Zero-Based Budgeting (ZBB)

Zero-Based Budgeting (ZBB) is a methodology that helps align company spending with strategic goals. Its approach requires organizations to build their annual budget from zero each year to help verify that all components of the annual budget are cost-effective, relevant, and drive improved savings.

Implemented effectively, ZBB is a cost discipline that can help businesses improve resource planning, employee engagement, and organizational collaboration. Although ZBB is often credited with measures to reduce costs, its approach doesn’t exclusively focus on savings and can help test assumptions, solve problems, and ensure that spending is aligned to the growth objectives of the organization. If performance does not meet expectations, ZBB can help businesses identify how to best course-correct for the months ahead.[1] Zero-Based Budgeting in management accounting involves preparing the budget from scratch with a zero-base. It involves re-evaluating every line item of cash flow statement and justifying all the expenditure that is to be incurred by the department.

Definition of Zero-Based Budgeting[2]

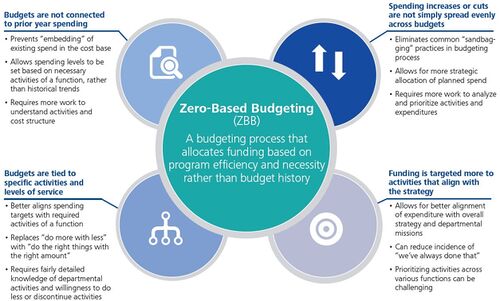

Zero-based budgeting (ZBB) is a budgeting process that allocates funding based on program efficiency and necessity rather than budget history.1 As opposed to traditional budgeting, no item is automatically included in the next budget.2 In ZBB, budgeters review every program and expenditure at the beginning of each budget cycle and must justify each line item in order to receive funding. Budgeters can apply ZBB to any type of cost: capital expenditures; operating expenses; sales, general, and administrative costs; marketing costs; variable distribution; or cost of goods sold.3 When successful, ZBB produces radical savings and liberates organizations from entrenched departments and methodologies.4 When unsuccessful, the costs to an organization can be considerable.

Zero-Based Budgeting vs. Traditional Budgeting[3]

Traditional budgeting calls for incremental increases over previous budgets, such as a 2% increase in spending, as opposed to a justification of both old and new expenses, as called for with zero-based budgeting. Traditional budgeting analyzes only new expenditures, while ZBB starts from zero and calls for a justification of old, recurring expenses in addition to new expenditures. Zero-based budgeting aims to put the onus on managers to justify expenses, and aims to drive value for an organization by optimizing costs and not just revenue.

Zero Based Budgeting Example[4]

Let us take an example of a manufacturing department of a company ABC that spent $ 10 million last year. The problem is to budget the expenditure for the current year. There are multiple ways of doing so:

- The board of directors of the company decides to increase/decrease the expenditure of the department by 10 percent. So the manufacturing department of ABC Ltd will get $ 11 million or $ 9 million depending on the management’s decision.

- The senior management of the company may decide to give the department the same amount as it got in the previous year without hiring more people in the department, or increasing the production etc. This way, the department ends up getting $ 10 million.[adsense]

- Another way is, as, against the traditional method, management may use zero-based budgeting in which the previous year’s number of $ 10 million is not used for calculation. Zero-based budgeting application involves calculating all the expenses of the department and justifying each of these. This reflects the actual requirement of the manufacturing department of company ABC which may be $ 10.6 million.

Zero-Based Budgeting Implementation Process[5]

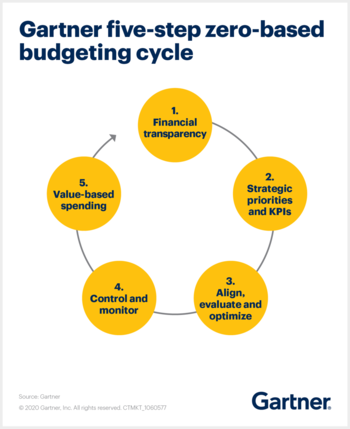

The Gartner approach to ZBB incorporates five prerequisites and follow-on activities to ensure the principles of ZBB are implemented successfully — and operationalized on an ongoing basis.

