Difference between revisions of "Resource-Based View (RBV)"

| Line 31: | Line 31: | ||

Although the literature presents many different ideas around the concept of the resource-advantage perspective, at its heart, the common theme is that the firm's resources are financial, legal, human, organizational, informational and relational; resources are heterogeneous and imperfectly mobile and that management's key task is to understand and organize resources for sustainable competitive advantage.[10] Key theorists who have contributed to the development of a coherent body of literature include Jay B. Barney, George S. Day, Gary Hamel, Shelby D. Hunt, G. Hooley and C.K. Prahalad. | Although the literature presents many different ideas around the concept of the resource-advantage perspective, at its heart, the common theme is that the firm's resources are financial, legal, human, organizational, informational and relational; resources are heterogeneous and imperfectly mobile and that management's key task is to understand and organize resources for sustainable competitive advantage.[10] Key theorists who have contributed to the development of a coherent body of literature include Jay B. Barney, George S. Day, Gary Hamel, Shelby D. Hunt, G. Hooley and C.K. Prahalad. | ||

| + | |||

| + | |||

| + | ===See Also=== | ||

| + | [[VRIO Framework]]<br /> | ||

| + | [[Contingency Theory]]<br /> | ||

| + | [[Disruptive Innovation]]<br /> | ||

| + | [[Disruptive Technology]]<br /> | ||

| + | [[First-Mover Advantage (FMA)]]<br /> | ||

| + | [[X-Efficiency]]<br /> | ||

| + | [[Upper Echelons Theory]]<br /> | ||

| + | [[Stewardship Theory]]<br /> | ||

| + | [[Agency Theory]]<br /> | ||

| + | [[Five Case Model]]<br /> | ||

| + | [[Five Disciplines]]<br /> | ||

| + | [[Five Forces CRM Model]]<br /> | ||

| + | [[Five Forces Model]]<br /> | ||

| + | [[Five Whys]]<br /> | ||

| + | [[Five W's]]<br /> | ||

| + | [[Resource Scarcity Theory]]<br /> | ||

| + | [[Resource Dependence Theory]]<br /> | ||

| + | [[Resource Access Control Facility (RACF)]]<br /> | ||

| + | [[Resource Allocation]]<br /> | ||

| + | [[Resource Description Framework (RDF)]]<br /> | ||

| + | [[Resource Management]]<br /> | ||

| + | |||

| + | |||

| + | ===References=== | ||

| + | <references/> | ||

Revision as of 18:52, 11 April 2021

The Resource-Based View (RBV) (aka Resource-Based Theory) of the organization is a strategy for achieving competitive advantage that emerged during the 1980s and 1990s, following the works of academics and businessmen such as Birger Wernerfelt, Prahalad and Hamel, Spender and Grant. The core idea of the theory is that instead of looking at the competitive business environment to get a niche in the market or an edge over competition and threats, the organization should instead look within at the resources and potential it already has available.[1]

Resource-based theory contends that the possession of strategic resources provides an organization with a golden opportunity to develop competitive advantages over its rivals. These competitive advantages in turn can help the organization enjoy strong profits. Resource-based theory also stresses the merit of an old saying: the whole is greater than the sum of its parts. Specifically, it is also important to recognize that strategic resources can be created by taking several strategies and resources that each could be copied and bundling them together in a way that cannot be copied.[2]

Explaining the Resource-Based View Model[3]

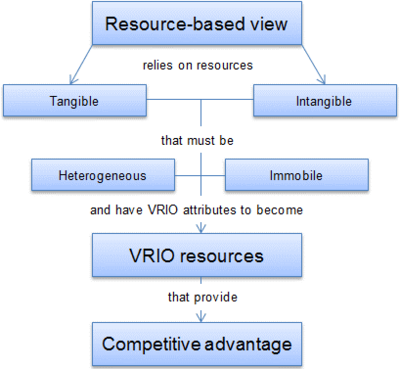

The following model explains RBV and emphasizes the key points of it.

source: Strategic Management Insights

According to RBV proponents, it is much more feasible to exploit external opportunities using existing resources in a new way rather than trying to acquire new skills for each different opportunity. In RBV model, resources are given the major role in helping companies to achieve higher organizational performance. There are two types of resources: tangible and intangible.

- Tangible assets are physical things. Land, buildings, machinery, equipment and capital – all these assets are tangible. Physical resources can easily be bought in the market so they confer little advantage to the companies in the long run because rivals can soon acquire the identical assets.

- Intangible assets are everything else that has no physical presence but can still be owned by the company. Brand reputation, trademarks, intellectual property are all intangible assets. Unlike physical resources, brand reputation is built over a long time and is something that other companies cannot buy from the market. Intangible resources usually stay within a company and are the main source of sustainable competitive advantage.

