Liability

A liability is a debt owed by a company that requires the entity to give up an economic benefit (cash, assets, etc.) to settle past transactions or events. A liability is typically an amount owed by a company to a supplier, bank, lender, or other provider of goods, services, or loans. Liabilities can be listed under accounts payable, and are credited in the double entry bookkeeping method of managing accounts. To settle a liability, a business must sell or hand over an economic benefit. An economic benefit can include cash, other company assets, or the fulfillment of a service.[1]

Liabilities are categorized as current or non-current depending on their temporality. They can include a future service owed to others; short- or long-term borrowing from banks, individuals, or other entities; or a previous transaction that has created an unsettled obligation. The most common liabilities are usually the largest like accounts payable and bonds payable. Most companies will have these two line items on their balance sheet, as they are part of ongoing current and long-term operations. Liabilities are a vital aspect of a company because they are used to finance operations and pay for large expansions. They can also make transactions between businesses more efficient. For example, in most cases, if a wine supplier sells a case of wine to a restaurant, it does not demand payment when it delivers the goods. Rather, it invoices the restaurant for the purchase to streamline the dropoff and make paying easier for the restaurant. The outstanding money that the restaurant owes to its wine supplier is considered a liability. In contrast, the wine supplier considers the money it is owed to be an asset.[2]

Classification of Liabilities[3]

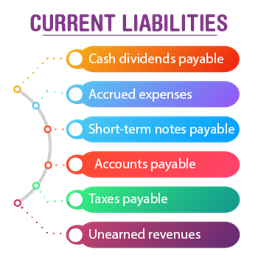

Liabilities are reported on a balance sheet and are usually divided into two categories:

- Current liabilities – these liabilities are reasonably expected to be liquidated within a year. They usually include payables such as wages, accounts, taxes, and accounts payable, unearned revenue when adjusting entries, portions of long-term bonds to be paid this year, short-term obligations (e.g. from purchase of equipment).OR' current liabilities are obligations whose liquidation is reasonably expected to require the use of current assets, the creation of other current liabilities, or the provision of services within the next year or operating cycle, whichever is longer.

source: ByJu's

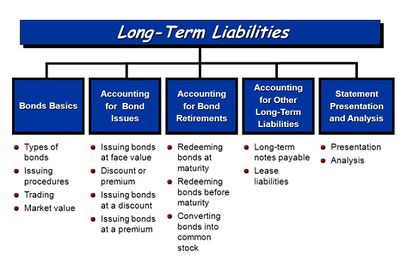

- Long-term liabilities – these liabilities are reasonably expected not to be liquidated within a year. They usually include issued long-term bonds, notes payables, long-term leases, pension obligations, and long-term product warranties. Liabilities of uncertain value or timing are called provisions.

source: Coby Harmon

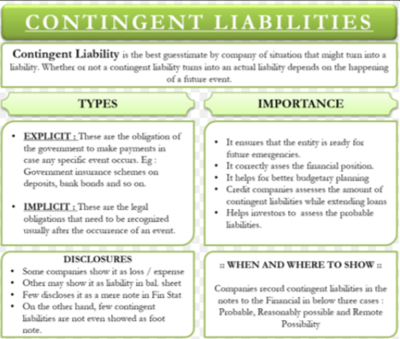

Contingent Liability[4]

Contingent Liability is the best guesstimate by the company of a situation that might turn into a liability. Whether or not a contingent liability turns into an actual liability depends on the happening of a future event. Suppose an employee sues a company for $100,000. Whether or not a company will pay this amount depends on the outcome of the case. Companies create a provision for a contingent liability in anticipation of any future liability or liabilities. By making a provision, the company’s makes sure that they are ready for any such situation even if such liability may or may not occur. There are two types of contingent liabilities:

- Explicit: Such liabilities are the obligation of the government to make payments in case any specific event occurs. Assessing the explicit contingent liabilities could be tough since these items do not appear until they occur. Such liabilities are a huge burden, and therefore could be a drain on the future government finances. Some of the examples of explicit contingent liabilities are:

- Government insurance schemes on deposits, bank bonds and so on.

- Mortgage Loan, student loan, civil service pensions etc.

- Central Government guarantees for non-sovereign borrowings.

- Currency exchange rates.

- Any probable case wherein the court orders to pay the penalty or specific sum of money towards specific cases.

- Implicit: These are the legal obligations that need to be recognized usually after the occurrence of an event. The government does not officially record such contingent liabilities as there is no certainty of their occurrence. Few examples are disaster relief (Floods, Cyclones, Tsunami and more), environment management, municipality defaults and so on.

Contingent Liabilities are important because:

- Recording contingent liabilities ensure that the companies, government, and non-government organizations are ready for any emergency in the future.

- Recording such liabilities help to correctly asses the financial position of the economy or the company.

- It helps a company or government to better plan its budget.

- Credit companies also consider the amount and nature of contingent liabilities while extending a loan to a company.

- Before making an investment, investors might also want to know the probable liabilities that the company might have to pay in the future.

The relationship between liabilities and assets[5]

Assets are things a company owns. These include tangible items, such as equipment, machinery, buildings, and intangible items, such as interest owed, accounts receivable, intellectual property and patents.

If we subtract the company’s liabilities from its assets, we will get the owners’ or shareholders’ equity:

Assets – Liabilities = Shareholders' Equity

Generally, this fundamental accounting equation is presented as follows:

Liabilities + Shareholders’ Equity = Assets

References

- ↑ Definition of a Liability Debitoor

- ↑ Explaining Liabilities Investopedia

- ↑ Classification of Liabilities Wikipedia

- ↑ What is a Contingent Liability? eFinance Management

- ↑ The relationship between liabilities and assets Capital.com