International Accounting Standards Board (IASB)

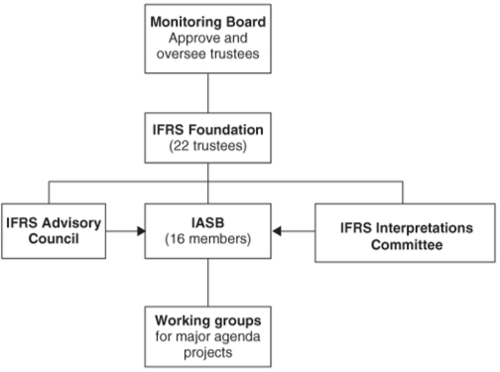

The International Accounting Standards Board (IASB) is the independent standard-setting body of the IFRS Foundation responsible for the development and publication of IFRSs and for approving Interpretations of IFRSs as developed by the IFRS Interpretations Committee.[1]

The Board is an independent group of experts with an appropriate mix of recent practical experience in setting accounting standards, in preparing, auditing, or using financial reports, and accounting education. Broad geographical diversity is also required. The IFRS Foundation Constitution outlines the full criteria for the composition of the Board, and the geographical allocation can be seen on the individual profiles. Board members are responsible for the development and publication of IFRS Standards, including the IFRS for SMEs Standard. The Board is also responsible for approving Interpretations of IFRS Standards as developed by the IFRS Interpretations Committee (formerly IFRIC). Members are appointed by the Trustees of the IFRS Foundation through an open and rigorous process that includes advertising vacancies and consulting relevant organizations.[2]

The IASB originally had 13 full-time Board members, each with one vote. They are selected as a group of experts with a mix of experience in standard-setting, preparing and using accounts, and academic work. At their January 2009 meeting, the Trustees of the Foundation concluded the first part of the second Constitution Review, announcing the creation of a Monitoring Board and the expansion of the IASB to 16 members and giving more consideration to the geographical composition of the IASB. The IFRS Interpretations Committee has 15 members. Its brief is to provide timely guidance on issues that arise in practice. A unanimous vote is not necessary in order for the publication of a Standard, exposure draft, or final "IFRIC" Interpretation. The Board's 2008 Due Process manual stated that approval by nine of the members is required.[3]

IASB's Role[4]

Under the IFRS Foundation Constitution, the IASB has complete responsibility for all technical matters of the IFRS Foundation including:

- full discretion in developing and pursuing its technical agenda, subject to certain consultation requirements with the Trustees and the public

- the preparation and issuing of IFRSs (other than Interpretations) and exposure drafts, following the due process stipulated in the Constitution

- the approval and issuing of Interpretations developed by the IFRS Interpretations Committee.

IASB - Background and Structure'[5]

The IASB was previously known as the International Accounting Standards Committee (IASC) until April 2001, when it became the IASB. The IASC was originally set up in 1973 and was the sole body to have both responsibility and authority to issue international accounting standards. In 2001, when the IASB took over responsibility for international financial reporting, it took on all of the IASC's standards (which were all prefixed with ‘IAS’ – e.g. IAS 2 Inventories, IAS 10 Events After the Reporting Period). The IASB amended many of the standards but then began to issue its own standards, which were known as International Financial Reporting Standards (IFRS). This is why you see standards prefixed with IAS (IASC standards) and IFRS (IASB standards). The term ‘IFRS’ has become a somewhat generic term that refers to all the standards (both IAS and IFRS). The setup of the IASB is as follows:

Standard Setting Process[6]

According to IASB, a thorough, transparent, and participatory due process is followed when issuing an IFRS Standard or an IFRIC Interpretation that helps companies better implement their Standards. Standard-setting entails:

- Public Board meetings broadcast live from their London office;

- Agenda papers that inform the Board's deliberations;

- Discussion and decision summaries that are made available after meetings; and

- Comment letters received on their consultation documents.

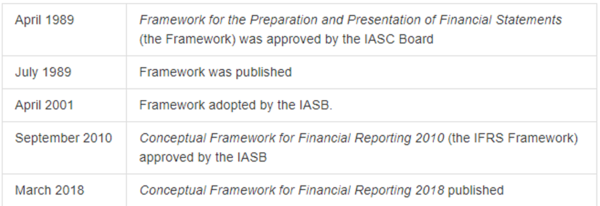

IASB Conceptual Framework[7]

While the International Accounting Standards Board (IASB) is not a country it does have a sort of constitution, in the form of the Conceptual Framework for Financial Reporting (the Framework), that proves the definitive reference document for the development of accounting standards. The Framework can also be described as a theoretical base, a statement of principles, a philosophy, and a map. By setting out the very basic theory of accounting the Framework points the way for the development of new accounting standards. It should be noted that the Framework is not an accounting standard, and where there is perceived to be a conflict between the Framework and the specific provisions of an accounting standard then the accounting standard prevails. The IASB Framework:

- seeks to ensure that accounting standards have a consistent approach to problem-solving and do not represent a series of ad hoc responses that address accounting problems on a piecemeal basis

- assists the IASB in the development of coherent and consistent accounting standards

- is not a standard, but rather acts as a guide to the preparer of financial statements to enable them to resolve accounting issues that are not addressed directly in a standard

- is an important and influential document that helps users understand the purpose of, and limitations of, financial reporting

- used to be called the Framework for the Preparation and Presentation of Financial Statements

- is a current issue as it is being revised as a joint project with the IASB's American counterparts the Financial Accounting Standards Board.

