Insider Trading

Insider Trading is using information not publicly available and which has been received illicitly to make trade decisions.

What is Insider Trading

The U.S. Securities and Exchange Commission (SEC) defines illegal insider trading as:

"The buying or selling a security, in breach of a fiduciary duty or other relationship of trust and confidence, on the basis of material, nonpublic information about the security."

Material information is any information that could substantially impact an investor's decision to buy or sell the security. Non-public information is information that is not legally available to the public. The question of legality stems from the SEC's attempt to maintain a fair marketplace. An individual who has access to insider information would have an unfair edge over other investors, who do not have the same access, and could potentially make larger, unfair profits than their fellow investors. Illegal insider trading includes tipping others when you have any sort of material nonpublic information. Legal insider trading happens when directors of the company purchase or sell shares, but they disclose their transactions legally. The Securities and Exchange Commission has rules to protect investments from the effects of insider trading. It does not matter how the material nonpublic information was received or if the person is employed by the company. For example, suppose someone learns about nonpublic material information from a family member and shares it with a friend. If the friend uses this insider information to profit in the stock market, then all three of the people involved could be prosecuted.[1]

The Securities and Exchange Commission (SEC) is the government agency responsible for monitoring these kinds of transactions. It has adopted rules regarding insider trading that define it as any securities transaction made when a person involved in the trade has nonpublic, material information, and uses this information to violate his or her duty to maintain the confidentiality of such knowledge by using it for financial gain.

Insider information is “material” if its release would affect a company's stock price. For example, the announcement of a tender offer, a pending merger, a positive earnings report, the pending release of a new product, etc. A person is defined as an “insider” if they have a relationship with a business that makes them privy to information that has yet to be released to the public. Insiders are expected to maintain a fiduciary relationship with their companies and shareholders, and trying to profit from insider information puts the insider's interests above those of the entities to whom they owe this duty.

Sometimes people outside of a company can run afoul of these laws, as well, using information obtained from those on the inside to seek a profit, even if the insider does not directly profit. In these situations, there is a “tipper” and a “tippee.” The tipper is the person who has broken his or her fiduciary duty by intentionally revealing confidential information to outsiders. The tippee is the person who knowingly uses that confidential information to make a trade for purposes of turning a profit or avoiding a financial loss. Obviously, the reason insider trading is illegal is because it gives the insider an unfair advantage in the market, puts the interests of the insider above those to whom he or she owes a fiduciary duty, and allows an insider to artificially influence the value of a company's stocks.[2]

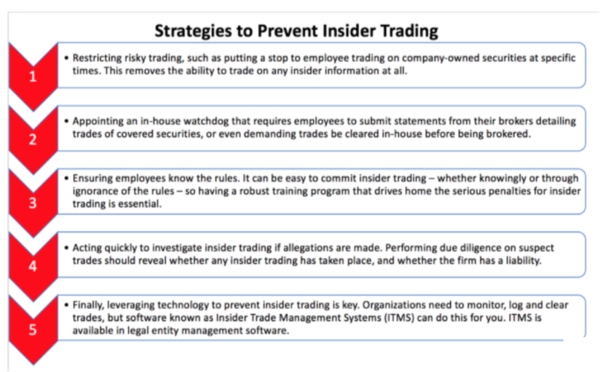

Strategies to Prevent Insider Trading[3]

Insider trading has been a buzzword for the last two decades. We think of New York Congressman Christopher Collins, Martha Stewart and the bacchanalia of Martin Scorsese’s The Wolf of Wall Street. Little discussed, however, is that the greatest risk facing corporations with respect to insider trading is not greed or malicious intent, but negligence. Most instances of insider trading are preventable, at least on a corporate level. There are checks and balances that can be installed to insulate the corporation from allegations of wrongdoing in cases of insider trading – the non-negative returns on which can be substantial. Although corporate criminal fines for insider trading are capped at $25 million, the penalties for other charges associated with insider trading activities can far exceed this number.1 With that in mind, illustrated below are five best practices to prevent illegal insider trading:

Examples of Insider Trading[4]

Legal Insider Trading Examples

The Securities and Exchange Commission explains that while most people hear the words "insider trading" and think of the illegal act, "insider trading" can also be legal under some circumstances. Examples of insider trading that are legal include:

- A CEO of a corporation buys 1,000 shares of stock in the corporation. The trade is reported to the Securities and Exchange Commission.

