Difference between revisions of "Above the Line"

| Line 1: | Line 1: | ||

'''Above the Line''' refers to all [[Revenue|revenue]] generated and [[Expense|expenses]] incurred by a [[Business|business]] that have a direct impact on reported [[Profit|profits]]. In effect, the term includes all activity reported on an [[Organization|organization's]] [[Income Statement|income statement]]. The term does not refer to other activity that only impacts the financing or [[Cash Flow|cash flows]] of the business. For example, the receipt of funds from the sale of [[Stock|company stock]] is not considered to be above the line. Conversely, the sale of goods and the associated [[Cost of Goods Sold (COGS)|cost of goods sold]] are considered to be above the line. A different interpretation of the concept is that "above the line" refers to the [[Gross Margin|gross margin]] earned by a business. Under this interpretation, revenues and the cost of goods sold are considered to be above the line, while all other expenses (including [[Operating Expenses|operating expenses]], interest and taxes) are considered to be below the line.<ref>Definition - What Does Above the Line Mean? [https://www.accountingtools.com/articles/2017/8/27/above-the-line Accounting Tools]</ref> | '''Above the Line''' refers to all [[Revenue|revenue]] generated and [[Expense|expenses]] incurred by a [[Business|business]] that have a direct impact on reported [[Profit|profits]]. In effect, the term includes all activity reported on an [[Organization|organization's]] [[Income Statement|income statement]]. The term does not refer to other activity that only impacts the financing or [[Cash Flow|cash flows]] of the business. For example, the receipt of funds from the sale of [[Stock|company stock]] is not considered to be above the line. Conversely, the sale of goods and the associated [[Cost of Goods Sold (COGS)|cost of goods sold]] are considered to be above the line. A different interpretation of the concept is that "above the line" refers to the [[Gross Margin|gross margin]] earned by a business. Under this interpretation, revenues and the cost of goods sold are considered to be above the line, while all other expenses (including [[Operating Expenses|operating expenses]], interest and taxes) are considered to be below the line.<ref>Definition - What Does Above the Line Mean? [https://www.accountingtools.com/articles/2017/8/27/above-the-line Accounting Tools]</ref> | ||

| − | Example of Above-the-Line Costs | + | '''Example of Above-the-Line Costs<ref>Example of Above-the-Line Costs [https://www.investopedia.com/terms/a/above-the-line-cost.asp Investopedia]</ref>'''<br /> |

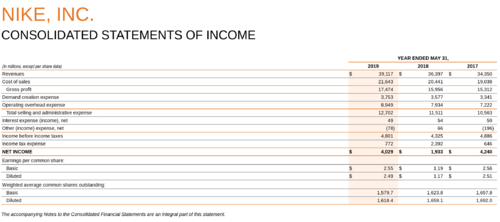

As an example, Nike Inc. reported $39.1 billion in sales in its fiscal year 2019. Gross profits were $17.5 billion. Therefore, Nike's above-the-line costs for the quarter were $21.6 billion, which the company labels cost of sales on its income statement | As an example, Nike Inc. reported $39.1 billion in sales in its fiscal year 2019. Gross profits were $17.5 billion. Therefore, Nike's above-the-line costs for the quarter were $21.6 billion, which the company labels cost of sales on its income statement | ||

| + | |||

| + | |||

| + | [[File:Nike Consolidated income statements.png|500px|Nike Consolidated statements of income ]]<br /> | ||

| + | Source: SEC | ||

| + | |||

| + | |||

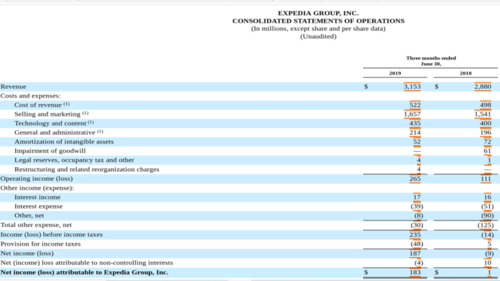

| + | Also consider Expedia Inc., the travel website, which reported $3.2 billion in revenue in its second quarter of 2019 and an operating income of $265 million. The company is not involved in the production of goods so the company does not use gross profit as a metric in its income statement. | ||

| + | |||

| + | |||

| + | [[File:expedia group consolidated operations statement.png|500px|Expedia Group Consolidated statements of operations]]<br /> | ||

| + | Source: SEC | ||

| + | |||

| + | |||

| + | All expenses before operating income are considered above-the-line costs for Expedia, including the cost of revenue and selling and marketing expenses, among others. | ||

Revision as of 16:54, 15 February 2021

Above the Line refers to all revenue generated and expenses incurred by a business that have a direct impact on reported profits. In effect, the term includes all activity reported on an organization's income statement. The term does not refer to other activity that only impacts the financing or cash flows of the business. For example, the receipt of funds from the sale of company stock is not considered to be above the line. Conversely, the sale of goods and the associated cost of goods sold are considered to be above the line. A different interpretation of the concept is that "above the line" refers to the gross margin earned by a business. Under this interpretation, revenues and the cost of goods sold are considered to be above the line, while all other expenses (including operating expenses, interest and taxes) are considered to be below the line.[1]

Example of Above-the-Line Costs[2]

As an example, Nike Inc. reported $39.1 billion in sales in its fiscal year 2019. Gross profits were $17.5 billion. Therefore, Nike's above-the-line costs for the quarter were $21.6 billion, which the company labels cost of sales on its income statement

Also consider Expedia Inc., the travel website, which reported $3.2 billion in revenue in its second quarter of 2019 and an operating income of $265 million. The company is not involved in the production of goods so the company does not use gross profit as a metric in its income statement.

All expenses before operating income are considered above-the-line costs for Expedia, including the cost of revenue and selling and marketing expenses, among others.

- ↑ Definition - What Does Above the Line Mean? Accounting Tools

- ↑ Example of Above-the-Line Costs Investopedia