Payment Card Industry Data Security Standard (PCI DSS)

The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards designed to ensure that ALL companies that accept, process, store or transmit credit card information maintain a secure environment.[1]

The Payment Card Industry Security Standards Council (PCI SSC) was launched on September 7, 2006 to manage the ongoing evolution of the Payment Card Industry (PCI) security standards with a focus on improving payment account security throughout the transaction process. The PCI DSS is administered and managed by the PCI SSC (www.pcisecuritystandards.org), an independent body that was created by the major payment card brands (Visa, MasterCard, American Express, Discover and JCB.). It is important to note that the payment brands and acquirers are responsible for enforcing compliance, not the PCI council.

PCI DSS Objectives[2]

The PCI DSS specifies and elaborates on six major objectives.

- First, a secure network must be maintained in which transactions can be conducted. This requirement involves the use of firewalls that are robust enough to be effective without causing undue inconvenience to cardholders or vendors. Specialized firewalls are available for wireless LANs, which are highly vulnerable to eavesdropping and attacks by malicious hackers. In addition, authentication data such as personal identification numbers (PINs) and passwords must not involve defaults supplied by the vendors. Customers should be able to conveniently and frequently change such data.

- Second, cardholder information must be protected wherever it is stored. Repositories with vital data such as dates of birth, mothers' maiden names, Social Security numbers, phone numbers and mailing addresses should be secure against hacking. When cardholder data is transmitted through public networks, that data must be encrypted in an effective way. Digital encryption is important in all forms of credit-card transactions, but particularly in e-commerce conducted on the Internet.

- Third, systems should be protected against the activities of malicious hackers by using frequently updated anti-virus software, anti-spyware programs, and other anti-malware solutions. All applications should be free of bugs and vulnerabilities that might open the door to exploits in which cardholder data could be stolen or altered. Patches offered by software and operating system (OS) vendors should be regularly installed to ensure the highest possible level of vulnerability management.

- Fourth, access to system information and operations should be restricted and controlled. Cardholders should not have to provide information to businesses unless those businesses must know that information to protect themselves and effectively carry out a transaction. Every person who uses a computer in the system must be assigned a unique and confidential identification name or number. Cardholder data should be protected physically as well as electronically. Examples include the use of document shredders, avoidance of unnecessary paper document duplication, and locks and chains on dumpsters to discourage criminals who would otherwise rummage through the trash.

- Fifth, networks must be constantly monitored and regularly tested to ensure that all security measures and processes are in place, are functioning properly, and are kept up-do-date. For example, anti-virus and anti-spyware programs should be provided with the latest definitions and signatures. These programs should scan all exchanged data, all applications, all random-access memory (RAM) and all storage media frequently if not continuously.

- Sixth, a formal information security policy must be defined, maintained, and followed at all times and by all participating entities. Enforcement measures such as audits and penalties for non-compliance may be necessary.

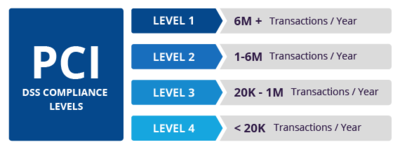

PCI DSS Compliance levels[3]

PCI compliance is divided into four levels, based on the annual number of credit or debit card transactions a business processes. The classification level determines what an enterprise needs to do to remain compliant.

- Level 1: Applies to merchants processing more than six million real-world credit or debit card transactions annually. Conducted by an authorized PCI auditor, they must undergo an internal audit once a year. In addition, once a quarter they must submit to a PCI scan by an Approved Scanning Vendor (ASV).

- Level 2: Applies to merchants processing between one and six million real-world credit or debit card transactions annually. They’re required to complete an assessment once a year using a Self-Assessment Questionnaire (SAQ). Additionally, a quarterly PCI scan may be required.

- Level 3: Applies to merchants processing between 20,000 and one million e-commerce transactions annually. They must complete a yearly assessment using the relevant SAQ. A quarterly PCI scan may also be required.

- Level 4: Applies to merchants processing fewer than 20,000 e-commerce transactions annually, or those that process up to one million real-world transactions. A yearly assessment using the relevant SAQ must be completed and a quarterly PCI scan may be required.

- ↑ Defining Payment Card Industry Data Security Standard (PCI DSS) PCI Compliance Guide

- ↑ PCI DSS Objectives Techtarget

- ↑ PCI DSS Compliance levels Imperva