- An employee of a corporation exercises his stock options and buys 500 shares of stock in the company that he works for.

- A board member of a corporation buys 5,000 shares of stock in the corporation. The trade is reported to the Securities and Exchange Commission.

Illegal Insider Trading Examples

Illegal insider trading is very different than legal insider trading. A person who engages in illegal insider trading may work for the company that he buys the stock for, but does not necessarily have to. The key is that the person who buys or sells the stock acts on insider information (not public information) in violation of the law. Examples include:

- A lawyer representing the CEO of a company learns in a confidential meeting that the CEO is going to be indicted for accounting fraud the next day. The lawyer shorts 1,000 shares of the company because he knows that the stock price is going to go way down on news of the indictment.

- A board member of a company knows that a merger is going to be announced within the next day or so and that the company stock is likely to go way up. He buys 1,000 shares of the company stock in his mother's name so he can make a profit using his insider knowledge without reporting the trade to the Securities and Exchange Commission and without news of the purchase going public.

- A high-level employee of a company overhears a meeting where the CFO is talking about how the company is going to be driven into bankruptcy as a result of severe financial problems. The employee knows that his friend owns shares of the company. The employee warns his friend that he needs to sell his shares right away.

- A government employee is aware that a new regulation is going to be passed that will significantly benefit an electricity company. The government employee secretly buys shares of the electricity company and then pushes for the regulation to go through as quickly as possible.

- A corporate officer learns of a confidential merger between his company and another lucrative business. Knowing that the merger will require the purchase of shares at a high price, the corporate officer buys the stock the day before the merger is going to go through.

Real-life Examples of Insider Trading[5]

- Martha Stewart: Shares of ImClone took a sharp dive when it was found out that the FDA rejected its new cancer drug. Even after such a fall in the share price, the family of CEO Samuel Waskal seemed to be unaffected. After receiving advance notice of the rejection, Martha Stewart sold her holdings in the company’s stock when the shares were trading in the $50 range, and the stock subsequently fell to $10 in the following months. She was forced to resign as CEO of her company and Waskal was sentenced to more than seven years in prison and fined $4.3 million in 2003.

- Reliance Industries: The Securities and Exchange Board of India banned RIL from the derivatives sector for a year and levied a fine on the company. The exchange regulator charged the company with the intention of making profits by skirting regulations on its legally permissible trading limits and lowering the price of its stock in the cash market.

- Joseph Nacchio: Joseph Nacchio made $50 million by dumping his stock on the market while giving positive financial projections to shareholders as chief of Qwest Communications at a time when he knew of severe problems facing the company. He was convicted in 2007.

- Yoshiaki Murakami: In 2006, Yoshiaki Murakami made $25.5 million by using non-public material information about Livedoor, a financial services company that was planning to acquire a 5% stake in Nippon Broadcasting. His fund acted upon this information and bought two million shares.

- Raj Rajaratnam: Raj Rajaratnam made about $60 million as a billionaire hedge fund manager by swapping tips with other traders, hedge fund managers, and key employees of IBM, Intel Corp, and McKinsey & Co. He was found guilty of 14 counts of conspiracy and fraud in 2009 and fined $92.8 million.

Notable Happenings[6]

There have been a number of high-profile insider trading cases over the past few decades.

SEC vs. Switzer

Barry Switzer, Oklahoma's football coach in 1981, was prosecuted that year by the SEC after he and his friends purchased shares in Phoenix Resources, an oil company. Switzer was at a track meet when he overheard a conversation between executives concerning the liquidation of the business. He purchased the stock at around $42 per share and later sold it at $59 per share, earning about $98,000 in the process. The charges against him were later dismissed by a federal judge due to a lack of evidence. Switzer probably would have been fined and served jail time if one of his players was the son or daughter of the executives and if they mentioned the tip to him off-handedly. The Supreme Court found that the tipper had not breached their fiduciary duty for personal gain.5

U.S. vs. O'Hagan

James O'Hagan was a lawyer with the firm of Dorsey & Whitney in 1988. The firm began representing Grand Metropolitan PLC, which planned to launch a tender offer for Pillsbury. O'Hagan subsequently acquired a large number of options in the company, knowing that the options would soar following the announcement of the tender offer. O'Hagan eventually sold his options and realized a $4.3 million gain. He chose to acquire the options based on information that wasn't available to other investors and did so without informing his firm. He was found guilty on 57 charges, but his conviction was overturned on appeal.