- Ensure financial transparency: You need visibility into:

- The relationship between activity (cost driver) and cost, so you can see which levers of cost are adding value and which aren’t.

- Whether costs are variable, fixed, discretionary or nondiscretionary

- The impact on costs if spend changes, e.g., contract penalties, severance costs

Without this level of transparency, you can’t see inefficiencies hidden within services/projects/initiatives and can’t identify behaviors that need to be managed to change costs.

- Identify strategic business priorities and KPIs: Identify and cascade strategic business priorities into the budgeting process to ensure alignment and to identify key performance indicators (KPIs) by which to measure the success of investments. Executive leaders must agree and communicate strategic priorities collaboratively and across functions. Without this consensus, zero-based budgeting can’t effectively prioritize spend in terms of business value and outcomes. The choice of metrics/KPIs should reinforce the strategic alignment. Also make sure senior executives endorse the use of the zero-based budgeting approach vs. traditional budgeting methods, either across the enterprise or in the function(s) adopting it. Clearly communicate its purpose and principles to avoid pushback and gain buy-in from the budget holders who will need to examine their cost base. This smooths ZBB implementation.

- Align, evaluate and optimize: Conduct the process of zero-based budgeting as a rightsizing exercise to align functional area spending priorities with desired business outcomes. Especially amid the post-pandemic resetting of business strategy, this realignment ensures that approved budgets are focused on driving value, that is, enabling a business priority/outcome. Note that even though cost-cutting is not the primary objective of zero-based budgeting, cost reduction could be an outcome — although only if:

- There are no value-adding priorities to which spend could be shifted.

- The enterprise needs to return cash to the bottom-line for imminent survival.

- Control and monitor the budget: Maintain a comprehensive and regular review of budgets, spending and variances, at least quarterly and maybe monthly, to stay aligned with business priorities and to contain variances. Monitor budgets to ensure that spending and forecasts remain closely aligned to the activities and outcomes that were the original intent of ZBB implementation. Use the chosen metrics and KPIs to measure and assess the value and alignment of spending to the strategic/desired business outcomes. Just because spending stays within budget doesn’t automatically mean the objectives of the spend have been met.

- Value-based spending : Operationalize the concepts of zero-based budgeting through an ongoing process of value-based spending. If senior leaders focus too much on the procedural changes of ZBB implementation, functions may view it as just another budgeting method. Instead, articulate and reinforce that budget holders don’t “own” approved budgets and value-based spending involves an active assessment of all spending — regardless of whether or not it has been previously agreed to in the budgeting process. Senior executives should actively demonstrate and reinforce behaviors that are at the core of zero-based budgeting, such as:

- Encouraging honest trade-off discussions, driven by alignment to business outcomes

- Making tough resource sacrifices.

Use of Zero-Based Budgeting in Public and Private Sectors[6]

Zero-based budgeting in the public sector versus the private sector is a different process. "The use of ZBB in the private sector has been limited primarily to administrative overhead activities (i.e. administrative expenses needed to maintain the organization).:51 In the United States Zero-based budgeting was developed in 1969 at Texas Instrument Inc. Jimmy Carter, then Governor of Georgia, was the first to adopt the process of zero-base into the government for the preparation of the fiscal of 1973 budget. Three years later, sponsored by the President and Congress the federal government for the first time implemented zero-base budgeting in The Government Economy and Spending Reform act of 1976.

President Carter later required the adoption of ZBB by the federal government during the late 1970s. "Zero-Base Budgeting (ZBB) was an executive branch budget formulation process introduced into the federal government in 1977. Its main focus was on optimizing outputs available at alternative budgetary levels. Under ZBB agencies were expected to set priorities based on the program results that could be achieved at alternative spending levels, one of which was to be below current funding."

For most of the United States government, the main users of ZBB are the legislative, executive, and the agency. The legislative includes the congress, state legislature, and city council, and they require more summarization and focusing on public priorities and objectives. Agencies include the agency director and department managers and they require more detailed information and focus on program implementation and efficiency. Lastly, the executive includes the President, governors, mayor/city manager and they focus on the needs of the legislature and agency. Although the legislative, the agency, and the executive have different focuses they all have to address two standard questions:

- Are the current activities efficient and effective?

