Difference between revisions of "Customer Lifetime Value"

| Line 2: | Line 2: | ||

The [[Pareto Principle]] states that, for many events, roughly 80% of the effects come from 20% of the causes. When applied to [[E-Commerce|e-commerce]], this means that 80% of your revenue can be attributed to 20% of your customers. While the exact percentages may not be 80/20, it is still the case that some customers are worth a whole lot more than others, and identifying your “All-Star” customers can be extremely valuable to your business. Taking CLV into account can shift how you think about [[Customer Acquisition Cost (CAC)|customer acquisition]]. Rather than thinking about how you can acquire a lot of customers and how cheaply you can do so, CLV helps you think about how to optimize your acquisition spending for maximum value rather than minimum cost. | The [[Pareto Principle]] states that, for many events, roughly 80% of the effects come from 20% of the causes. When applied to [[E-Commerce|e-commerce]], this means that 80% of your revenue can be attributed to 20% of your customers. While the exact percentages may not be 80/20, it is still the case that some customers are worth a whole lot more than others, and identifying your “All-Star” customers can be extremely valuable to your business. Taking CLV into account can shift how you think about [[Customer Acquisition Cost (CAC)|customer acquisition]]. Rather than thinking about how you can acquire a lot of customers and how cheaply you can do so, CLV helps you think about how to optimize your acquisition spending for maximum value rather than minimum cost. | ||

| + | |||

| + | |||

| + | [[File:Customer_Lifetime_Value.gif|400px|Customer Lifetime Value]]<br /> | ||

| + | source: Brandwise | ||

| Line 19: | Line 23: | ||

*CLV is an important measure of customer profitability and | *CLV is an important measure of customer profitability and | ||

*Customer lifetime value is usually considered to be a very important marketing metric, because of the range of the marketing objectives it measures within a single number. | *Customer lifetime value is usually considered to be a very important marketing metric, because of the range of the marketing objectives it measures within a single number. | ||

| + | |||

| + | |||

| + | == The Need for Customer Lifetime Value<ref>The Need for Customer Lifetime Value [https://www.getbrandwise.com/branding-blog/bid/115243/What-is-Customer-Lifetime-Value-and-Why-is-it-So-Important Brandwise]</ref> == | ||

| + | Understanding Customer Lifetime Value is helpful to the business owner or CEO as they develop strategies for: | ||

| + | *Acquisition: Customer Lifetime Value (CLV) helps you allocate your customer procurement budget based on what the new client will actually bring to your firm. You’ll develop a better understanding of what you can spend to acquire customers. | ||

| + | *Advertising and marketing targeting: Use CLV data to help build more accurate and detailed customer personas. Customer lifetime value helps you spend advertising and marketing dollars wisely, focusing on the customer segments(s) that deliver the highest profit to your company. | ||

| + | *ROI: CLV provides an excellent indicator and accurate measurement of marketing campaign performance. Get maximum return from often limited resources. | ||

| + | *Impact of management strategies: Learn the effect of certain high-level decisions on the value of customer assets. The CLV data can be used to encourage a company culture emphasizing long-term customer satisfaction, rather than solely focusing on short-term sales. | ||

| + | *Retention efforts: Decide what you should spend to retain specific customer segments. This helps you manage your customer relationships toward profitability. Measure customer loyalty, including factors such as purchase frequency and probability. | ||

| + | *Individual-customer profitability: You can calculate the profitability of a single customer. This info can be used by the sales team, for example: to focus their efforts on the most profitable new-customer demographic for a particular product/service and to point out upsell opportunities within the current customer base. | ||

| + | *Company profitability/valuation: CLV is a key data point in determining the valuation of your company. Knowing the value of your customer base, and expected growth, is useful when seeking additional rounds of funding or evaluating buy-out offers. | ||

| Line 32: | Line 47: | ||

[[File:Customer_Lifetime_Value_Model.png|400px|Traditional Customer Lifetime Value Calculation]]<br /> | [[File:Customer_Lifetime_Value_Model.png|400px|Traditional Customer Lifetime Value Calculation]]<br /> | ||