Investigation and Prosecution of Insider Trading[7]

The Securities and Exchange Commission (SEC) regularly monitors the security market and tracks the trading pattern. Any abnormal pattern in trading triggers the SEC and they strictly monitor it. Thus a strong market surveillance system is important to find insider trading. Once SEC founds a different trading pattern, they vigorously pursue anyone they believe may be involved. They try to make strict surveillance. They search for financial records and wiretaps through warrants or by any other means to clarify their doubts. An individual will be arrested and handed over to the U.S. attorney if strong evidence is found against him.

There are different penalties for insider trading in a different jurisdiction. Prison, charging a fine or both are the punishment for insider trading. An investor can have any of the punishment if caught for insider trading. According to the U.S. Securities and Exchange Commission (SEC), an investor may have a maximum fine of $5 million and up to 20 years of imprisonment for this.

Arguments for Legalizing[8]

Some economists and legal scholars (such as Henry Manne, Milton Friedman, Thomas Sowell, Daniel Fischel, and Frank H. Easterbrook) have argued that laws against insider trading should be repealed. They claim that insider trading based on material nonpublic information benefits investors, in general, by more quickly introducing new information into the market.

Friedman, laureate of the Nobel Memorial Prize in Economics, said: "You want more insider trading, not less. You want to give the people most likely to have knowledge about deficiencies of the company an incentive to make the public aware of that." Friedman did not believe that the trader should be required to make his trade known to the public, because the buying or selling pressure itself is information for the market.

Other critics argue that insider trading is a victimless act: a willing buyer and a willing seller agree to trade property that the seller rightfully owns, with no prior contract (according to this view) having been made between the parties to refrain from trading if there is asymmetric information. The Atlantic has described the process as "arguably the closest thing that modern finance has to a victimless crime."

Legalization advocates also question why "trading" where one party has more information than the other is legal in other markets, such as real estate, but not in the stock market. For example, if a geologist knows there is a high likelihood of the discovery of petroleum under Farmer Smith's land, he may be entitled to make Smith an offer for the land, and buy it, without first telling Farmer Smith of the geological data.

Advocates of legalization make free speech arguments. Punishment for communicating about a development pertinent to the next day's stock price might seem an act of censorship. If the information being conveyed is proprietary information and the corporate insider has contracted to not expose it, he has no more right to communicate it than he would to tell others about the company's confidential new product designs, formulas, or bank account passwords.

Some authors have used these arguments to propose legalizing insider trading on negative information (but not on positive information). Since negative information is often withheld from the market, trading on such information has a higher value for the market than trading on positive information.

There are very limited laws against "insider trading" in the commodities markets if, for no other reason than that the concept of an "insider" is not immediately analogous to commodities themselves (corn, wheat, steel, etc.). However, analogous activities such as front running are illegal under US commodity and futures trading laws. For example, a commodity broker can be charged with fraud for receiving a large purchase order from a client (one likely to affect the price of that commodity) and then purchasing that commodity before executing the client's order to benefit from the anticipated price increase.

References

- ↑ Definition - What Does Insider Trading Mean? Investopedia

- ↑ Explaining Insider Trading HG.Org

- ↑ Five Strategies to Prevent Insider Trading Dilingent Insights

- ↑ Examples of Insider Trading Your Dictionary

- ↑ Real-life Examples of Insider Trading CFI

- ↑ Notable Happenings in Insider Trading the Balance

- ↑ Investigation and Prosecution of Insider Trading eFinance Management

- ↑ Arguments for legalizing Insider Trading Wikipedia