Personal Consumption Expenditure (PCE)

The Personal Consumption Expenditure (PCE) measure is the component statistic for consumption in gross domestic product (GDP) collected by the United States Bureau of Economic Analysis (BEA). It consists of the actual and imputed expenditures of households and includes data pertaining to durable and non-durable goods and services. It is essentially a measure of goods and services targeted towards individuals and consumed by individuals.[1]

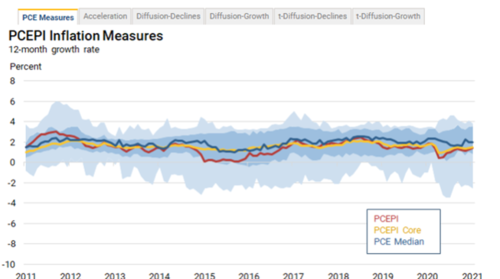

Collectively personal consumption expenditures are one of three main parts of the Personal Income and Outlays report. Personal income shows how much money consumers are bringing in. Personal consumption expenditures are a measure of the outlays or how much consumers are spending. The PCE Price Index uses the personal consumption expenditures component of the Personal Income and Outlays report to derive the PCE Price Index, which is the third major component of Personal Income and Outlays showing how prices are periodically inflating or deflating. Personal consumption expenditures are shown by the BEA in current dollars and chained dollars since 2012. Personal consumption expenditures form the basis for the reporting of the PCE Price Index, which is detailed both comprehensively using all categories of PCE and excluding food and energy, which is known as the Core PCE Price Index.

Like most economic breakdowns, personal consumption expenditures are split between goods and services. Goods can be broken out further into durable and nondurable goods. Each month the BEA reports the total value of personal consumption expenditures collectively and broken out by goods, durable goods, nondurable goods, and services. Durable goods are items that last a household for more than three years and typically carry a larger price tag. Examples of durable goods include cars, televisions, refrigerators, furniture, and other similar items. Non-durable goods are considered "transitory," meaning that their life expectancy is typically less than three years. These items are also typically less costly and include products like makeup, gasoline, and clothing. The BEA uses the current dollar value of personal consumption expenditures to calculate the PCE Price Index, which shows the amount of price inflation or deflation occurring from one period to the next (PCE inflation). Like most price indexes, the PCE Price Index must incorporate a deflator (the PCE deflator) and real values in order to determine the amount of periodic price change. Ultimately, the PCE Price Index and Core PCE Price Index excluding food and energy show how much the prices of personal consumption expenditures have changed from one period to another, but breakdowns of the PCE Price Index also show PCE inflation/deflation by category as well.[2]

source: FRBSF.org

How PCE is Measured and Why it is Important[3]<br />

Measuring PCE

The BEA reports on PCE every month. It's part of the National Income and Product Accounts. You'll find PCE in the Personal Income and Outlays report. That tells you how people spend their income. They spend most of it on personal outlays. That category includes PCE, interest payments, and transfer payments. They put some of it into personal savings. To create the National Income Accounts, the BEA uses the GDP statistics for its base. It must convert the GDP production data to the PCE consumer spending report. How does it do that?

- First, it separates out production that goes toward consumer purchases. That includes things like manufacturers’ shipments. It also includes revenue for utilities, service receipts, and commissions for securities brokerage.

- Second, it adds imports. Third, it subtracts both exports and changes in inventory. That gives it the amount available for domestic consumption. It allocates that among domestic purchasers. It bases the allocation on trade source data, U.S. Census Bureau data, and household income surveys.

One problem is that GDP comes out quarterly, and the BEA estimates PCE every month. The BEA uses the monthly Retail Sales report to fill in gaps. Every 10 years, it revises all its calculations based on the U.S. Census. (Source: “Methodology Papers,” NIPA Handbook: Concepts and Methods of the U.S. National Income and Product Accounts, Chapter 5: Personal Consumption Expenditures, BEA.)3 4

Importance of PCE

PCE reveals how much households spend on immediate consumption versus saving for the future. Higher consumption levels translate into greater GDP growth in the short term. On the other hand, a higher savings rate is good for long-term economic health. Banks use savings to fund loans for mortgages and business investments.

Analysts use the PCE report to understand household buying habits. For example, it shows how shopping patterns change in response to sharp price increases. That happens most often when gas prices rise or fall. In that way, PCE reveals the elasticity of demand. When demand for a good or service is elastic, people cut back even if the price goes up just a little.

The Bureau of Economic Analysis uses PCE to calculate the PCE Inflation Index. That’s the Federal Reserve’s preferred measure of inflation. It is more accurate than the more well-known Consumer Price Index.

Consumer Price Index Vs. Personal Consumption Expenditures Price Index[4]

The differences between the CPI and PCE measures of inflation can be summarized into four categories or effects. The following sections quantify the magnitude of these effects over two distinct periods.

- Formula effect. The CPI and the PCE index are constructed from different index-number formulas. The CPI index is an average based on a Laspeyres formula, whereas the PCE index is based on a Fisher-Ideal formula. A Fisher-Ideal index is considered a “superlative” index in that it reflects consumer substitution among detailed items as relative prices change. In practice, superlative indexes are difficult to implement in real time because such indexes require expenditure data for the period that is current, and such data are not available. For example, data on household consumer expenditures that are used to estimate the CPI are not available for the current period. For the Consumer Price Index for Urban Consumers (CPI-U), a Laspeyres index provides an alternative to the FisherIdeal index. To estimate a “formula effect,” or the differences in the rates of growth between the CPI and PCE caused by the differences in formula, the detailed price and quantity data used to estimate the PCE index can be reaggregated with the use of a Laspeyres price-index formula.

- Weight effect. The relative weights assigned to each of the CPI and PCE categories of items are based on different data sources. The relative weights used in the CPI are based primarily on the Consumer Expenditure Survey, a household survey conducted for the BLS by the Census Bureau. The relative weights used in the PCE index are derived from business surveys—for example, the Census Bureau’s annual and monthly retail trade surveys, the Service Annual Survey, and the Quarterly Services Survey. In order to estimate a “weight effect,” or the effect of using different weight sources on CP and PCE index changes, CPI relative weights for comparable item categories can be used to estimate the PCE fixed-weight price index.

- Scope effects. The CPI measures the change in the out-of-pocket expenditures of all urban households and the PCE index measures the change in goods and services consumed by all households, and nonprofit institutions serving households. This conceptual difference means that some items and expenditures in the PCE index are outside the scope of the CPI. For example, the expenditure weights for medical care services in the CPI are derived only from out-of-pocket expenses paid for by consumers. By contrast, medical care services in the PCE index include those services purchased out of pocket by consumers and those services paid for on behalf of consumers—for example, medical care services paid for by employers through employer-provided health insurance, as well as medical care services paid for by governments through programs such as Medicare and Medicaid. These differences can also be isolated and measured, and can be referred to as “scope effects.”

- Other effects. A variety of remaining differences consisting of seasonal-adjustment differences, price differences, and residual differences must be taken into account for a complete understanding of the differences between the CPI and the PCE index. For example, the PCE index for airline fares is based on passenger revenues and the number of miles traveled by passengers. The CPI, however, is based on prices charged for air travel for sampled routes.

References

- ↑ Definition of Personal Consumption Expenditure (PCE) Wikipedia

- ↑ Understanding Personal Consumption Expenditures (PCE) Investopedia

- ↑ How PCE is Measured and Why it is Important? the balance

- ↑ Differences between the Consumer Price Index and the Personal Consumption Expenditures Price Index Bureau of Labor Statistics