source: [https://finnchat.com/en/how-to-calculate-customer-lifetime-value-ltv/ FinnChat] | source: [https://finnchat.com/en/how-to-calculate-customer-lifetime-value-ltv/ FinnChat] | ||

| + | |||

| + | |||

| + | == The Purpose of the Customer Lifetime Value Metric<ref>What is the purpose of the customer lifetime value metric? [https://en.wikipedia.org/wiki/Customer_lifetime_value Wikipedia]</ref> == | ||

| + | The purpose of the customer lifetime value metric is to assess the financial value of each customer. Don Peppers and Martha Rogers are quoted as saying, “some customers are more equal than others.” Customer lifetime value differs from customer profitability or CP (the difference between the revenues and the costs associated with the customer relationship during a specified period) in that CP measures the past and CLV looks forward. As such, CLV can be more useful in shaping managers’ decisions but is much more difficult to quantify. While quantifying CP is a matter of carefully reporting and summarizing the results of past activity, quantifying CLV involves forecasting future activity. Present value is the discounted sum of future cash flows: each future cash flow is multiplied by a carefully selected number less than one, before being added together. The multiplication factor accounts for the way the value of money is discounted over time. The time-based value of money captures the intuition that everyone would prefer to get paid sooner rather than later but would prefer to pay later rather than sooner. The multiplication factors depend on the discount rate chosen (10% per year as an example) and the length of time before each cash flow occurs. For example, money received ten years from now must be discounted more than money received five years in the future. CLV applies the concept of present value to cash flows attributed to the customer relationship. Because the present value of any stream of future cash flows is designed to measure the single lump sum value today of the future stream of cash flows, CLV will represent the single lump sum value today of the customer relationship. Even more simply, CLV is the monetary value of the customer relationship to the firm. It is an upper limit on what the firm would be willing to pay to acquire the customer relationship as well as an upper limit on the amount the firm would be willing to pay to avoid losing the customer relationship. If we view a customer relationship as an asset of the firm, CLV would present the monetary value of that asset. One of the major uses of CLV is customer segmentation, which starts with the understanding that not all customers are equally important. CLV-based segmentation model allows the company to predict the most profitable group of customers, understand those customers' common characteristics, and focus more on them rather than on less profitable customers. CLV-based segmentation can be combined with a Share of Wallet (SOW) model to identify "high CLV but low SOW" customers with the assumption that the company's profit could be maximized by investing marketing resources in those customers. Customer Lifetime Value metrics are used mainly in relationship-focused businesses, especially those with customer contracts. Examples include banking and insurance services, telecommunications and most of the business-to-business sector. However, the CLV principles may be extended to transactions-focused categories such as consumer packaged goods by incorporating stochastic purchase models of individual or aggregate behavior.[4] In either case, retention has a decisive impact on CLV, since low retention rates result in Customer Lifetime Value barely increasing over time. | ||

| Line 63: | Line 82: | ||

=== What Customers Cost the Business<ref>How Much Are Your Customers Costing You? [https://www.qualtrics.com/experience-management/customer/customer-lifetime-value/ Qualtrics]</ref> === | === What Customers Cost the Business<ref>How Much Are Your Customers Costing You? [https://www.qualtrics.com/experience-management/customer/customer-lifetime-value/ Qualtrics]</ref> === | ||

CLV is a great metric to track and optimize, but one thing to keep a close eye on too is the cost of that customer to your business. This is where [[Cost to Serve (CTS)|Cost to Serve]] comes in. If the cost of serving an existing customer becomes too high, you may be making a loss despite their seemingly high CLV. So there’s a balancing act to negotiate here. To go back to our paid TV subscription, your cost to serve might be higher in the first year of a contract but gradually drop off the longer they stay with you. Thus, if your renewal rates drop, your average cost to serve is likely to rise and cause a drop in profitability. Understanding these numbers over time and being able to track them side by side is the only way to get a true understanding not only of what’s driving customer spend and loyalty but also what it’s delivering back to the business’s bottom line. | CLV is a great metric to track and optimize, but one thing to keep a close eye on too is the cost of that customer to your business. This is where [[Cost to Serve (CTS)|Cost to Serve]] comes in. If the cost of serving an existing customer becomes too high, you may be making a loss despite their seemingly high CLV. So there’s a balancing act to negotiate here. To go back to our paid TV subscription, your cost to serve might be higher in the first year of a contract but gradually drop off the longer they stay with you. Thus, if your renewal rates drop, your average cost to serve is likely to rise and cause a drop in profitability. Understanding these numbers over time and being able to track them side by side is the only way to get a true understanding not only of what’s driving customer spend and loyalty but also what it’s delivering back to the business’s bottom line. | ||

