Aggregate Demand

Aggregate Demand is the relationship between the aggregate price level and the quantity of output. AD is similar to the existing law of demand, but the factors affecting AD are slightly different from demand. The factors that affect AD are household consumption, government spending, investment, and net exports. It is important to note that AD is the same in both the short and long run. Aggregate Demand represents how a change in a certain price level will change expenditures on all services and goods in an economy. Several components make up AD, and explain how it works. These are:

- The Effects of Price on Aggregate Demand

- Other Factors Besides Price Affecting Aggregate Demand

- The Multiplier Effect[1]

Aggregate Demand Curves[2]

Two specific AD representations are helpful to consider:

- Keynesian Cross: The Keynesian Cross illustrates the relationship between aggregate demand and desired total spending (linear at 45 degrees). The intersecting AD line will generally have an upward slope, assuming that increased national output should result in increased disposable income.

- Aggregate Demand/Aggregate Supply Model (AD/AS):The x-axis represents the overall output, while the y-axis represents the price level. The aggregate quantity demanded (Y = C + I + G + NX) is calculated at every given aggregate average price level.

According to Keynesian demand-side theory, future economic production is propelled by money spent on goods and services. British economist John Maynard Keynes considered unemployment to be a byproduct of insufficient aggregate demand because wage prices would not adjust downward fast enough to compensate for reduced spending. He believed the government could spend money and increase aggregate demand until idle economic resources, including laborers, were redeployed.

The Keynesian equation for aggregate demand is: AD = C+I+G+(Nx)

Where:

C = Consumer spending

I = Private investment spending for non-final capital goods

G = Government spending

Nx = Net exports[3]

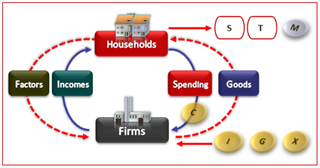

Aggregate demand and the circular flow

Aggregate demand can be illustrated by reference to the circular flow of income (figure below):

source: Economics Online

Austrian theorist Henry Hazlitt argued that aggregate demand is "a meaningless concept" in economic analysis. Friedrich Hayek, another Austrian, wrote that Keynes' study of the aggregate relations in an economy is "fallacious," arguing that micro-economic factors cause recessions.[4]

See Also

Aggregate demand is the total demand for goods and services within an economy at a given price level and period. It represents the total spending by households, businesses, governments, and foreigners on domestically produced goods and services.

- Consumption: Consumption refers to household spending on goods and services for personal use. It is the largest component of aggregate demand. It includes expenditures on durable goods (such as cars and appliances), nondurable goods (such as food and clothing), and services (such as healthcare and education).

- Investment: Investment refers to spending by businesses on capital goods, such as machinery, equipment, buildings, and infrastructure, as well as inventories. It is another component of aggregate demand and reflects businesses' spending on expanding production capacity, improving efficiency, and replenishing inventories.

- Government Spending: Government spending refers to expenditures by governments at the federal, state, and local levels on goods and services, including defense, education, healthcare, infrastructure, and social programs. It represents a component of aggregate demand and is influenced by government policies and budget priorities.

- Net Exports: Net exports represent the difference between exports and imports of goods and services. If exports exceed imports, there is a trade surplus, which contributes positively to aggregate demand. Conversely, if imports exceed exports, there is a trade deficit, which detracts from aggregate demand.

- Consumer Confidence: Consumer confidence refers to the degree of optimism or pessimism among consumers about the state of the economy and their financial situation. High consumer confidence tends to lead to increased consumer spending, while low consumer confidence may result in decreased spending, affecting aggregate demand.

References

Further Reading

- What Creates Aggregate Demand?6 Determinants and 5 Components of Aggregate Demand the balance

- Presentation - Aggregate Demand Practice Jacob Clifford