Staggered Board of Directors

A staggered board (also known as a classified board) is a governing board of directors of an organization in which approximately one third of the members are elected each term. The directors are organized into different groups and each group falls within a specified class.There are typically three classes of members. Board members’ terms expire at different times.[1]

According to a study conducted by three Harvard University professors and published in the Stanford Law Review, more than 70% of all companies that went public in 2001 had staggered boards. Despite their popularity, however, the study suggests that staggered boards tend to reduce shareholder returns more significantly than non-staggered boards in the event of a hostile takeover. When a hostile bidder tries to acquire a company with a staggered board, it is forced to wait at least one year for the next annual meeting of shareholders before it can gain control. Furthermore, hostile bidders are forced to win two seats on the board; the elections for these seats occur at different points in time (at least one year apart), creating yet another obstacle for the hostile bidder. Hostile bidders that manage to win one seat allow staggered boards the opportunity to defend the company they represent against the takeover by implementing a poison pill tactic to further deter the takeover, effectively guaranteeing continuity of management. Furthermore, in a hostile takeover, hostile bidders tend to offer shareholders a premium for their shares, so in many cases, hostile takeovers are good for shareholders. They get to sell their shares for more money after a hostile bid than they would have before it occurred. According to the Harvard study, in the nine months after a hostile takeover bid was announced, shares in companies with staggered boards increased only 31.8%, compared to the average of 43.4% returned to stockholders of companies with non-staggered boards (Bebchuk, Coates and Subramanian; 2002). Although hostile takeovers are a fairly rare occurrence, the fact remains that boards are elected to represent shareholder interests; because staggered boards may deter takeovers (and the premiums paid for shares as a result of takeovers), this puts the two at odds. Even so, a staggered board does offer continuity of leadership, which surely has some value provided that the company is being led in the right direction in the first place.[2]

Also known as a Classified Board, a staggered board of directors board is a prominent practice in US corporate law governing the board of directors of a company, corporation, or other organization, in which only a fraction (often one third) of the members of the board of directors is elected each time instead of en masse (where all directors have one year terms). Each group of directors falls within a specified "class"— e.g., Class I, Class II, etc. — hence the use of the term "classified" board. In publicly held companies, staggered boards have the effect of making hostile takeover attempts more difficult. When a board is staggered, hostile bidders must win more than one proxy fight at successive shareholder meetings in order to exercise control of the target firm. Particularly in combination with a poison pill, a staggered board that cannot be dismantled or evaded is one of the most potent takeover defenses available to U.S. companies. In corporate cumulative voting systems, staggering has two basic effects: it makes it more difficult for minorities to elect directors, as the fewer directorships up for election requires a larger per cent of the equity to win; and it makes takeover attempts less likely to succeed as it is harder to vote in a majority of new directors.[4] Staggering may also however serve a more beneficial purpose, that is provide "institutional memory" — continuity in the board of directors — which may be significant for corporations with long-range projects and plans. Institutional shareholders are increasingly calling for an end to staggered boards of directors—also called "declassifying" the boards. The Wall Street Journal reported in January 2007 that 2006 marked a key switch in the trend toward declassification or annual votes on all directors: more than half (55%) of the S&P 500 companies have declassified boards, compared with 47% in 2005.[3]

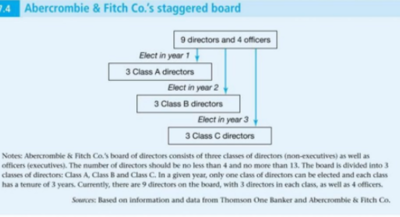

What a Staggered Board Looks Like (Figure 1.)

Below is an illustrative example of the Staggered Board of Directors for Abercombie and Fitch

Figure 1. source: [^https://twitter.com/marcgjg/status/719598305815224320%7CMarc Goergen]

Reasons to Consider Using or Not Using a Staggered Board[4]

- Using a Staggered Board

This type of board allows for the leadership to continue in the same fashion it has operated in. If the company is being led in the right direction, the retention of the board is beneficial for all. A staggered board can also incorporate something known as a poison pill. Poison pills are a tactic used by a corporation to prevent a targeted company against a hostile takeover. There are two types of poison pills:

1. Flip-in. This allows all shareholders, except the acquiring party, to buy shares at a discounted rate. This dilutes the value of the shares and makes the takeover more expensive.

2. Flip-over. This lets the stockholders buy the shares of the acquiring company at a discounted rate to discourage the takeover bid.

- Not Using a Staggered Board

A staggered board has the potential to lower shareholder returns. A single, hostile bidder can win one seat and give the rest of the board the opportunity to defend the company against a takeover. This all but guarantees the continuation of the current style of management. However, this can be seen as an anti-shareholder move and the directors are acting in their own interest to manage the corporation. Activist investors are putting more pressure on businesses to get rid of their staggered boards. They feel that making board members stand for re-election on an annual basis creates better corporate governance. One such incident involved McDonald's Corp. Activist shareholders put together a non-binding resolution to force McDonald's to eliminate its staggered board. However, a majority of shareholders voted to retain the staggered board, signalling their confidence in the governance of McDonald's Corp.

