Profit

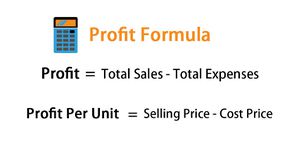

Profit describes the financial benefit realized when the revenue generated from a business activity exceeds the expenses, costs, and taxes involved in sustaining the activity in question. Any profits earned funnel back to business owners, who choose to either pocket the cash or reinvest it back into the business. Profit is calculated as total revenue less total expenses.[1]

Profit is an essential outcome of running a business. Often, earning a profit is the company's primary goal. A positive bottom line shows that the company is healthy and performing well. Profit is capital that companies can use for various purposes, like maintaining the workplace or equipment, replacing or upgrading vehicles or other high-cost items, or investing in new products, services, or employees. With good profits, businesses can expect to continue flourishing.

Types of Profit[2]

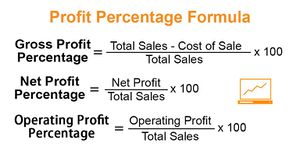

Businesses use three types of profit to examine different areas of their companies. They are gross profit, operating profit, and net profit.

- Gross Profit: Gross profit subtracts the cost of goods sold (COGS) from total sales. Variable costs are only those needed to produce each product, like assembly workers, materials, and fuel. It doesn't include fixed costs, like plants, equipment, and the human resources department. Companies compare product lines to see which is most profitable.

- Operating Profit: Operating profit includes variable and fixed costs. Since it doesn't include certain financial costs, it's also commonly called EBITDA. That stands for Earnings Before Interest, Tax, Depreciation, and Amortization. It's the most commonly used, especially for service companies that don't have products.

- Net Profit: Net profit includes all costs. It's the most accurate representation of how much money the business is making. On the other hand, it may be misleading. For example, if the company generates a lot of cash and invests in a rising stock market, it may look like it's doing well. But it might have a good finance department and not make money on its core products.

Companies analyze all three types of profit by using the profit margin. That's the profit, whether gross, operating, or net, divided by the revenue. A high ratio means it generates a lot of profit for each revenue dollar. A low ratio means the company's costs are eating into its profits. Ratios differ according to each industry. Profit margins allow investors to compare the success of large companies versus small ones. A large company will have a lot of profit due to its size. But a small company might have a higher margin and be a better investment because it is more efficient. Margins also allow investors to compare a company over time. As the company grows, its profit will grow. But if it's not becoming more efficient, its margin could fall.

How to increase profit[3]

Often, businesses are looking for ways to improve their net profit. Companies can take several approaches to increase their profits:

- Increase revenue: Companies can increase revenue to improve net profit in three ways:

- Raise prices: Increasing the price of products or services will increase total sales and eventually net profits.

- Sell more products: Enticing customers to purchase more goods or services will lead to a higher net profit.

- Find new customers: New customers will increase profits through higher overall sales.

- Cut costs: Another method of increasing profits is cutting costs. Companies can assess and minimize direct and indirect costs to reduce expenses:

- Direct costs: These costs are expenses related specifically to the development of the product or service. Direct cost examples include labor and materials.

- Indirect costs: Also called overhead, indirect costs include expenses related to running the business but not specifically to the product or service sold. Indirect costs include rent or mortgage on the workplace and utilities like water and electricity.

- Remove products: Sometimes companies sell many products or services. For those businesses, a great method for increasing profits is removing products or services that do not sell well. Discontinuing poor sellers will decrease production costs, eventually improving the bottom line.

- Reduce inventory: Holding inventory can be costly. Depending on what the company sells, inventory storage may require a separate building and extra employees. Reducing the amount of stock the company keeps on-site can reduce costs and improve net profits.

See Also