Accounts Receivable

Accounts Receivable is a term used in accounting to describe the amount of money owed to a business by its customers for goods or services that have been delivered or provided but not yet paid for. Accounts Receivable (often abbreviated as AR) are amounts due to be received by a company from its customers. These amounts are usually in the form of invoices that are expected to be paid within a specific time frame, typically 30, 60, or 90 days. The accounts receivable is classified as a current asset on a company's balance sheet.

Importance

- Cash Flow: Accounts receivable is an important factor that directly affects a company’s cash flow. Efficient management of accounts receivable can help businesses maintain good liquidity.

- Credit History: It allows companies to extend credit to trustworthy clients, building long-term relationships.

- Revenue Recognition: AR helps in the calculation and recognition of revenue, which is essential for financial reporting.

Recognition and Measurement

Accounts receivable are initially recorded at the fair value of the goods or services provided. As time progresses, companies may need to adjust the value of their accounts receivable to account for possible bad debts or delinquent accounts.

Journal Entry for Recognizing Accounts Receivable

When goods or services are sold on credit, the journal entry would typically be:

- Debit: Accounts Receivable

- Credit: Sales Revenue

Types of Accounts Receivable

- Trade Receivables: Amounts billed to a customer for goods and services sold.

- Notes Receivable: A formal document promising payment at a future date.

- Related Party Receivables: Amounts due from entities or individuals closely related to the company, such as subsidiary companies or board members.

Aging of Accounts Receivable

The aging of accounts receivable involves categorizing outstanding invoices by their age. This helps a company identify which accounts to pursue for collection and assess the risk of bad debts.

Risk Management

- Provision for Bad Debts: Many companies establish a provision for bad debts to account for the risk that some receivables will never be collected.

- Credit Policies: Establishing strict credit policies can minimize the risk associated with accounts receivable.

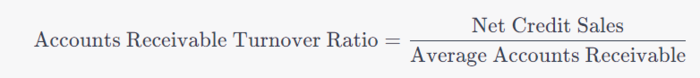

Accounts Receivable Turnover Ratio

This is a metric that measures how effectively a business is managing its accounts receivable. The ratio is calculated as follows:

See Also