- Should current activities be eliminated or reduced to fund higher-priority new programs or reduce the current budget?

According to Peter Sarant, the former director of management analysis training for the US Civil Service Commission during the Carter ZBB implementation effort, "ZBB means 'different things to different people'." Some definitions imply that zero-based budgeting is the act of starting budgets from scratch or requiring each program or activity to be justified from the ground up. This is not true; the acronym ZBB is a misnomer. ZBB is a misnomer because in many large agencies a complete zero-base review of all program elements during one budget period is not feasible; it would result in excessive paperwork and be an almost impossible task if implemented." In many respects, the "common misunderstanding" of ZBB noted above resembles a "sunset review" process more than a traditional public sector ZBB process.

Components of a Public Sector ZBB Analysis

In an overview of zero-based budgeting, there are a total of three elements that make up the concept:

- Decision Unit Determination: the building process of the formulation of a budget structure.

- Decision Package Formulation: when compiling and packaging a budget request, this is the mechanism is utilized.

- Ranking: this process requires the most attention as it requires a company's manager(s) to prioritize out of a group of decision packages that are laid out to them.

In general three components make up public sector ZBB:

- Identify three alternate funding levels for each decision unit (Traditionally, this has been a zero-base level, a current funding level, and an enhanced service level.);

- Determine the impact of these funding levels on program (decision unit) operations using program performance metrics; and

- Rank the program "decision packages" for the three funding levels.

In many cases, program staffers were asked to look for alternative service delivery models that could deliver services more efficiently at lower funding levels.

The US General Accounting Office (GAO) reviewed past performance budgeting initiatives in 1997 and found that ZBBs "main focus was on optimizing accomplishments available at alternative budgetary levels:

Set priorities based on the program results that could be achieved at alternative spending levels, one of which was to be below current funding.

- In developing budget forms, these were to be ranked against each other sequentially from the lowest level organizations up through the department and without reference to a past base.

- In concept, ZBB sought a precise link between budgetary resources and program results."

Further, "ZBB illustrated the usefulness of:

- Defining and presenting alternative funding levels; and

- Expanded participation of program managers in the budget process."

The federal ZBB budgeting system had the following components: "Budget requests for each decision unit were to be prepared by their managers, who would (1) identify alternative approaches to achieving the unit's objectives, (2) identify several alternative funding levels, including a "minimum" level normally below current funding, (3) prepare "decision packages" according to a prescribed format for each unit, including budget and performance information, and (4) rank the decision packages against each other."

ZBB was officially eliminated in federal budgeting on August 7, 1981. "Some participants in the budget process, as well as other observers, attributed certain program efficiencies, arising from the consideration of alternatives, to ZBB. ZBB established within federal budgeting a requirement to:

- Present alternative levels of funding; and

- Link (them) to alternative results."

This element of the ZBB budgeting process remained in effect through the Reagan, Bush and early Clinton administrations before being eliminated in 1994.

Defining the Government Program Zero-base

As noted earlier, there is often considerable confusion over the meaning of zero-base budgeting. There is no evidence that public sector ZBB has ever included "building budgets from the bottom up" and "reviewing every invoice" as part of the analysis. In discussions of ZBB, there is often confusion between a ZBB process and a sunset review process. In a sunset review, the entire function is eliminated unless evidence is provided of program effectiveness. This confusion ultimately leads to the question: what is a zero-base?

Sarant's definition of the zero-base based on the federal training experience is: "A minimum level is the grassroots funding level necessary to keep a program alive. Therefore, the minimal level is the "program or funding level below which it is not feasible to continue a program... because no constructive contribution can be made toward fulfilling its objective." Identifying this level of program funding has been subjective and problematic.

Consequently, "some states have selected arbitrary percentages to ensure that an amount smaller than last year's request is considered. They do this by stipulating that one alternative must be 50, 80, or 90 percent of last year's request." This equates to analyzing the impact on program operations of a 10, 20 or 50 percent reduction in funding as the "zero bases" funding level.

