain executive benefits (e.g. golden handshake and golden parachute plans) or those that exceed federal or state tax-exemption standards.

American corporations may also offer cafeteria plans to their employees. These plans offer a menu and level of benefits for employees to choose from. In most instances, these plans are funded by both the employees and by the employer(s). The portion paid by employees is deducted from their gross pay before federal and state taxes are applied. Some benefits would still be subject to the Federal Insurance Contributions Act tax (FICA), such as 401(k) and 403(b) contributions; however, health premiums, some life premiums, and contributions to flexible spending accounts are exempt from FICA.

If certain conditions are met, employer provided meals and lodging may be excluded from an employee's gross income. If meals are furnished (1) by the employer; (2) for the employer's convenience; and (3) provided on the business premises of the employer they may be excluded from the employee's gross income per section 119(a). In addition, lodging furnished by the employer for its convenience on the business premise of the employer (which the employee is required to accept as a condition of employment) is also excluded from gross income. Importantly, section 119(a) only applies to meals or lodging furnished "in kind." Therefore, cash allowances for meals or lodging received by an employee are included in gross income.

Qualified disaster relief payments made for an employee during a national disaster are not taxable income to the employee. The payments must be reasonable and necessary personal, family, living, or funeral expenses that have been incurred as a result of a national disaster. Eligible expenses include medical expenses, childcare and tutoring expenses due to school closings, internet, and telephone expenses. Replacement of lost income or lost wages are not eligible.

Employee benefits provided through ERISA (Employee Retirement Income Security Act) are not subject to state-level insurance regulation like most insurance contracts, but employee benefit products provided through insurance contracts are regulated at the state level. However, ERISA does not generally apply to plans by governmental entities, churches for their employees, and some other situations.

Under the Obamacare or ACA's Employer Shared Responsibility provisions, certain employers, known as applicable large employers are required to offer minimum essential coverage that is affordable to their full-time employees or else make the employer shared responsibility payment to the IRS. Private firms in the US have come up with certain unusual perquisites. In the United States paid time off, in the form of vacation days or sick days, is not required by federal or state law. Despite that fact, many United States businesses offer some form of paid leave. In the United States, 86% of workers at large businesses and 69% of employees at small business receive paid vacation days.

United Kingdom

In the United Kingdom, employee benefits are categorized by three terms: flexible benefits (flex) and flexible benefits packages, voluntary benefits and core benefits.

"Core benefits" is the term given to benefits which all staff enjoy, such as pension, life insurance, income protection, and holiday. Employees may be unable to remove these benefits, depending on individual employers' preferences.

"Flexible benefits", often called a "flex scheme", is where employees are allowed to choose how a proportion of their remuneration is paid or they are given a benefits budget by their employer to spend. Currently around a third of UK employers operate such a scheme. How flexible benefits schemes are structured has remained fairly consistent over the years, although the definition of flex has changed quite a lot since it first arrived in the UK in the 1980s. When flex first emerged, it was run as a formal scheme for a set contract period, through which employees could opt in and out of a selection of employer-paid benefits, select employee-paid benefits, or take the cash. In recent years increasing numbers of UK companies have used the tax and national insurance savings gained through the implementation of salary sacrifice benefits to fund the implementation of flexible benefits. In a salary sacrifice arrangement an employee gives up the right to part of the cash remuneration due under their contract of employment. Usually the sacrifice is made in return for the employer's agreement to provide them with some form of non-cash benefit. The most popular types of salary sacrifice benefits include childcare vouchers and pensions.

A number of external consultancies (such as Barnett Waddingham, JLT, Thomsons and Benefex) exist that enable organizations to manage Flex packages centered around the provision of an Intranet or Extranet website where employees can view their current flexible benefit status and make changes to their package. Adoption of flexible benefits has grown considerably, with 62% of employers in a 2012 survey offering a flexible benefit package and a further 21% planning to do so in the future. This has coincided with increased employee access to the internet and studies suggesting that employee engagement can be boosted by their successful adoption.