| + | |||

| + | |||

| + | == Predicting Customer Lifetime Value<ref>How to predict your Customer Lifetime Value [https://www.stitchdata.com/customer-lifetime-value/ Stitch Data]</ref> == | ||

| + | CLV can be calculated historically, over specific time periods, or it can be predictive. Each of these calculations serves different purposes. Predictive CLTV is the most powerful way to not only understand what a customer is worth to you now, but also see how their value will change over time. Let’s look at an example for the ecommerce industry. Here's a chart that shows CLTV benchmark data from nearly 200 ecommerce companies. In this chart we’re looking at the most basic form of CLV. It has a single input, sum of all purchases, and closed time parameters, 365 days. | ||

| + | |||

| + | |||

| + | [[File:CLV_by_Quartile.png|500px|CLTV Benchmark Data Chart]]<br /> | ||

| + | source: StitchData | ||

| + | |||

| + | |||

| + | On day one, customers with the highest lifetime values have already distinguished themselves. This means marketers don’t need to wait long to make important invest-or-kill decisions about their marketing campaigns. CLV is the best metric to predict future customer behaviors. | ||

| Line 70: | Line 100: | ||

*Set expectations regarding delivery dates, aiming to underpromise and overdeliver. It’s much better to promise delivery by August 1 and have it in their hands by July 20th than the reverse. | *Set expectations regarding delivery dates, aiming to underpromise and overdeliver. It’s much better to promise delivery by August 1 and have it in their hands by July 20th than the reverse. | ||

*Create a rewards program to encourage repeat purchases, with rewards that are both attainable and desirable. | *Create a rewards program to encourage repeat purchases, with rewards that are both attainable and desirable. | ||

| − | Offer freebies for doing business with you, to build brand loyalty. | + | *Offer freebies for doing business with you, to build brand loyalty. |

*Use upsells to increase the average value of a customer transaction, which is the equivalent of McDonald’s asking, “Do you want fries with that?” | *Use upsells to increase the average value of a customer transaction, which is the equivalent of McDonald’s asking, “Do you want fries with that?” | ||

*Stay in touch. Long-time customers want to know you haven’t forgotten them. Make it easy for them to reach out to you as well. | *Stay in touch. Long-time customers want to know you haven’t forgotten them. Make it easy for them to reach out to you as well. | ||

Revision as of 19:22, 15 October 2019

Customer Lifetime Value, CLV or CLTV is the present value of the future cash flows or the value of business attributed to the customer during his or her entire relationship with the company. CLTV is the value a customer contributes to your business over the entire lifetime at your company. It is a very important metric and is used while making important decisions about sales, marketing, product development, and customer support.[1] CLV is different from customer profitability (CP), which measures the customer's worth over a specific period of time, in that the metric predicts the future whereas CP measures the past. If your customer revenue is high but CLV is low, it could tell you that you’re spending too much money to obtain new customers or that you’re not convincing those customers to purchase enough.

The Pareto Principle states that, for many events, roughly 80% of the effects come from 20% of the causes. When applied to e-commerce, this means that 80% of your revenue can be attributed to 20% of your customers. While the exact percentages may not be 80/20, it is still the case that some customers are worth a whole lot more than others, and identifying your “All-Star” customers can be extremely valuable to your business. Taking CLV into account can shift how you think about customer acquisition. Rather than thinking about how you can acquire a lot of customers and how cheaply you can do so, CLV helps you think about how to optimize your acquisition spending for maximum value rather than minimum cost.