Pros and Cons of Staggered Board of Directors[5]

The pros and cons of a staggered board of directors show that there is some merit to this format type. It may not be the best option for every company, but structure must be taken on a case by case basis. Because of this, each key point should be carefully weighed when designed the structure of every company’s board of directors.

- Pros

1. Non-management directors receive a longer term: Instead of being elected to a board of directors on an annual basis, a classified board offers non-management directors a longer overall term of service. This allows people from outside of the business to receive more dividends from their involvement. Instead of facing an annual election, they can focus the issues which a business may face.

2. There is protection from an aggressive or abusive takeover: Because it may be 3+ years before a non-management director faces another election, a staggered board of directors naturally prevents an aggressive or abusive takeover of company interests. Many issues which cause dissent and disgruntlement tend to be short-term in nature, so instead of making emotional decisions, electors can focus on doing what is right for the business.

3. There is less pressure to bow to short-term needs Most businesses must focus on long-term goals in order to survive. When a company is publicly traded, however, there tend to be numerous short-term shareholders that want immediate profits. A staggered board of directors can help create the stability long-term investors need because there isn’t as much pressure to make instant profits that might cost everyone their job in the future.

4. It reduces training needs: If you have a board of directors which is constantly changing, then you’re investing resources into the new members who need to be trained and brought up to date. This means the board loses a bit of its continuity. With a staggered election cycle, only a certain percentage of the board will be up for election every year, which means continuity can be in place because there will always be veteran board members in place.

- Cons

1. A staggered board typically reduces the value of a company:The value of a company is affected by a staggered board because the directors are locked into place for an extended period of time. If the decisions made by the board are poor, then shareholders have little in the way of financial protections beyond getting out and cutting their losses. Reduced levels of changeover are directly correlated to lower company values.

2. Sometimes you do need a revolution: Evolution within a company is always the best way to go… except when it isn’t Sometimes you do need to have a revolution. Changes can help a business to survive even some of the most difficult of times. If only a small fraction of the board is up for an election in any given year, the changes which need to get made can be difficult to make and that may sink the business.

3. There may not be any need to follow the recommendations of a vote In 2009, nearly 100 board members in the top US companies failed to receive 50% or more of the votes cast by their shareholders. Not a single one of those board members who lost an election actually stepped down. For Pulte Homes, shareholders voted out 3 directors up for election. The board just reappointed them anyway. Some systems allow a director to stay in place if just 1 vote is received, making the point of having an election a waste of time.

4. It is always difficult to make the correct decisions during an election: The US is evidence of this. Budget deficits have been run for consecutive years for more than a decade. Programs like Social Security are serially underfunded. Yet the same type of politician tends to be elected by a majority of the people. Change is naturally difficult and staggered boards make it even more difficult to change because there are fewer elections.

The Future of Staggered Boards (Figure 2.)[6]

Proponents of Staggered or Classified boards say that this system creates continuity on the board and allows directors to focus on long-term goals absent the risk of not being re-elected. This system also deters hostile takeovers, since a majority of a classified board cannot be overturned in one year. Proponents of declassified boards suggest increased accountability to shareholders. As back and forth between shareholders and boards continues, data shows a notable move away from classified boards. The prevalence of classified boards in the S&P 500 declined by 66.5% from 2010 to 2014—in 2014, only 10.5% of boards were classified, down from 31.3% in 2010. Classified board prevalence dropped significantly in all sectors from 2010 to 2014. The basic materials sector had the most drastic drop of 28.0 percentage points and the utilities sector had the smallest drop of 9.7 percentage points. The technology sector currently has the lowest percentage of classified boards at 4%—a total of three companies.

Figure 2. source: Equilar

The decline of classified boards reflects the increased focus on director accountability and diversity. Now that more and more directors face re-election each year, there are more opportunities to appoint new candidates to refresh a company’s boardroom. In addition, incumbent directors face an annual evaluation of their performance in the form of shareholder vote. As declassified boards become the norm across the S&P 500, boardrooms may in turn see more movement to become more accountable and diverse.

See Also

Board of Directors

IT Governance

Corporate Governance

Information Management (IM)

Enterprise Risk Management (ERM)

Resource Management

Records Management (RM)

Information Security Governance

Compliance

Data Governance

eGovernance

Policy Governance

Information Governance (IG)

References

- ↑ Defining Staggered Board of Directors Divestopedia

- ↑ Explaining Staggered Board of Directors Investopedia

- ↑ Understanding Staggered Board of Directors - Application in Business Wikipedia

- ↑ Reasons to Consider Using or Not Using a Staggered Board UpCounsel

- ↑ Pros and Cons of Staggered Board of Directors Brandon Gaille

- ↑ The Future of Staggered Boards Equilar

Further Reading

- How Do Staggered Boards Affect Shareholder Value? Evidence from a Natural Experiment Alma Cohen, Charles C.Y. Wang

- The Case Against Staggered Boards NY Times

- 21st Century Board Composition: Four Considerations For A Winning Strategy Forbes

- Classified Boards Remain in the Crosshairs WSJ