Importance of Performance Measures

Performance measures are a key component of the ZBB process. At the core, ZBB requires quality measures that can be used to analyze the impact of alternative funding scenarios on program operations and outcomes. Without quality measures ZBB simply will not work because decision packages cannot be ranked. To perform a ZBB analysis "alternative decision packages are prepared and ranked, thus allowing marginal utility and comparative analysis."

Traditionally, a ZBB analysis focused on three types of measures. "They (federal agency program staff) were to identify the key indicators to be used in measuring performance and results. These should be "measures of:

- effectiveness,

- efficiency, and

- workload for each decision unit.

Indirect or proxy indicators could be used if these systems did not exist or were under development."

Impact on Government Operations

According to the GAO, "Agencies believed that inadequate time had been allowed to implement the new initiative. The requirement to compress planning and budgeting functions within the time frames of the budget cycle had proven especially difficult, affecting program managers' ability to identify alternative approaches to accomplishing agency objectives. Some agency officials also believed that the performance information needed for ZBB analysis was lacking."[5]:50–51

Also, according to the National Conference of State Legislatures:, In its original sense, ZBB meant that no past decisions are taken for granted. Every previous budget decision is up for review. Existing and proposed programs are on an equal footing, and the traditional state practice of altering almost all existing budget lines by small amounts every year or two would be swept away. No state government has ever found this feasible. Even Georgia, where Governor Jimmy Carter introduced ZBB to state budgeting in 1971, employed a much-modified form.

State programs are not, in practice, amenable to such a radical annual re-examination. Statutes, obligations to local governments, requirements of the federal government, and other past decisions have many times created state funding commitments that are almost impossible to change very much in the short run. Education funding levels are determined in many states partly by state and federal judicial decisions and state constitutional provisions, as well as by statutes. Federal mandates require that state Medicaid funding meet a specific minimum level if Medicaid is to exist at all in a state. Federal law affects environmental program spending, and both state and federal courts help determine state spending on prisons. Much state spending, therefore, cannot usefully be subjected to the kind of fundamental re-examination that ZBB in its original form envisions.

To the extent that ZBB has encouraged governors and legislators to take a hard look at the impact of incremental changes in state spending, it produced a significant improvement in state budgeting. But in its classic form – begin all budget evaluations from zero – ZBB is as unworkable as it ever was."

Use in the Chinese Public Sector

The concept of ZBB was first introduced to China at the beginning of the 1990s and was primarily focused in the Hubei Province area of China. Just as the United States encountered many problems and failures with ZBB, China ran into them as well. But even with the numerous problems and failures along the way, they have gradually adjusted appropriately since then to become more effective in using ZBB as a budget reform. Western influence on budgeting was non-existent in China before 1993. It was during the 1990s that China began looking out for a new and modern form of budgeting for their country’s nationwide budget reform. They ended up settling on ZBB. A new policy was set in place to put ZBB into action, known as the DBR, or the Departmental Budgeting Reform. The DBR and ZBB were first implemented in the Hubei province of China. According to Jun Ma, a professor at the University of Nebraska, the beginning years of ZBB in Hubei were a bit rocky as the DBR had not yet been implemented into all the state departments in Hubei. Only a few departments implemented the budgeting system and the results of multiple departments using multiple budgeting systems were not good. It slowly became clear that using ZBB in a traditional sense would not work out. Officials in the Hubei province and the DBR began looking for ways to incorporate the best parts of ZBB and form a new budgeting system that would work for their needs. The result of this change was a Chinese-styled Target-Based Budgeting system. This form of budgeting required bureaucracies and agencies to submit a simple budget within a pre-set time limit. TBB, as a modified form of ZBB, has worked out moderately well for the Chinese government in Hubei over the years, but many problems still face the budgeting system.

Some number of issues ranging from the absence of a unified budget and certain expenditures that are somehow exempt from the ZBB process, to the influence or effects of political factors have been widely noted.