Other Definitions of Customer Lifetime Value (CLTV)[2]

A formal definition of customer lifetime value (CLV) from a well-regarded marketing metrics textbook. In the textbook Marketing Metrics: the definitive guide to measuring marketing performance (Farris et al 2010), the authors defined customer lifetime value as:

- “Customer lifetime value is the dollar value of a customer relationship based on the present value of the projected future cash flows from the relationship.”

Some othe approaches to defining customer lifetime value (CLV) include:

- Customer lifetime value is the economic net worth of a customer to the firm.

- Customer lifetime value is the net profit contribution of the customer to the firm over time.

- Customer lifetime value is a measure of a customer’s aggregate profit to the firm over the total time that the customer deals with the firm.

- Customer lifetime value measures the total profit derived from a customer during the time that they are a customer of the firm.

All of these definitions are appropriate to use, and are essentially communicating the same definition of customer lifetime value. The key points to note are:

- Customer lifetime value is calculated as a single dollar number,

- CLV summarizes total revenue and costs related to a customer over time,

- CLV provides a net profit/loss summary of the customer’s total relationship with the firm,

- It is calculated on per customer basis, or more usually on the average value for a customer within a particular market segment,

- CLV is an important measure of customer profitability and

- Customer lifetime value is usually considered to be a very important marketing metric, because of the range of the marketing objectives it measures within a single number.

The Need for Customer Lifetime Value[3]

Understanding Customer Lifetime Value is helpful to the business owner or CEO as they develop strategies for:

- Acquisition: Customer Lifetime Value (CLV) helps you allocate your customer procurement budget based on what the new client will actually bring to your firm. You’ll develop a better understanding of what you can spend to acquire customers.

- Advertising and marketing targeting: Use CLV data to help build more accurate and detailed customer personas. Customer lifetime value helps you spend advertising and marketing dollars wisely, focusing on the customer segments(s) that deliver the highest profit to your company.

- ROI: CLV provides an excellent indicator and accurate measurement of marketing campaign performance. Get maximum return from often limited resources.

- Impact of management strategies: Learn the effect of certain high-level decisions on the value of customer assets. The CLV data can be used to encourage a company culture emphasizing long-term customer satisfaction, rather than solely focusing on short-term sales.

- Retention efforts: Decide what you should spend to retain specific customer segments. This helps you manage your customer relationships toward profitability. Measure customer loyalty, including factors such as purchase frequency and probability.

- Individual-customer profitability: You can calculate the profitability of a single customer. This info can be used by the sales team, for example: to focus their efforts on the most profitable new-customer demographic for a particular product/service and to point out upsell opportunities within the current customer base.

- Company profitability/valuation: CLV is a key data point in determining the valuation of your company. Knowing the value of your customer base, and expected growth, is useful when seeking additional rounds of funding or evaluating buy-out offers.

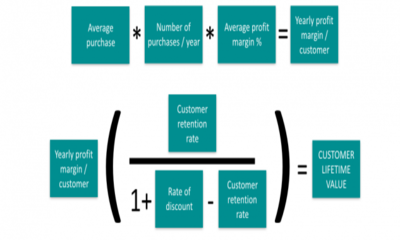

Customer Lifetime Value Model[4]

To calculate customer lifetime value you need to calculate average purchase value, and then multiply that number by the average purchase frequency rate to determine customer value. Then, once you calculate average customer lifespan, you can multiply that by customer value to determine customer lifetime value.

- Calculate average purchase value: Calculate this number by dividing your company's total revenue in a time period (usually one year) by the number of purchases over the course of that same time period.

- Calculate average purchase frequency rate: Calculate this number by dividing the number of purchases over the course of the time period by the number of unique customers who made purchases during that time period.

- Calculate customer value: Calculate this number by multiplying the average purchase value by the average purchase frequency rate.

- Calculate average customer lifespan: Calculate this number by averaging out the number of years a customer continues purchasing from your company.