"Voluntary benefits" is the name given to a collection of benefits that employees choose to opt-in for and pay for personally, although as with flex plans, many employers make use of salary sacrifice schemes where the employee reduces their salary in exchange for the employer paying for the perk. These tend to include benefits such as the government-backed (and therefore tax-efficient) cycle to work, pension contributions and childcare vouchers and also specially arranged discounts on retail and leisure vouchers, gym membership and discounts at local shops and restaurants (providers include Xexec). These can be run in-house or arranged by an external employee benefits consultant.

Employee Benefits Management[6]

Employee benefits have a significant impact on the administrative aspect of HR, especially when regulatory issues are involved. But there are ways to manage benefit plans more effectively to save time and reduce the possibility of mistakes. Here are five things to consider:

- Hire a dedicated employee benefits specialist. This person could be in-house (as a Benefits Administrator or Compensation and Benefits Manager) or external (such as a Benefits Broker). They will help you find the best options based on your company’s needs, calculate costs and gains, and even negotiate prices for certain benefits.

- Find the right software. It’s very difficult (and unnecessary) to manage benefit packages without the help of technology. A good employee benefits information system helps you see which employees receive which benefits, export statistics and administer benefits (it might also integrate with your talent acquisition software to further streamline the entire HR process). To find the right software, do your research and make a compelling business case.

- Measure benefits and costs diligently. This will be the responsibility of the finance department, but it’s important for HR to keep track of rising or plummeting costs and gains. Having data will be vital to form your long-term benefits strategy.

- Include a description of benefits and perks in your Employee Handbook. No number of great benefits will be effective if employees don’t know they have them. Prepare a section in your Employee Handbook to give important information on what your company offers (use our benefits and perks template as an employee benefits package example to get started with your own).

- Monitor employees’ wishes and needs. Employees’ needs may change. Offering free lunches and gym memberships is great for younger employees. But, as they grow older and have families, flexible hours or parental leave might be more important. Listen and make changes when needed.

Desirable Employee Benefits[7]

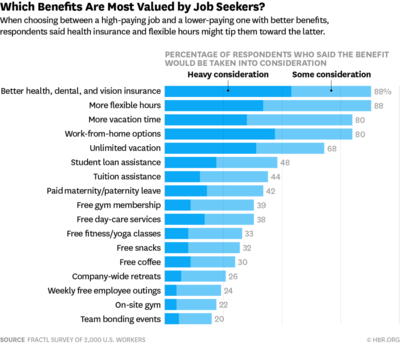

In 2017 a survey conducted by the company Fractl found that, after health insurance, employees place the highest value on benefits that are relatively low-cost to employers, such as flexible hours, more paid vacation time, and work-from-home options. Furthermore, they found that certain benefits can win over some job seekers faced with higher-paying offers that come with fewer additional advantages. As part of their study, they gave 2,000 U.S. workers, ranging in age from 18 to 81, a list of 17 benefits and asked them how heavily they would weigh the options when deciding between a high-paying job and a lower-paying job with more perks. Below is an illustration of how the benefits ranked:

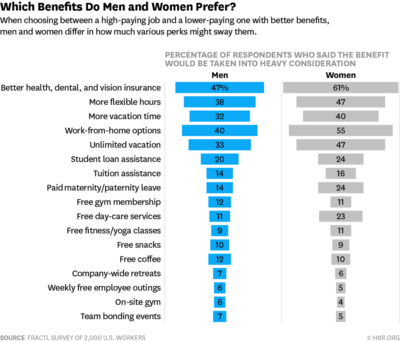

They also noticed gender differences regarding certain benefits. Most notable, women were more likely to prefer family benefits like paid parental leave and free day care services. Men were more likely than women to value team-bonding events, retreats, and free food. Both genders value fitness-related perks, albeit different types. Women are more likely to prefer free fitness and yoga classes, while men are more likely to prefer an on-site gym and free gym memberships.