The framework includes the following five elements:

- Asset: An asset is defined as a resource controlled by the entity as a result of past events and from which future economic benefits are expected to flow to the entity. Assets are presented on the statement of financial position as being non-current or current. They can be intangible, that is, without physical presence – for example, goodwill. Examples of assets include property plant and equipment, financial assets, and inventory. While most assets will be both controlled and legally owned by the entity it should be noted that legal ownership is not a prerequisite for recognition, rather it is the control that is the key issue.

- Liability: A liability is defined as a present obligation of the entity arising from past events, the settlement of which is expected to result in an outflow from the entity of resources embodying economic benefits. Liabilities are also presented on the statement of financial position as being non-current or current. Examples of liabilities include trade payables, tax creditors, and loans. It should be noted that in order to recognize a liability there does not have to be an obligation that is due on demand but rather there has to be a present obligation.

- Equity: Equity is defined as the residual interest in the assets of the entity after deducting all its liabilities. The effect of this definition is to acknowledge the supreme conceptual importance of identifying, recognizing, and measuring assets and liabilities, as equity is conceptually regarded as a function of assets and liabilities, ie a balancing figure. Equity includes the original capital introduced by the owners, ie share capital and share premium, the accumulated retained profits of the entity, ie retained earnings, unrealized asset gains in the form of revaluation reserves, and, in group accounts, the equity interest in the subsidiaries not enjoyed by the parent company, ie the non-controlling interest (NCI). Slightly more exotically, equity can also include the equity element of convertible loan stock, equity-settled share-based payments, differences arising when there are increases or decreases in the NCI, group foreign exchange differences, and contingently issuable shares. These would probably all be included in equity under the umbrella term of Other Components of Equity.

- Income: Income is defined as the increases in economic benefits during the accounting period in the form of inflows or enhancements of assets or decreases of liabilities that result in increases in equity, other than those relating to contributions from equity participants. Most income is revenue generated from the normal activities of the business in selling goods and services, and as such is recognized in the Income section of the statement of profit or loss and other comprehensive income, however, certain types of income are required by specific standards to be recognized directly to equity, ie reserves, for example, certain revaluation gains on assets. In these circumstances, the income (gain) is then also reported in the Other Comprehensive Income section of the statement of profit or loss and other comprehensive income. The reference to ‘other than those relating to contributions from equity participants’ means that when the entity issues shares to equity shareholders, while this clearly increases the asset of cash, it is a transaction with equity participants and so does not represent income for the entity. The definition of income is also linked to assets and liabilities. This is often referred to as ‘the balance sheet approach’ (the former name for the statement of financial position).

- Expense: Expenses are defined as decreases in economic benefits during the accounting period in the form of outflows or depletions of assets or incurrences of liabilities that result in decreases in equity, other than those relating to distributions to equity participants. Examples of expenses include depreciation, impairment of assets, and purchases. As with income, most expenses are recognized in the Income Statement section of the statement of profit or loss and other comprehensive income, but in certain circumstances expenses (losses) are required by specific standards to be recognized directly in equity and reported in the Other Comprehensive Income Section of the statement of profit or loss and other comprehensive income. An example of this is an impairment loss, on a previously revalued asset, that does not exceed the balance of its Revaluation Reserve.

Benefits of IFRS Standards[8]

Modern economies rely on cross-border transactions and the free flow of international capital. More than a third of all financial transactions occur across borders, and that number is expected to grow. Investors seek diversification and investment opportunities across the world, while companies raise capital, undertake transactions or have international operations and subsidiaries in multiple countries. In the past, such cross-border activities were complicated by different countries maintaining their own sets of national accounting standards. This patchwork of accounting requirements often added cost, complexity, and ultimately risk both to companies preparing financial statements and investors and others using those financial statements to make economic decisions. Applying national accounting standards meant amounts reported in financial statements might be calculated on a different basis. Unpicking this complexity involved studying the minutiae of national accounting standards, because even a small difference in requirements could have a major impact on a company’s reported financial performance and financial position—for example, a company may recognize profits under one set of national accounting standards and losses under another. IFRS Standards address this challenge by providing a high-quality, internationally recognized set of accounting standards that bring transparency, accountability, and efficiency to financial markets around the world.

- IFRS Standards bring transparency by enhancing the international comparability and quality of financial information, enabling investors and other market participants to make informed economic decisions.

- IFRS Standards strengthen accountability by reducing the information gap between the providers of capital and the people to whom they have entrusted their money. Our Standards provide information that is needed to hold management to account. As a source of globally comparable information, IFRS Standards are also of vital importance to regulators around the world.

- IFRS Standards contribute to economic efficiency by helping investors to identify opportunities and risks across the world, thus improving capital allocation. For businesses, the use of a single, trusted accounting language lowers the cost of capital and reduces international reporting costs.

History of the IASB Conceptual Framework

source: Deloitte

See Also

Generally Accepted Accounting Principles (GAAP)

References

- ↑ What is the International Accounting Standards Board (IASB)?

- ↑ About the International Accounting Standards Board

- ↑ IASB members

- ↑ What is the role of the International Accounting Standards Board (IASB)?

- ↑ IASB - Background and Structure

- ↑ Standard Setting Process at the IASB

- ↑ IASB Conceptual Framework

- ↑ Benefits of IFRS Standardsifrs.org

Further Reading

- Fair Value and the IASB/FASB Conceptual Framework Project: An Alternative View

- Harmonisation or discord? The critical role of the IASB conceptual framework review

- Relevance of Academic Research and Researchers' Role in the IASB's Financial Reporting Standard Setting

- The Evolution of the IASC into the IASB, and the Challenges it Faces

- The impact of International Accounting Standards Board (IASB)/International Financial Reporting Standard 16 (IFRS 16)