Insider Trading

Insider Trading is using information not publicly available and which has been received illicitly to make trade decisions.

The U.S. Securities and Exchange Commission (SEC) defines illegal insider trading as:

"The buying or selling a security, in breach of a fiduciary duty or other relationship of trust and confidence, on the basis of material, nonpublic information about the security."

Material information is any information that could substantially impact an investor's decision to buy or sell the security. Non-public information is information that is not legally available to the public. The question of legality stems from the SEC's attempt to maintain a fair marketplace. An individual who has access to insider information would have an unfair edge over other investors, who do not have the same access, and could potentially make larger, unfair profits than their fellow investors. Illegal insider trading includes tipping others when you have any sort of material nonpublic information. Legal insider trading happens when directors of the company purchase or sell shares, but they disclose their transactions legally. The Securities and Exchange Commission has rules to protect investments from the effects of insider trading. It does not matter how the material nonpublic information was received or if the person is employed by the company. For example, suppose someone learns about nonpublic material information from a family member and shares it with a friend. If the friend uses this insider information to profit in the stock market, then all three of the people involved could be prosecuted.[1]

The Securities and Exchange Commission (SEC) is the government agency responsible for monitoring these kinds of transactions. It has adopted rules regarding insider trading that define it as any securities transaction made when a person involved in the trade has nonpublic, material information, and uses this information to violate his or her duty to maintain the confidentiality of such knowledge by using it for financial gain.

Insider information is “material” if its release would affect a company's stock price. For example, the announcement of a tender offer, a pending merger, a positive earnings report, the pending release of a new product, etc. A person is defined as an “insider” if they have a relationship with a business that makes them privy to information that has yet to be released to the public. Insiders are expected to maintain a fiduciary relationship with their companies and shareholders, and trying to profit from insider information puts the insider's interests above those of the entities to whom they owe this duty.

Sometimes people outside of a company can run afoul of these laws, as well, using information obtained from those on the inside to seek a profit, even if the insider does not directly profit. In these situations, there is a “tipper” and a “tippee.” The tipper is the person who has broken his or her fiduciary duty by intentionally revealing confidential information to outsiders. The tippee is the person who knowingly uses that confidential information to make a trade for purposes of turning a profit or avoiding a financial loss. Obviously, the reason insider trading is illegal is because it gives the insider an unfair advantage in the market, puts the interests of the insider above those to whom he or she owes a fiduciary duty, and allows an insider to artificially influence the value of a company's stocks.[2]

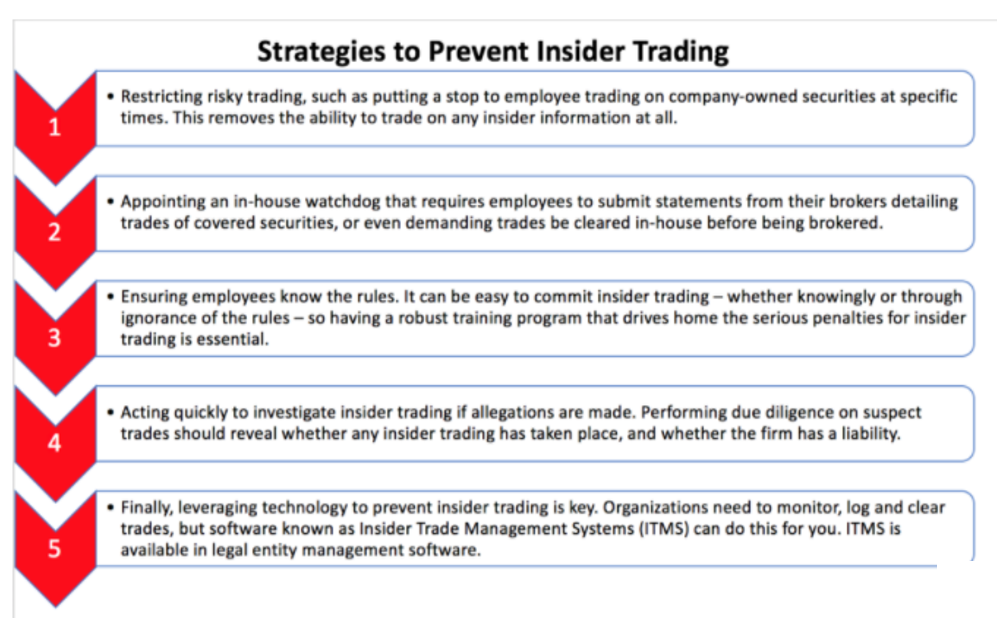

Strategies to Prevent Insider Trading[3]

Insider trading has been a buzzword for the last two decades. We think of New York Congressman Christopher Collins, Martha Stewart and the bacchanalia of Martin Scorsese’s The Wolf of Wall Street. Little discussed, however, is that the greatest risk facing corporations with respect to insider trading is not greed or malicious intent, but negligence. Most instances of insider trading are preventable, at least on a corporate level. There are checks and balances that can be installed to insulate the corporation from allegations of wrongdoing in cases of insider trading – the non-negative returns on which can be substantial. Although corporate criminal fines for insider trading are capped at $25 million, the penalties for other charges associated with insider trading activities can far exceed this number.1 With that in mind, illustrated below are five best practices to prevent illegal insider trading:

- ↑ Definition - What Does Insider Trading Mean? Investopedia

- ↑ Explaining Insider Trading HG.Org

- ↑ Five Strategies to Prevent Insider Trading Dilingent Insights