Errors and legal Matters in Providing Employee Benefits[8]

Providing benefits that meet employee needs and mesh with all the laws isn't cheap--benefits probably add 30 to 40 percent to base pay for most employees--and that makes it crucial to get the most from these dollars. But this is exactly where many small businesses fall short because often their approach to benefits is riddled with costly errors that can get them in financial trouble with their insurers or even with their own employees. The most common mistakes:

- Absorbing the entire cost of employee benefits. Fewer companies are footing the whole benefits bill these days. According to a survey of California companies by human resources management consulting firm William M. Mercer, 91 percent of employers require employee contributions toward health insurance, while 92 percent require employees to contribute toward the cost of insuring dependants. The size of employee contributions varies from a few dollars per pay period to several hundred dollars monthly, but one plus of any co-payment plan is it eliminates employees who don't need coverage. Many employees are covered under other policies--a parent's or spouses, for instance--and if you offer insurance for free, they'll take it. But even small co-pay requirements will persuade many to skip it, saving you money.

- Covering nonemployers. Who would do this? Lots of business owners want to buy group-rate coverage for their relatives or friends. The trouble: If there is a large claim, the insurer may want to investigate. And that investigation could result in disallowance of the claims, even cancellation of the whole policy. Whenever you want to cover somebody who might not qualify for the plan, tell the insurer or your benefits consultant the truth.

- Sloppy paperwork. In small businesses, administering benefits is often assigned to an employee who wears 12 other hats. This employee really isn't familiar with the technicalities and misses a lot of important details. A common goof: Not enrolling new employees in plans during the open enrollment period. Most plans provide a fixed time period for open enrollment. Bringing an employee in later requires proof of insurability. Expensive litigation is sometimes the result. Make sure the employees overseeing this task stays current with the paperwork and knows that doing so is a top priority.

- Not telling employees what their benefits cost. "Most employees don't appreciate their benefits, but that's because nobody ever tells them what the costs are," says PRO's Silverstein. Many experts suggest you annually provide employees with a benefits statement that spells out what they're getting and at what cost. A simple rundown of the employee's individual benefits and what they cost the business is very powerful.

- Giving unwanted benefits. A workforce composed largely of young, single people doesn't need life insurance. How to know what benefits employee's value? You can survey employees and have them rank benefits in terms of desirability. Typically, medical and financial benefits, such as retirement plans, appeal to the broadest cross-section of workers.

Complications quickly arise as soon as business begins offering benefits, however. That's because key benefits such as health insurance and retirement plans fall under government scrutiny, and "it is very easy to make mistakes in setting up a benefits plan," says Kathleen Meagher, an attorney specializing in benefits at Kirkpatrick Lockhart LLP. The IRS can discover in an audit what you are doing doesn't comply with regulations. So can the U.S. Department of Labor, which has been beefing up its audit activities of late. Either way, a goof can be very expensive. "You can lose any tax benefits you have enjoyed, retroactively, and penalties can also be imposed," Meagher says.

The biggest mistake? Leaving employees out of the plan. Examples range from exclusions of part-timers to failing to extend benefits to clerical and custodial staff. A rule of thumb is that if one employee gets a tax-advantaged benefit--meaning one paid for with pretax dollars--the same benefit must be extended to everyone. There are loopholes that may allow you to exclude some workers, but don't even think about trying this without expert advice. Such complexities mean its good advice never to go this route alone. You can cut costs by doing preliminary research yourself, but before setting up any benefits plan, consult a lawyer or a benefits consultant. An upfront investment of perhaps $1,000 could save you far more money down the road by helping you sidestep expensive potholes.

Changing Trends in Employee Benefits<Changing Trends in Employee Benefits Sights in Plus</ref>

The current period is very interesting as organizations have multi-generations working together including Baby Boomers, Gen X, Millennials and Gen Z. And more interestingly, their benefit needs and expectations are different than each other. A recently published trend by BenefitFocus® shows that while Baby Boomers are looking for retirement benefits, Gen X is interested dependent or family benefits whereas Millennials and especially Gen Z is expecting lifestyle benefits.