- Then, calculate LTV by multiplying customer value by the average customer lifespan. This will give you an estimate of how much revenue you can reasonably expect an average customer to generate for your company over the course of their relationship with you.

source: FinnChat

The Purpose of the Customer Lifetime Value Metric[5]

The purpose of the customer lifetime value metric is to assess the financial value of each customer. Don Peppers and Martha Rogers are quoted as saying, “some customers are more equal than others.” Customer lifetime value differs from customer profitability or CP (the difference between the revenues and the costs associated with the customer relationship during a specified period) in that CP measures the past and CLV looks forward. As such, CLV can be more useful in shaping managers’ decisions but is much more difficult to quantify. While quantifying CP is a matter of carefully reporting and summarizing the results of past activity, quantifying CLV involves forecasting future activity. Present value is the discounted sum of future cash flows: each future cash flow is multiplied by a carefully selected number less than one, before being added together. The multiplication factor accounts for the way the value of money is discounted over time. The time-based value of money captures the intuition that everyone would prefer to get paid sooner rather than later but would prefer to pay later rather than sooner. The multiplication factors depend on the discount rate chosen (10% per year as an example) and the length of time before each cash flow occurs. For example, money received ten years from now must be discounted more than money received five years in the future. CLV applies the concept of present value to cash flows attributed to the customer relationship. Because the present value of any stream of future cash flows is designed to measure the single lump sum value today of the future stream of cash flows, CLV will represent the single lump sum value today of the customer relationship. Even more simply, CLV is the monetary value of the customer relationship to the firm. It is an upper limit on what the firm would be willing to pay to acquire the customer relationship as well as an upper limit on the amount the firm would be willing to pay to avoid losing the customer relationship. If we view a customer relationship as an asset of the firm, CLV would present the monetary value of that asset. One of the major uses of CLV is customer segmentation, which starts with the understanding that not all customers are equally important. CLV-based segmentation model allows the company to predict the most profitable group of customers, understand those customers' common characteristics, and focus more on them rather than on less profitable customers. CLV-based segmentation can be combined with a Share of Wallet (SOW) model to identify "high CLV but low SOW" customers with the assumption that the company's profit could be maximized by investing marketing resources in those customers. Customer Lifetime Value metrics are used mainly in relationship-focused businesses, especially those with customer contracts. Examples include banking and insurance services, telecommunications and most of the business-to-business sector. However, the CLV principles may be extended to transactions-focused categories such as consumer packaged goods by incorporating stochastic purchase models of individual or aggregate behavior.[4] In either case, retention has a decisive impact on CLV, since low retention rates result in Customer Lifetime Value barely increasing over time.

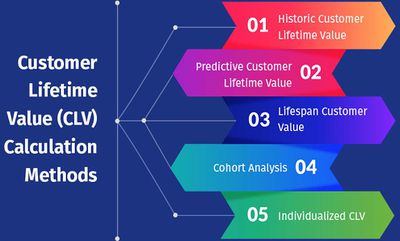

Customer Lifetime Value (CLV) Calculation Methods[6]

Some of the most widely used methods of calculating customer lifetime value are based on historic CLV, predictive CLV, lifespan CLV, cohort analysis, and individual CLV. The best method from the list below will depend on which metrics a business uses to track success and how they track their data.

- Historic CLV: customer lifetime value calculation: Historic CLV measures the value of transactions or the sum of gross profit from all past purchases made by an individual customer. This calculation requires access to existing customer data involving purchases from a specific time period. To calculate the historic customer lifetime value, you can use the following formula:

Customer Lifetime Value (Historic)= (Transaction 1+ Transaction 2 + Transaction 3….+ Transaction N) * AGM

Where N is the last transaction made by the customer at your store.

Calculating the CLV prediction in this manner (based on net profit) gives businesses the actual profit that a customer contributes to the business. The historic customer lifetime value accounts for customer service cost, cost of returns, acquisition cost, marketing cost, etc.

The downside to calculating historic CLV is that determining the value on an individual basis can get incredibly complex, so it is better to consider groups of customers or to create a system to manage data.