- Absence of a Budget Unification- Though the Hubei Province has developed a thorough budget by combining expenditures and off-budget revenues into the budget, there yet remains certain types of expenses that are still under the control of certain individuals other than the government Finance Department. Because of this, the difficulty of prioritizing all the possible government programs becomes confusing.

- Political Factor Influences- No matter what the term or whose term it is, political officials have always had a certain plan or change that they would like to implement that would greatly influence the prioritizing process of ZBB. Certain political officials could say they greatly support a certain program and would like the Finance Department to focus more money on that particular program whilst other political officials would think otherwise. Therefore, any real changes or improvements made will always face opposition unless they have unified political support.

- Expenditure exemptions- Ranging from operating and personnel expenses to central government policies that are unfunded that start after the budget year, these are just to name a few things that are excluded from the ZBB process. By not including a large portion of spending into the ZBB process, the effectiveness potential of these reforms becomes greatly reduced.

Two notable reforms to the ZBB process include having departments submit budget requests and the use of sunset legislation.

- Budget requests- These requests are to reflect (1) a cut of a certain percentage, (2) current level of spending, and (3) an increase of a certain percentage. This allows the opportunity of trading between departments of the funding of a lower priority of one department to a higher priority of another.

- Sunset legislation- This process places a sense of urgency on certain programs implemented or that are currently being funded as that program shall be placed under review to determine efficiency & effectiveness, and see whether the public or government need this program. (Bunch)

Use in Private Sector

3G Capital has become successful using ZBB within their company. arlos Brito, a protégé of Jorge Paulo Lemann, "brought to Anheuser-Busch the concept of 'zero-based budgeting,' wherein every expense must be newly justified every year, not just new ones, and the goal is to bring it lower than the year prior" at Anheuser-Busch InBev as early as in the 1990s. Following their decade of lessons in ZBB, 3G Capital employed similar cost management concepts at their next acquisitions: Burger King, Tim Hortons, Heinz, Kraft Foods, and Popeyes Louisiana Kitchen. The use of ZBB might have continued the subjective notion that this budgeting style is a fix-all for businesses trying to lighten the load of a new company. This concept triggered measures as drastic as cutting hundreds of management jobs and jettisoning corporate jets, to as simple as requiring employees to ask to make photocopies. Following the 2015 merger of Kraft and Heinz, some analysts and former employees blamed 3G Capital's use of ZBB for the company's poor performance.

Impact of ZBB on Stockholders

According to Accenture, "examples of companies that have successfully implemented ZBB...include a consumer goods company that was able to achieve 18 percent savings and a 20 percent increase in the share price. Another case was that of a prominent commercial bank, which unlocked a large sum of money and reinvested it in ‘going digital’, and a healthcare company that achieved savings of £1.2bn (€1.36bn) for three years." As a result, companies are vocal about their use of ZBB programs in their earning calls including Mondelēz International, Campbell Soup Company, Kraft Heinz, Anheuser-Busch InBev and Tesco. In its 2017 first-half results, Unilever even reported that ZBB was improving its marketing productivity and streamlining its advertising spend, while also reducing overhead costs that weren’t bringing much value. In another case, the use of ZBB within 3G Capital has been profitable for stockholders. When 3G Capital quickly cut costs within Kraft, their stock prices increased 36% as a direct result. This type of budgeting enabled companies like Kraft to compete again on price with some of the leaner competition, that had previously undercut Kraft's prices. Zero-based budgeting helps more money to flow to stockholders than into unused departments, over-funded programs, and wasteful spending habits.

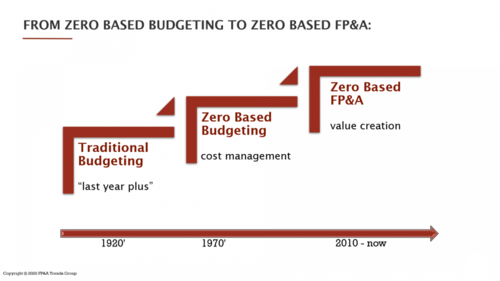

From Zero-Based Budgeting to Zero-Based Everything[7]

During times of great change and uncertainty, traditional budgeting has become increasingly less “fit for purpose”. When, in March 2020, the COVID-19 outbreak closed international borders and economies, the world was left with many dead budgets and unrealistic forecasts. At times like this, it has become even more clear that planning and forecasting should be much more adaptable and agile than before.

