Information Technology Investment Management (ITIM)

Information Technology Investment Management (ITIM) or IT Investment Management is a management process that provides for the identification, selection, control, and evaluation of business need-driven Information Technology (IT) investments across the investment lifecycle. ITIM uses structured processes to minimize risks, maximize return on investments, and support decisions to maintain, migrate, improve, retire, or obtain IT investments. In addition, ITIM establishes a common language to:[1]

- Organize IT investments and define their business value;

- Evaluate and prioritize the investments; and,

- Effectively manage change.

ITIM Background[2]

If managed wisely, investments in information technology (IT) can enrich people’s lives and improve organizational performance. For example, during the last decade the Internet has matured from being a technical novelty to a national resource where citizens can visit the Library of Congress or file their tax returns. Some organizations have realized substantial improvements in processing data and information by switching from centralized mainframe computing to decentralized personal computers linked by local area networks. The ability of software applications to locate and correlate relevant data in a data warehouse permits organizations to discover unknown fiscal or physical resource relationships and thus provide appropriate assistance where there had been none. However, along with the potential to improve lives and organizations, IT projects can become risky, costly, unproductive mistakes.

Information technology investment management (ITIM) traces its roots to the 1952 work of Harry Markowitz on Portfolio Selection (Markowitz, 1952). In this work, Markowitz proposed a new theory of financial investing based on a portfolio of investments balanced by a number of factors, with expected return, diversification, and risk being primary. Markowitz suggested that a portfolio with the proper balance of investments provided a higher return over time to the investor than simply evaluating each investment on its own merits. This theory is now referred to as Modern Portfolio Theory (MPT) and Markowitz received a Nobel Prize in 1990 for his work.

ITIM Framework

The ITIM framework is based on:

• The recognition that the business strategic planning process drives technology investment strategies;

• The concept that technology investments support and add value to the business of state government; and,

• The premise that technology investments should be prioritized, executed, and measured based on the benefits related to achieving business strategic goals and objectives.

A number of laws and Executive directives in the past years have mandates, guidance and goals that create requirements for government agencies to adopt an ITIM process , including the following:

- Clinger-Cohen Act (CCA) of 1996. CCA, formerly known as the Information Technology Management Reform Act (ITMRA), requires each agency to undertake capital planning and investment control by establishing a process for maximizing the value and assessing and managing risks of IT acquisitions of the executive agency.

- Government Performance and Results Act (GPRA) of 1993. GPRA requires agencies to prepare updateable strategic plans and to prepare annual performance plans covering each program activity displayed in the budget. The performance plans are to establish performance goals in objective, quantifiable, and measurable form and performance indicators to be used in measuring relevant outputs, service levels, and outcomes.

- Paperwork Reduction Act (PRA) of 1995. PRA intends to minimize the paperwork burden on citizens by the federal government. Its purpose is to: coordinate, integrate, and standardize federal IRM policies and practices; improve the quality and use of federal information; and ensure that information technology is acquired, used, and managed to improve efficiency and effectiveness of agency missions.[3]

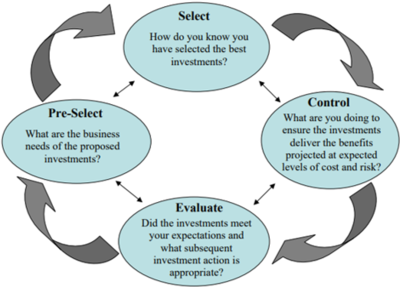

Built around the select/control/evaluate approach described in the Clinger-Cohen Act of 1996—which establishes statutory requirements for IT management—the framework provides a method for evaluating and assessing how well an agency is selecting and managing its IT resources. (see figure 1.)

Figure 1. source: CMS

Using the framework to analyze an agency's IT investment management processes provides:

(1) a rigorous, standardized tool for internal and external evaluations of these processes;

(2) a consistent and understandable mechanism for reporting the results of assessments; and

(3) a road map that agencies can follow in improving their processes.

