Difference between revisions of "Variable Costs"

(Created page with "'''Content coming soon'''") |

|||

| (2 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

| − | ''' | + | == What are Variable Costs? == |

| + | '''Variable costs''' are expenses that change proportionately to a business's activity. Unlike fixed costs, which remain constant regardless of production levels, variable costs fluctuate with the output volume. These costs typically include expenses directly tied to producing goods or services, such as raw materials, direct labor, and utilities for manufacturing equipment. | ||

| + | |||

| + | |||

| + | [[File:Variable Cost.png|600px|Examples of Variable Cost]] | ||

| + | |||

| + | |||

| + | __TOC__ | ||

| + | |||

| + | |||

| + | == Role and Purpose of Variable Costs == | ||

| + | Variable costs play a crucial role in the financial structure of a business by impacting pricing, profitability, and production decisions. Understanding variable costs helps businesses: | ||

| + | *Manage Pricing: Set prices that cover costs and generate profit. | ||

| + | *Control Expenses: Adjust production levels or operational strategies based on cost fluctuations. | ||

| + | *Enhance Profitability: Optimize operations by identifying the most cost-effective production levels. | ||

| + | |||

| + | |||

| + | == Components of Variable Costs == | ||

| + | Common components of variable costs include: | ||

| + | *Raw Materials: The cost of materials that are directly used in the production of products. | ||

| + | *Direct Labor: Wages paid to employees directly involved in manufacturing goods or providing services. | ||

| + | *Utilities for Production: Costs of utilities like electricity and water increase with more production. | ||

| + | *Commission Fees: Sales commissions vary with the number of sales completed. | ||

| + | *Packaging and Shipping Costs: Expenses related to the packaging and delivery of goods increase with sales volume. | ||

| + | |||

| + | |||

| + | == Importance of Variable Costs == | ||

| + | Variable costs are important for several reasons: | ||

| + | *Profit Margins: They directly affect product profit margins, as lower variable costs can lead to higher profits per unit. | ||

| + | *Break-Even Analysis: Critical in determining the break-even point, the production level at which total revenues equal total costs. | ||

| + | *Operational Flexibility: Provide flexibility in business operations, allowing businesses to adjust quickly to changes in market demand without significant financial repercussions. | ||

| + | |||

| + | |||

| + | == Benefits of Managing Variable Costs == | ||

| + | Effective management of variable costs can yield significant benefits: | ||

| + | *Improved Cost Efficiency: Helps businesses become more cost-effective by aligning expenses directly with production levels. | ||

| + | *Enhanced Competitive Advantage: Companies can offer competitive pricing by managing variable costs effectively, attracting more customers. | ||

| + | *Increased Scalability: Enables businesses to scale operations up or down with less financial risk. | ||

| + | |||

| + | |||

| + | == Examples of Variable Costs in Practice == | ||

| + | *Manufacturing: A toy manufacturer incurs costs for plastic and fabric that vary depending on the number of toys produced. | ||

| + | *Services: The costs for fuel and lawn care supplies for a landscaping service fluctuate with the number of properties serviced. | ||

| + | *Restaurants: Costs for ingredients in a restaurant vary daily based on the number of meals prepared. | ||

| + | Variable costs are a fundamental aspect of financial management within businesses. They provide a clear view of how costs behave with changes in production and sales volumes. By effectively managing these costs, companies can improve operational efficiency, adjust pricing strategies, and enhance profitability. | ||

| + | |||

| + | |||

| + | ==See Also== | ||

| + | *[[Cost Optimization]] | ||

| + | *[[Fixed Costs]]: Discuss fixed costs, which do not change with the production level, contrast variable costs, and show how the two contribute to total costs. | ||

| + | *[[Cost Accounting Standards (CAS)]]: Covering the broader field of cost accounting, which includes tracking and analyzing both variable and fixed costs to help businesses make informed financial decisions. | ||

| + | *Break-Even Analysis: Explaining how variable and fixed costs are used in break-even analysis to determine the point at which a business neither makes a profit nor incurs a loss. | ||

| + | *[[Marginal Cost]]: Discussing marginal cost, the cost of producing one additional product unit, and how it typically involves variable costs. | ||

| + | *Contribution Margin: The concept of contribution margin is calculated by subtracting variable costs from revenues, indicating how much revenue contributes to covering fixed costs and generating profit. | ||

| + | *[[Pricing Strategy]]: Linking to how businesses use variable costs knowledge to set pricing strategies to ensure profitability. | ||

| + | *Budgeting and [[Forecasting]]: Discuss how variable costs are forecasted and budgeted in financial planning, which is especially important for businesses with significant production-level fluctuations. | ||

| + | *Cost-Volume-Profit Analysis (CVP): Explaining how CVP analysis helps determine how changes in costs (both fixed and variable) and volume affect a company's operating profit. | ||

| + | *[[Manufacturing]] and [[Production]]: Discussing the impact of variable costs in manufacturing and production industries, where such costs often include raw materials and direct labor. | ||

| + | *[[Financial Statement]] and Reporting: How variable costs are reported in financial statements and their impact on profitability and financial analysis. | ||

| + | |||

| + | |||

| + | ==References== | ||

| + | <references /> | ||

Latest revision as of 00:55, 16 May 2024

What are Variable Costs?

