Acquisition

Acquisition is the act of one company taking over or acquiring a controlling interest of another company by means of an asset purchase or a stock purchase.[1]

Acquisition has become one of the most popular ways to grow today. Since 1990, the annual number of mergers and acquisitions has doubled, meaning that this is the most popular era ever for growth by acquisition. Companies choose to grow by acquiring others to increase market share, to gain access to promising new technologies, to achieve synergies in their operations, to tap well-developed distribution channels, to obtain control of undervalued assets, and a myriad of other reasons. But acquisition can be risky because many things can go wrong with even a well-laid plan to grow by acquiring: Cultures may clash, key employees may leave, synergies may fail to emerge, assets may be less valuable than perceived, and costs may skyrocket rather than fall. Still, perhaps because of the appeal of instant growth, acquisition is an increasingly common way to expand.[2]

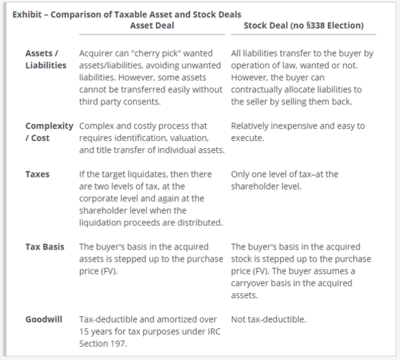

Types of Acquisition - Asset and Stock Deals (see Exhibit below)[3]

Note that in a stock sale, the sellers are the target's shareholders (which may be a corporate entity). In an asset sale, the seller is a corporate entity. So, the type of acquisition will determine who pays taxes on the transaction and the amount of taxes to be paid based on the tax rate applicable to the seller. One must not confuse the type of acquisition with the form of consideration. A buyer may use either cash or stock (or a combination thereof) as consideration in exchange for the assets or stock of the target.

- Asset Acquisitions

In an asset sale, individually identified assets and liabilities of the seller are sold to the acquirer. The acquirer can choose ("cherry pick") which specific assets and liabilities it wants to purchase, avoiding unwanted assets and liabilities for which it does not want to assume responsibility. The asset purchase agreement between the buyer and seller will list or describe and assign values to each asset (or liability) to be acquired, including every asset from office supplies to goodwill. Determining the fair value of each asset (or liability) acquired can be mechanically complex and expensive; tedious valuations are costly and title transfer taxes must be paid on each asset transferred. Also, some assets, such as government contracts, may be difficult to transfer without the consent of business partners or regulators. If the assets to be acquired are not held in a separate legal entity, they must be purchased in an asset sale, rather than a stock sale, unless they can be organized into a separate legal entity prior to sale. Subsidiaries of consolidated companies are often organized as separate legal entities, whereas operating divisions are usually not. A major tax advantage to the acquirer of structuring a transaction as a taxable asset purchase is that the acquirer receives stepped-up tax basis in the target's net assets (assets minus liabilities). This means that the acquired net assets are written up (or down) from their carrying values on the seller's tax balance sheet to fair value (FV) on the acquirer's tax balance sheet. The higher resulting tax basis in the acquired net assets will minimize taxes on any gain on the future sale of those assets. Under U.S. tax law, goodwill and other intangibles acquired in a taxable asset purchase are required by the IRS to be amortized over 15 years, and this amortization is tax-deductible. Goodwill is never amortized for accounting purposes but instead tested for impairment.

- Stock Acquisitions

In a stock purchase, all of the assets and liabilities of the seller are sold upon transfer of the seller's stock to the acquirer. As such, no tedious valuation of the seller's individual assets and liabilities is required and the transaction is mechanically simple. The acquirer does not receive a stepped-up tax basis in the acquired net assets but, rather, a carryover basis. Any goodwill created in a stock acquisition is not tax-deductible. However, if an Internal Revenue Code (IRC) Section 338 election is made by the acquirer (or jointly by the acquirer and seller), the stock sale is treated as an asset sale for tax purposes. A Section 338 election entitles the buyer to the coveted stepped-up tax basis and tax-deductible goodwill, but also triggers a taxable gain on the hypothetical asset sale. We will discuss Section 338 elections more in another lesson. Although the buyer acquires all assets and liabilities in a stock purchase, it may contractually allocate unwanted liabilities to the seller by selling them back to the seller. In the stock acquisition of a corporate subsidiary without a Section 338 election, the selling parent company may use the tax attributes (e.g. NOLs) of its other subsidiaries to offset its gain on the sale of target stock. However, the parent cannot use the tax attributes of the target subsidiary because they are lost to the buyer in the transaction and subject to limitation under Section 382.

source:Macabacus

The first step of a friendly acquisition includes developing a strategy and researching the financial benefit of acquiring the target company. Acquiring companies must know the resources needed to purchase another company. The next step in the acquisition process includes identifying and performing a valuation of the target firm. Companies perform valuations by examining financial statements, identifying market positions, researching legal obligations and performing a SWOT analysis on the target firm. After the valuation process, a company must determine how much the target company is worth, and the best way to raise the resources needed for the acquisition. The last step includes both companies agreeing to the terms of the acquisition and meeting all legal requirements.