- During the selection phase the organization

- (1) selects those IT projects that will best support its mission needs and

- (2) identifies and analyzes each project’s risks and returns before committing significant funds to a project.

- During the control phase the organization ensures that, as projects develop and as investment costs rise, the project is continuing to meet mission needs at the expected levels of cost and risk. If the project is not meeting expectations or if problems have arisen, steps are quickly taken to address the deficiencies.

- Lastly, during the evaluation phase, actual versus expected results are compared once projects have been fully implemented. This is done to

(1) assess the project’s impact on mission performance,

(2) identify any changes or modifications to the project that may be needed, and

(3) revise the investment management process based on lessons learned.[4]

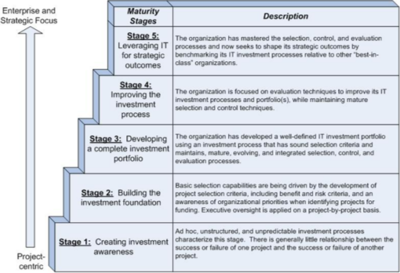

The IT Investment Management Framework (ITIM) is a maturity model composed of five progressive stages of maturity that an agency can achieve in its IT investment management capabilities. (see figure 2.) These maturity stages are cumulative; that is, in order to attain a higher stage of maturity, the agency must have institutionalized all of the requirements for that stage in addition to those for all of the lower stages. The framework can be used both to assess the maturity of an agency’s investment management processes and as a tool for organizational improvement. For each maturity stage, the ITIM describes a set of critical processes that must be in place for the agency to achieve that stage. The figure below shows the five stages and lists the critical processes for each stage.

- At the Stage 1 level of maturity, an agency is selecting investments in an unstructured, ad hoc manner. Project outcomes are unpredictable and successes are not repeatable; the agency is creating awareness of the investment process.

- Stage 2 critical processes lay the foundation for sound IT investment processes by helping the agency to attain successful, predictable, and repeatable investment control processes at the project level.

- Stage 3 represents a major step forward in maturity, in which the agency moves from project-centric processes to a portfolio approach, evaluating potential investments by how well they support the agency’s missions, strategies, and goals.

- At Stage 4, an agency uses evaluation techniques to improve its IT investment processes and its investment portfolio. It is able to plan and implement the “de-selection” of obsolete, high-risk, or low-value IT investments.

- The most advanced organizations, operating at Stage 5 maturity, benchmark their IT investment processes relative to other “best in class” organizations and look for breakthrough information technologies that will enable them to change and improve their business performance.[5]

Figure 2. source: VITA

The ITIM Process[6]

ITIM is the primary process for:

- Identifying the potential business value in proposed IT investments;

- Selecting IT investments that best meet the business needs;

- Monitoring the performance of the initiatives for developing and placing the selected IT investments into operation; and,

- Determining if the selected IT investments are continuing to deliver the expected business value.

The ITIM process consists of four phases.

- The goal of the Pre-Select (Identify) phase is to identify, analyze, and document IT investments that support agency business needs.

- The goal of the Select phase is to decide from among the potential investments identified in the Pre-Select (Identify) phase which investments to undertake.

- The goal of the Control phase is to ensure that IT investments are developed and placed in operation using a disciplined, well-managed and consistent process.

- The goal of the Evaluate phase is to compare the actual performance results and benefits of an investment to the range of target performance measures established for the investment.

See Also

References

- ↑ Information Technology (IT) Investment Management Guide

- ↑ Background of Information Technology Investment Management (ITIM) David Van Over

- ↑ Legal and Executive Directives that mandate requirements for Agency ITIM process HUD

- ↑ Using the IT Investment Management Process United States General Accounting Office

- ↑ The ITIM Maturity Model GAO.gov

- ↑ The ITIM Process Virginia IT Agency

Further Reading

- Developing IT investment management framework of government institution ieee.org

- Use of Information Technology Investment Management to Manage State Government Information Technology Investments David Van Over

- Information Technology Investment Management: A Framework for Assessing and Improving Process Maturity GAO