The two critical assumptions of RBV are that resources must also be heterogeneous and immobile.

- Heterogeneous. The first assumption is that skills, capabilities and other resources that organizations possess differ from one company to another. If organizations would have the same amount and mix of resources, they could not employ different strategies to outcompete each other. What one company would do, the other could simply follow and no competitive advantage could be achieved. This is the scenario of perfect competition, yet real world markets are far from perfectly competitive and some companies, which are exposed to the same external and competitive forces (same external conditions), are able to implement different strategies and outperform each other. Therefore, RBV assumes that companies achieve competitive advantage by using their different bundles of resources.

The competition between Apple Inc. and Samsung Electronics is a good example of how two companies that operate in the same industry and thus, are exposed to the same external forces, can achieve different organizational performance due to the difference in resources. Apple competes with Samsung in tablets and smartphones markets, where Apple sells its products at much higher prices and, as a result, reaps higher profit margins. Why Samsung does not follow the same strategy? Simply because Samsung does not have the same brand reputation or is capable to design user-friendly products like Apple does. (heterogeneous resources)

- Immobile. The second assumption of RBV is that resources are not mobile and do not move from company to company, at least in short-run. Due to this immobility, companies cannot replicate rivals’ resources and implement the same strategies. Intangible resources, such as brand equity, processes, knowledge or intellectual property are usually immobile.

Resource-Based View (RBV) - Origins and Background[4]

During the 1990s, the resource-based view (also known as the resource-advantage theory) of the firm became the dominant paradigm in strategic planning. RBV can be seen as a reaction against the positioning school and its somewhat prescriptive approach which focused managerial attention on external considerations, notably industry structure. The so-called positioning school had dominated the discipline throughout the 1980s. In contrast, the resource-based view argued that sustainable competitive advantage derives from developing superior capabilities and resources. Jay Barney's 1991 article, "Firm Resources and Sustained Competitive Advantage," is seen as pivotal in the emergence of the resource-based view.[2]

A number of scholars point out that a fragmentary resource-based perspective was evident from the 1930s, noting that Barney was heavily influenced by Wernerfelt's earlier work which introduced the idea of resource position barriers being roughly analogous to entry barriers in the positioning school. Other scholars suggest that the resource-based view represents a new paradigm, albeit with roots in "Ricardian and Penrosian economic theories according to which firms can earn sustainable supranormal returns if, and only if, they have superior resources and those resources are protected by some form of isolating mechanism precluding their diffusion throughout the industry." While its exact influence is debated, Edith Penrose's 1959 book The Theory of the Growth of the Firm is held by two scholars of strategy to state many concepts that would later influence the modern, resource-based theory of the firm.

The RBV is an interdisciplinary approach that represents a substantial shift in thinking. The resource-based view is interdisciplinary in that it was developed within the disciplines of economics, ethics, law, management, marketing, supply chain management and general business.

RBV focuses attention on an organization's internal resources as a means of organizing processes and obtaining a competitive advantage. Barney stated that for resources to hold potential as sources of sustainable competitive advantage, they should be valuable, rare, imperfectly imitable and not substitutable (now generally known as VRIN criteria). The resource-based view suggests that organizations must develop unique, firm-specific core competencies that will allow them to outperform competitors by doing things differently.

Although the literature presents many different ideas around the concept of the resource-advantage perspective, at its heart, the common theme is that the firm's resources are financial, legal, human, organizational, informational and relational; resources are heterogeneous and imperfectly mobile and that management's key task is to understand and organize resources for sustainable competitive advantage.[10] Key theorists who have contributed to the development of a coherent body of literature include Jay B. Barney, George S. Day, Gary Hamel, Shelby D. Hunt, G. Hooley and C.K. Prahalad.

See Also

VRIO Framework

Contingency Theory

Disruptive Innovation

Disruptive Technology

First-Mover Advantage (FMA)

X-Efficiency

Upper Echelons Theory

Stewardship Theory

Agency Theory

Five Case Model

Five Disciplines

Five Forces CRM Model

Five Forces Model

Five Whys

Five W's

Resource Scarcity Theory

Resource Dependence Theory

Resource Access Control Facility (RACF)

Resource Allocation

Resource Description Framework (RDF)

Resource Management

References

- ↑ Definition - What Does Resource-Based View Mean? Business Balls

- ↑ Definition: What is Resource-Based Theory? Saylordotorg

- ↑ Explaining the Resource-Based View Model SMI

- ↑ Resource-Based View (RBV) - Origins and Background Wikipedia