The word “Budget” is not associated with flexibility and dynamics. Zero-Based Budgeting has started to be evolved to “Zero-Based Everything”:

A quick search amongst the major consultancies shows offerings that include Zero-Based Redesign (Bain), Zero-Based Supply Chain (Accenture), Zero-Based Mindset (Accenture), Zero-Based Marketing (McKinsey), Zero-Based Productivity (McKinsey), etc.

As it was famously quoted by Albert Einstein, “we cannot solve our problems with the same thinking we used when we created them”.

Though the concept of ZBB is becoming more popular, it has some historical limitations. The International FP&A Board has developed a Zero-Based FP&A (ZB FP&A) concept that allows a fresh look into the entire planning and forecasting process. In contrast to ZBB, Zero-Based FP&A entails applying the Zero-Based concept to the overall planning and forecasting framework. Most importantly, it helps to identify the underlying business and value drivers for those “Independent Packages” that are subject to the Zero-Based examination. Therefore, the exercise is not solely applicable to expense items, but also to other lines of the three accounting statements (P&L, Balance Sheet, and Cash Flow). In other words, Zero-Based FP&A helps to remove unnecessary “fat” from traditional plans and forecasts and to enhance the understanding of key business and value drivers. This is an exercise that is managed by FP&A but relates to the entire organization.

Implementing ZB FP&A involves both analytical and business partnering techniques, namely:

- Interviewing and collaborating with key business stakeholders (cost centres and profit centre owners.)

- Researching the key business drivers using analytical methods.

- Educating key business stakeholders on key drivers, models, and forecasting techniques.

- Managing and maintaining the process of Zero-Based FP&A, if necessary. In some cases repeating this process regularly is not needed: when the drivers are identified, they can be maintained through analytical methods alone.

Zero-Based Budgeting Myths and Realities[8]

- Myth one: ZBB simply means building your budget from zero

- Reality: ZBB is a repeatable process to build a sustainable culture of cost management

Zero-based budgeting is much more than building a budget from zero. World-class ZBB efforts successfully build cultures of cost management throughout the organization by using a structured approach to facilitate cost visibility, cost governance, cost accountability, and aligned incentives. Fortunately the culture shift isn’t left to chance. We believe that there is a proven, step-by-step approach to implementing successful ZBB programs, and when this implementation is done well, ZBB makes cost management a part of the way every employee works on a daily basis.

- Reality: ZBB is a repeatable process to build a sustainable culture of cost management

- Myth two: Implementing ZBB requires cutting ‘to the bone’

- Reality: The degree of cost reduction is based on the company’s top-down target

Although very little has been written recently about zero-based budgeting, the published content that exists often associates it with cutting costs to the bone, using any means necessary (for example, eliminating mini refrigerators in office kitchens to save electricity). While this may sometimes occur, it is by no means necessary. Simply put, the degree (and aggressiveness) of each company’s cost cutting reflects the size of its top-down savings target. For instance, in the most aggressive situations, we’ve seen 30 percent reduction targets in year one versus other situations that aim for 10 percent reduction targets with an agreement to reinvest half of that into more productive areas, therefore only taking 5 percent to the bottom line.

- Reality: The degree of cost reduction is based on the company’s top-down target

- Myth three: ZBB will overwhelm your business and prevent it from doing anything else

- Reality: Initial rollout of a new ZBB program can be led by a central team and completed in four to ten months

The idea that ZBB requires dedicated focus from every employee for a year or more is simply not true. While it takes time to embed a new cost-management culture into any organization, the setup and rollout of a new ZBB program has much more limited requirements. During the initial setup, a central coordination team develops deep visibility into costs and sets detailed savings targets for the next budgeting cycle. That team also ensures that the company’s systems and processes are in place for the detailed reporting, governance, and performance management that a world-class ZBB requires. In our experience, this setup period could take anywhere from four to ten months and is primarily led by full-time support from finance and IT, with part-time involvement from profit-and-loss owners and cost-category owners across the company. Organizations that are unsure about ZBB’s upside are well suited to pilot the process. There are many ways to build these pilots, each of which can be customized to meet the company’s objectives. One company, for instance, is piloting a ZBB rollout across its global finance function. This approach builds capabilities within the team that will help drive the program across the enterprise while having the added benefit of helping team members achieve their existing budget targets.