How Acquisition Works (Example)[5]

An acquisition is commonly mistaken with a merger – which occurs when the purchaser and the target both cease to exist and instead form a new, combined company. When a target company is acquired by another company, the target company ceases to exist in a legal sense and becomes part of the purchasing company. Acquisitions are commonly made by using cash or debt to purchase outstanding stock, but companies can also use their own stock by exchanging it for the target firm's stock. Acquisitions can be either hostile or friendly.

For example: Let's assume Company XYZ wants to acquire Company ABC. Company XYZ starts to buy ABC shares on the open market, but once Company XYZ acquires 5% of ABC, it must formally (and publicly) declare to the Securities and Exchange Commission (SEC) how many shares it owns. Company XYZ must also state whether it intends to buy ABC or just hold its existing shares as an investment. If Company XYZ wants to proceed with the acquisition, it will make a "tender offer" to ABC's board of directors, followed by an announcement to the press. The tender offer will indicate, among other things, how much Company XYZ is willing to pay for ABC and how long ABC shareholders have to accept the offer. Once the tender offer is made, ABC can accept (1) the terms of the offer, (2) negotiate a different price, (3) use a "poison pill" or other defense to avert the deal, or (4) find another company, who hopefully will pay as much or more as XYZ is offering, to buy them. If ABC accepts the offer, regulatory bodies then review the transaction to ensure the combination does not create a monopoly or other anti-competitive circumstances within the industries involved. If the regulatory bodies approve the transaction, the parties exchange funds and the deal is closed.

Share Prices and Acquisitions[6]

The acquiring company often offers a premium on the market price of the target company's shares to entice shareholders to sell. For example, News Corp.'s bid to acquire Dow Jones back in 2007 was equal to a 65% premium over the stock's market price. When a firm acquires another entity, there usually is a predictable short-term effect on the stock price of both companies. In general, the acquiring company's stock will fall while the target company's stock will rise. The target company's stock usually goes up because of the premium that the acquiring company pays. The acquiring company's stock usually goes down for several reasons. First, as we mentioned above, the acquiring company must pay more than the target company currently is worth. Beyond that, there are often several uncertainties involved with acquisitions. Here are some of the problems the takeover company could face during an acquisition:

- A turbulent integration process: problems associated with integrating different workplace cultures

- Lost productivity because of management power struggles

- Additional debt or expenses that must be incurred to make the purchase

- Accounting issues that weaken the takeover company's financial position, including restructuring charges and goodwill

Mergers vs. Acquisitions[7]

A merger takes place when two companies combine together as equals to form an entirely new company. Mergers are rare, since most often companies are acquired by other companies, and it is more of absorption of operation of the target company. The term merger is more often used to show deference to employees and former owners when another company is taken over. Mergers and acquisition are a means to a long-term business strategy. New alliances, mergers or takeovers are usually based on company vision and mission statements, and they have to truly reflect company corporate strategy in terms of what it wants to achieve with the strategic move in the industry. The process of acquisition or a merger calls for a disciplined approach by the decision makers at the company. Three important considerations should be taken into account:

- Company must be willing to take risk, and make investment early-on to benefit fully from the merger, competitors and the industry takes heed and start to merger or acquirer themselves.

- In order to reduce and diversify risk, multiple bets must be made, since some of the initiatives will fail, while some will prove fruitful.

- The management of the acquiring firm must learn to be resilient, patient and able to emulate change owing to ever-changing business dynamics in the industry.

Takeover vs Acquisition[8]

Acquisitions and takeovers are quite similar to each other, and in both acquisitions and takeovers, the acquirer firm purchases the target and both firms will operate as one larger unit. The reasons for which either an acquisition or takeover occurs is also quite similar, and usually occurs because combined operations can benefit both firms through economies of scale, better technology and knowledge sharing, larger market share etc. During both an acquisition and takeover, the acquirer is entitled to all assets as well as liabilities of the target firm. The only major difference between the two is that a takeover is usually a hostile act, whereas an acquisition is usually an agreed upon well planned operation.

References

- ↑ Definition of Acquisition Attract Capital

- ↑ Why Companies Acquire? Entrepreneur

- ↑ Types of Acquisition (Asset and Stock Deals) Macabacus

- ↑ Understanding the Acquisition Process [^http://smallbusiness.chron.com/takeover-vs-acquisition-32510.html%7CChron]

- ↑ An Example of How Acquisition Works Investing Answers

- ↑ How are Share Prices Affected during an Acquisition? Investopedia

- ↑ Mergers vs. Acquisitions Cleverism

- ↑ Takeover vs Acquisition Difference Between.com

Further Reading

- The six types of successful acquisitions McKinsey & Co

- Acquisitions: The Process Can Be a Problem HBR

- Want A Smooth Acquisition? Follow These Six Strategies Forbes

- Big Firms Lose Value in Acquisitions [1]