Considering the needs of an increasingly diverse and multi-generational workforce, benefits design and its delivery has to be more agile than ever. Work-life balance was not a key agenda for many companies in India until recent times. But, since aspects like increased commuting time, long or odd working hours, nuclear families have started impacting the life of people; companies are now focusing on managing the work-life balance of their employees. Flexible work hours, working from home, reduced work hours, common interest groups at workplace is being introduced in many companies with an intent to allow their employees to manage their personal life and professional life well.

Revision in the Maternity Benefit Act has added the benefit of crèche facility for employees across all industries. This certainly is re-establishing employees’ sense of security, boosting their engagement in the workplace. It has been noticed that Millennials and Gen Z are more interested in such facilities and keen to maintain a proper balance in their life.

We are living in a VUCA (Volatile, Uncertain, Complex and Ambiguous) world and this volatility and uncertainty is a creating a lot of negative pressure on the mental and physical health of employees. There has been a considerable increase in the number of employees not able to manage the stress, going through depression, having heart or sugar trouble at young age or having weight control issues. The impact is also seen on the personal life as well like, increase in divorce cases, infertility issues etc.

To help employees in coping up with such problems, companies have started various benefits like EAP (Employee Assistance Program), in-house Gym facility or tie up with external Gym facilities, preventive health check-ups, voluntary insurance benefits, etc. Some companies are allowing their employees to spare time for meditation or Yoga during the work hours at least once in a week. Services like EAP help employees to deal with the stressful situations and handle other personal issues with better control. To support parents in all stages, some employers are even offering support during fertility treatment and adoption. As the medical and insurance costs are increasing, employees’ are expecting enrolment of family into various corporate insurance benefits or at least at a discounted rate.

The very recent trend of digitalization of all HR processes for enhanced employee experience, also encompasses benefits especially health related benefits. For example an insurance company giving discounts in the premium to its corporate customers, based on their health records. And this health record will be monitored through an mobile App. The more you exercise, the more discount you get. Another company is helping companies and employees manage their insurance records through mobile application including claim processing. EAP services are also available on a phone or mobile App. Such services and applications not only add convenience to employees but, also provides greater transparency.

Some companies are allowing customization of benefits, where employees can choose from a bouquet of benefits as per their need. This also includes flexibility to make changes whenever required. Allowing employees for choice and flexibility can get more value from their benefit programs. Some other interesting ideas have also been seen globally like allowing pets at work place or allowing employees to take a power nap, opening a salon or a spa within premises, paying allowance for having a good sleep at night. And now with the entry of more and more Gen Z in the industry, such ideas will continue to pop up.

All these benefits are now becoming a part of EVP (Employee value Proposition) where companies are eager to showcase their employees and candidates what they are giving beyond a fixed and variable compensation. Such policies and practices are also becoming a judging factor of employee engagement and best places to work initiatives. However, implementation of any discretionary program has to be validated from a cost and return point of view. And the priority has to be given to design and strategize the plan to manage the cost better but, influence the employee behavior in a positive manner.

See Also

Employee

Employability

Employee Attitude Survey

Employee Assistance Program (EAP)

Employee Development

Employee Engagement

Employee Selection

Employee Stock Options

Employee Stock Ownership Plan (ESOP)

Employee Turnover

Employee Value

Employee Value Proposition (EVP)

References

- ↑ What are Employee Benefits? HR Zone

- ↑ What are the Different Ways Employee Benefits can be Structured? Peoplekeep

- ↑ Employee Benefits Plans Virgin Pulse

- ↑ Types of employee benefits every HR practitioner should know AIHR Digital

- ↑ Benefits Can Vary By Country Wikipedia

- ↑ How to do it effectively manage Employee Benefits Workable

- ↑ Most Desirable Employee Benefits hbr.org

- ↑ Errors and legal Matters in Providing Employee Benefits Entrepreneur