- Predictive Customer Lifetime Value Formula: The predictive CLV is a great indicator of the total value a customer will eventually give a business over their whole lifetime, as it uses more collected data. In practice, determining the exact predictive CLV can be difficult when considering fluctuations in price, discounts, etc. For this reason, there are a couple of ways to calculate predictive CLV that vary in complexity and precision. To calculate with the predictive CLV model, businesses must use transaction history and behavioral patterns to forecast how a customer’s value will evolve over time. Simple predictive CLV can be calculated using the formula:

Customer lifetime value= ((Average monthly transactions * Average order value) Average gross margin) * Average customer lifespan

This equation becomes gross margin contribution per customer lifespan (GML). Therefore,

Customer lifetime value= Gross margin contribution * (Monthly retention rate/(1+Monthly discount rate-Monthly retention rate))

- Lifespan Customer Value Calculation Steps: Another widely used method to calculate the CLV is the lifespan customer value calculation. This method requires you to have the customer value and multiply that by the customer lifespan. This CLV calculation method consists of five steps. They are:

- Calculate the average purchase value: This number can be derived by dividing the revenue of the organization by the total number of purchases in the year. This timespan should be of a fixed time, like one year or two years.

- Calculate the average frequency purchase rate: This number can be derived by dividing the number of purchases by the unique customers that made a purchase over that time period.

- Calculate the customer value: The average customer value can be derived by multiplying the average purchase value and the average frequency purchase rate.

- Calculate the average customer lifespan: The customer lifespan can be derived by averaging the number of years a customer buys from a business.

- The last step would be to multiply the customer value and the average customer lifespan together. This can help calculate how much revenue a customer can contribute in their life cycle with you.

The lifespan customer value calculation is similar to the predictive customer lifetime value calculation in that they are both popular predictive models. Although extensive, the lifetime CLV shouldn’t be considered a conclusive research method.

- Cohort Analysis: The cohort analysis method collects current customers with similar characteristics and groups them together. Cohort analysis can help organizations draw conclusions between groups of people. To keep cohort analysis conclusive, organizations must be aware of any changes in market dynamics. There are a few things to keep in mind when calculating cohort analysis, including determining what should be measured (subscription start/cancel dates), the specific cohorts that are relevant and how far they should be segmented (measuring start dates and the differences between each subscription plan types), and which method should be used to perform the analysis (excel or another platform).

- Individualized CLV: Organizations may find the individualized CLV useful for considering a broader perspective. This value primarily helps to manage ROI by evaluating distribution methods, marketing methods, landing pages, campaigns, etc. One way that this CLV calculation can be used is to compare the spend of social media marketing to the spend of digital marketing. These CLV calculation methods are used by a variety of businesses and organizations, depending on their data collection methods and reporting objectives.

The above methods for calculating CLV give businesses insight into which of their channels are the most efficient, who they should be targeting, where their marketing strategy falls flat, and how they can direct their customer service resources to propel their profits and get a better understanding of their customer base.

What Customers Cost the Business[7]

CLV is a great metric to track and optimize, but one thing to keep a close eye on too is the cost of that customer to your business. This is where Cost to Serve comes in. If the cost of serving an existing customer becomes too high, you may be making a loss despite their seemingly high CLV. So there’s a balancing act to negotiate here. To go back to our paid TV subscription, your cost to serve might be higher in the first year of a contract but gradually drop off the longer they stay with you. Thus, if your renewal rates drop, your average cost to serve is likely to rise and cause a drop in profitability. Understanding these numbers over time and being able to track them side by side is the only way to get a true understanding not only of what’s driving customer spend and loyalty but also what it’s delivering back to the business’s bottom line.