Variable costs are expenses that change proportionately to a business's activity. Unlike fixed costs, which remain constant regardless of production levels, variable costs fluctuate with the output volume. These costs typically include expenses directly tied to producing goods or services, such as raw materials, direct labor, and utilities for manufacturing equipment.

Role and Purpose of Variable Costs

Variable costs play a crucial role in the financial structure of a business by impacting pricing, profitability, and production decisions. Understanding variable costs helps businesses:

- Manage Pricing: Set prices that cover costs and generate profit.

- Control Expenses: Adjust production levels or operational strategies based on cost fluctuations.

- Enhance Profitability: Optimize operations by identifying the most cost-effective production levels.

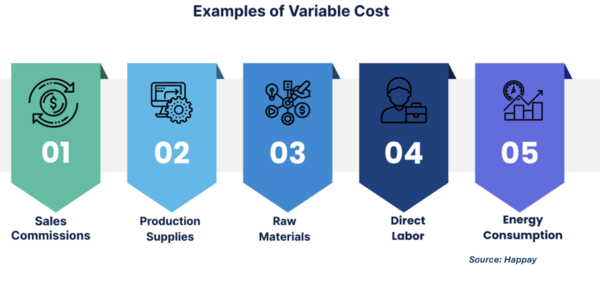

Components of Variable Costs

Common components of variable costs include:

- Raw Materials: The cost of materials that are directly used in the production of products.

- Direct Labor: Wages paid to employees directly involved in manufacturing goods or providing services.

- Utilities for Production: Costs of utilities like electricity and water increase with more production.

- Commission Fees: Sales commissions vary with the number of sales completed.

- Packaging and Shipping Costs: Expenses related to the packaging and delivery of goods increase with sales volume.

Importance of Variable Costs

Variable costs are important for several reasons:

- Profit Margins: They directly affect product profit margins, as lower variable costs can lead to higher profits per unit.

- Break-Even Analysis: Critical in determining the break-even point, the production level at which total revenues equal total costs.

- Operational Flexibility: Provide flexibility in business operations, allowing businesses to adjust quickly to changes in market demand without significant financial repercussions.

Benefits of Managing Variable Costs

Effective management of variable costs can yield significant benefits:

- Improved Cost Efficiency: Helps businesses become more cost-effective by aligning expenses directly with production levels.

- Enhanced Competitive Advantage: Companies can offer competitive pricing by managing variable costs effectively, attracting more customers.

- Increased Scalability: Enables businesses to scale operations up or down with less financial risk.

Examples of Variable Costs in Practice

- Manufacturing: A toy manufacturer incurs costs for plastic and fabric that vary depending on the number of toys produced.

- Services: The costs for fuel and lawn care supplies for a landscaping service fluctuate with the number of properties serviced.

- Restaurants: Costs for ingredients in a restaurant vary daily based on the number of meals prepared.

Variable costs are a fundamental aspect of financial management within businesses. They provide a clear view of how costs behave with changes in production and sales volumes. By effectively managing these costs, companies can improve operational efficiency, adjust pricing strategies, and enhance profitability.

See Also

- Cost Optimization

- Fixed Costs: Discuss fixed costs, which do not change with the production level, contrast variable costs, and show how the two contribute to total costs.

- Cost Accounting Standards (CAS): Covering the broader field of cost accounting, which includes tracking and analyzing both variable and fixed costs to help businesses make informed financial decisions.

- Break-Even Analysis: Explaining how variable and fixed costs are used in break-even analysis to determine the point at which a business neither makes a profit nor incurs a loss.

- Marginal Cost: Discussing marginal cost, the cost of producing one additional product unit, and how it typically involves variable costs.

- Contribution Margin: The concept of contribution margin is calculated by subtracting variable costs from revenues, indicating how much revenue contributes to covering fixed costs and generating profit.

- Pricing Strategy: Linking to how businesses use variable costs knowledge to set pricing strategies to ensure profitability.

- Budgeting and Forecasting: Discuss how variable costs are forecasted and budgeted in financial planning, which is especially important for businesses with significant production-level fluctuations.

- Cost-Volume-Profit Analysis (CVP): Explaining how CVP analysis helps determine how changes in costs (both fixed and variable) and volume affect a company's operating profit.

- Manufacturing and Production: Discussing the impact of variable costs in manufacturing and production industries, where such costs often include raw materials and direct labor.

- Financial Statement and Reporting: How variable costs are reported in financial statements and their impact on profitability and financial analysis.