- Reality: Initial rollout of a new ZBB program can be led by a central team and completed in four to ten months

- Myth four: ZBB only focuses on SG&A

- Reality: ZBB can be applied to any type of cost: capital expenditures; operating expenses; sales, general, and administrative costs; marketing costs; variable distribution; or cost of goods sold

The fundamental elements of a ZBB program—governance, accountability, visibility, aligned incentives, and a rigorous process—form a comprehensive cost-management tool kit. However, certain adjustments need to be made when using this tool kit in particular areas. For example, when ZBB is applied to variable costs (such as cost of goods sold, variable distribution) the budget needs to be volume adjusted in monthly performance reports. When ZBB is applied to capital expenditures, costs are categorized by discrete investment choices rather than types of expenses, as they are with operating expenses.

- Reality: ZBB can be applied to any type of cost: capital expenditures; operating expenses; sales, general, and administrative costs; marketing costs; variable distribution; or cost of goods sold

- Myth five: ZBB is not designed for growth-oriented companies

- Reality: ZBB is successfully used by growing companies to redirect unproductive costs to more productive areas that drive growth

Zero-based budgeting is a powerful tool for any company, whatever its orientation. Even if the organization’s primary focus is on growth, profit, or talent retention, cost management remains crucial to its success. Eliminating unproductive costs allows the company to be redirected to more productive areas. As we mentioned in the earlier example, back-office costs can be redirected to customer-facing activities. ZBB is not a slash-and-burn exercise that cuts costs without regard for the expense. With deep visibility into costs, changes can be made to surgically cut the fat and help build up organizational muscle.

- Reality: ZBB is successfully used by growing companies to redirect unproductive costs to more productive areas that drive growth

Zero-based budgeting can drive significant and sustainable savings, but it is much more than simply building a budget from zero. World-class ZBB programs build a culture of cost management through unprecedented cost visibility, a unique governance model, accountability at all levels of the organization, aligned incentives, and a rigorous and routine process. ZBB frees up unproductive costs and allows those savings to be taken to the bottom line or redirected to more productive areas that will drive future growth.

Advantages and Disadvantages of Zero-based Budgeting[9]

Advantages of Zero-based Budgeting

The final output is well justified and is aligned with the company’s overall business strategy or business plan.

Encourages more collaboration throughout the company

Improves performance and operating efficiency by challenging assumptions and examining expenditures

By avoiding traditional budgeting percentage increases, there is a significantly better chance of making cost reductions.

Disadvantages of Zero-based Budgeting

Implementing a zero-based budget requires qualified personnel and specialized training, which can be time-consuming and costly.

May harm the company’s overall culture or brand image

May be cost-prohibitive (because of time, research, and analysis required) for companies with minimal available funding

It is substantially more complex and tedious to start from a zero base. Traditional budgeting is much simpler, faster, and easier to implement.

See also

References

- ↑ What Does Zero-Based Budgeting (ZBB) Mean? Anaplan

- ↑ What is Zero-Based Budgeting? Deloitte

- ↑ Zero-Based Budgeting vs. Traditional Budgeting Invetopedia

- ↑ Zero Based Budgeting Example eFinance Management

- ↑ 5-step process for ZBB implementation Gartner

- ↑ Use of Zero-Based Budgeting in Public and Private Sectors Wikipedia

- ↑ From Zero-Based Budgeting to Zero-Based Everything FP&A Trends

- ↑ Five myths (and realities) about zero-based budgeting McKinsey

- ↑ Advantages and Disadvantages of Zero-based Budgeting CFI