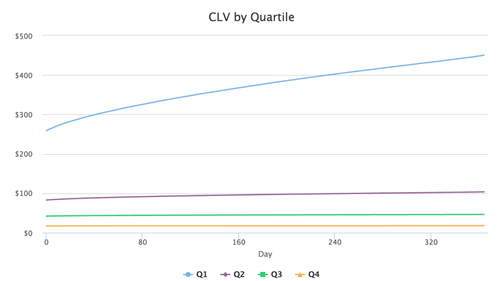

Predicting Customer Lifetime Value[8]

CLV can be calculated historically, over specific time periods, or it can be predictive. Each of these calculations serves different purposes. Predictive CLTV is the most powerful way to not only understand what a customer is worth to you now, but also see how their value will change over time. Let’s look at an example for the ecommerce industry. Here's a chart that shows CLTV benchmark data from nearly 200 ecommerce companies. In this chart we’re looking at the most basic form of CLV. It has a single input, sum of all purchases, and closed time parameters, 365 days.

On day one, customers with the highest lifetime values have already distinguished themselves. This means marketers don’t need to wait long to make important invest-or-kill decisions about their marketing campaigns. CLV is the best metric to predict future customer behaviors.

Boosting Customer Lifetime Value[9]

Since the odds of selling to a current customer is 60-70%, according to eConsultancy, and the odds of selling to a new customer are 5-20%, investing your resources in selling more to your existing customer base is the key. So what tactics will increase the likelihood of a customer buying more from you? Here are some proven techniques:

- Make it easy for customers to return items they’ve purchased from you. Making it hard or expensive will significantly reduce the odds of them making another purchase.

- Set expectations regarding delivery dates, aiming to underpromise and overdeliver. It’s much better to promise delivery by August 1 and have it in their hands by July 20th than the reverse.

- Create a rewards program to encourage repeat purchases, with rewards that are both attainable and desirable.

- Offer freebies for doing business with you, to build brand loyalty.

- Use upsells to increase the average value of a customer transaction, which is the equivalent of McDonald’s asking, “Do you want fries with that?”

- Stay in touch. Long-time customers want to know you haven’t forgotten them. Make it easy for them to reach out to you as well.

A more profitable and successful business can be built by focusing on attracting and retaining long-term customers who will become advocates for you, as well as repeat buyers.

Customer Lifetime Value Case Studies[10]

- Back in 2013, Consumer Intelligence Research Partners estimated that Amazon Prime members spent $1,340 per year on Amazon, which is twice what non-Prime shoppers spent. Based on this customer lifetime value metric, Amazon started focusing on Prime users and increased the company’s profit over the past four years.

- Netflix is another good example of why you should learn how to calculate LTV. In 2007, they found that a typical subscriber stayed with them for 25 months and that LTV was $291.25. This helped them determine that viewers were impatient. After analyzing statistics, Netflix decided to implement online streaming. This kept members satisfied while they waited for new DVDs to arrive in the mail. In this way, Netflix managed to improve retention by 4% and rented its billionth DVD.

- Likewise, Starbucks shows that by improving customer satisfaction you can increase lifetime value and grow profit. A study by Business Insider shows that Starbucks should spend on acquisition no more than average LTV $14,099.

This is how measuring customer lifetime value changes businesses in real life.

See Also

Customer

Customer Acquisition Cost (CAC)

Customer Centricity

Customer Data Integration (CDI)

Customer Data Management (CDM)

Customer Demographics

Customer Due Diligence (CDD)

Customer Dynamics

Customer Effort Score (CES)

Customer Churn

Customer Engagement Hub (CEH)

Customer Experience Management (CEM)

Customer Engagement

Customer Lifecycle

Customer Loyalty

Customer Needs

Customer Retention

Customer Service

Customer Service Management

Customer Relationship Management (CRM)

References

- ↑ Defining Customer Lifetime Value Economic Times

- ↑ Other Definitions of Customer Lifetime Value (CLTV) CLV

- ↑ The Need for Customer Lifetime Value Brandwise

- ↑ Customer Lifetime Value Model Clint Fontanella

- ↑ What is the purpose of the customer lifetime value metric? Wikipedia

- ↑ How to calculate customer lifetime value: methods and steps QuestionPro

- ↑ How Much Are Your Customers Costing You? Qualtrics

- ↑ How to predict your Customer Lifetime Value Stitch Data

- ↑ Boosting Lifetime Value Shopify

- ↑ LTV case studies Owox