Business Cycle

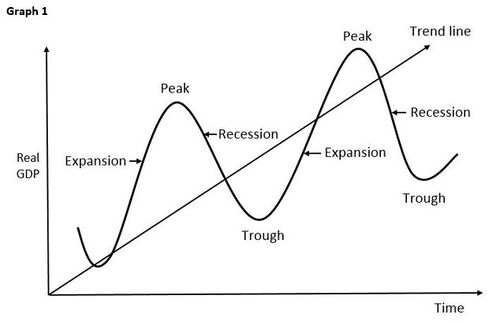

The business cycle is the fluctuation in economic activity that an economy experiences over a period of time. A business cycle is basically defined in terms of periods of expansion or recession. During expansions, the economy is growing in real terms (i.e. excluding inflation), as evidenced by increases in indicators like employment, industrial production, sales and personal incomes. During recessions, the economy is contracting, as measured by decreases in the above indicators. Expansion is measured from the trough (or bottom) of the previous business cycle to the peak of the current cycle, while recession is measured from the peak to the trough. In the United States, the National Bureau of Economic Research (NBER) determines the official dates for business cycles.[1]

The Phases of the Business Cycle[2]

While no two business cycles are exactly the same, they can be identified as a sequence of four phases that were classified and studied in their most modern sense by American economists Arthur Burns and Wesley Mitchell in their text Measuring Business Cycles. The four primary phases of the business cycle include:

- 1. Expansion: A speedup in the pace of economic activity defined by high growth, low unemployment, and increasing prices. The period marked from trough to peak.

- 2. Peak: The upper turning point of a business cycle and the point at which expansion turns into contraction.

- 3. Contraction: A slowdown in the pace of economic activity defined by low or stagnant growth, high unemployment, and declining prices. It is the period from peak to trough.

- 4. Trough: The lowest turning point of a business cycle in which a contraction turns into an expansion. This turning point is also called Recovery.

These four phases also make up what is known as the "boom-and-bust" cycles, which are characterized as business cycles in which the periods of expansion are swift and the subsequent contraction is steep and severe.

source: Rock Education

See Also

The business cycle refers to the recurring pattern of expansion and contraction in economic activity over time. Fluctuations in real GDP, employment, investment, consumer spending, and other macroeconomic indicators characterize it.

- Phases: The business cycle typically consists of four main phases: expansion, peak, contraction (recession), and trough. During the expansion phase, economic activity increases, leading to rising GDP, employment, and investment. The peak marks the highest point of economic activity before a contraction begins. In the contraction phase, economic activity slows down, leading to declining GDP, employment, and investment. The trough represents the lowest point of economic activity before the cycle begins again.

- Duration: Each phase of the business cycle can vary widely. Expansions and contractions can last from a few months to several years, depending on factors such as government policies, technological advancements, and global economic conditions.

- Causes: The business cycle is driven by a combination of factors, including changes in consumer and business confidence, monetary policy, fiscal policy, technological innovation, geopolitical events, and external shocks such as natural disasters or pandemics. These factors influence aggregate demand, production levels, and overall economic activity.

- Indicators: Economists use a variety of indicators to track the business cycle, including GDP growth, unemployment rate, consumer spending, business investment, industrial production, housing starts, and stock market performance. These indicators provide insights into the current phase of the cycle and help forecast future economic trends.

- Leading, Lagging, and Coincident Indicators: Economic indicators can be classified as leading, lagging, or coincident indicators based on their timing relative to the business cycle. Leading indicators, such as stock prices and consumer confidence, tend to change direction before the economy as a whole. Lagging indicators, such as the unemployment rate and inflation, change direction after the economy has entered a new phase. Coincident indicators like industrial production and retail sales move in tandem with the overall economy.

- Policy Response: Governments and central banks often use monetary and fiscal policy tools to stabilize the economy and mitigate the impact of the business cycle. During periods of economic downturn, policymakers may implement expansionary monetary and fiscal policies to stimulate demand and promote growth. Conversely, policymakers may implement contractionary policies to cool down the economy during overheating or inflationary pressure.

- Impact on Businesses: The business cycle can significantly impact businesses across various sectors. Companies may experience increased demand for their products and services during economic expansions, leading to higher sales and profits. However, during economic contractions, businesses may face declining demand, lower sales, and increased competition, resulting in layoffs, bankruptcies, and reduced investment.

- Investment Cycles: Business cycles often influence investment decisions by businesses and investors. During economic expansions, businesses may increase investment in capital equipment, technology, and expansion projects to meet growing demand. Conversely, during economic contractions, businesses may scale back investment to conserve cash and weather the downturn.

- International Business Cycle: The business cycle is not limited to individual countries but can also affect the global economy. Economic interconnectedness and trade relationships mean that economic fluctuations in one country can spill over to others through trade, investment, and financial channels. Global economic events, such as recessions or financial crises, can amplify the impact of the business cycle on businesses and economies worldwide.

- Economic Forecasting: Understanding the business cycle is essential for economic forecasting and risk management. Businesses, policymakers, and investors use economic indicators and forecasting models to anticipate changes in the business cycle and adjust their strategies and decisions accordingly.

- Economic Expansion: A phase of the business cycle where economic output is growing, typically characterized by increased employment, consumer spending, and production.

- Recession: A significant decline in economic activity spread across the economy, lasting more than a few months, visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.

- Boom: A period of significant economic growth and expansion, often characterized by increased productivity, sales, and incomes, leading to high levels of consumer and business confidence.

- Bust: The phase following a boom, where there is a sharp decline in economic activity, often leading to recession or depression.

- Economic Contraction: A phase of the business cycle where there is a decline in economic activity and output, characterized by reduced employment, spending, and investment.

- Depression: A severe and prolonged downturn in economic activity, more extreme than a recession, characterized by significant declines in GDP, high unemployment, and deflation.

- Inflation: The rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling. Inflation can be influenced by the business cycle.

- Monetary Policy: The process by which the monetary authority of a country, like the central bank, controls the supply of money, often targeting an inflation rate or interest rate to ensure stability and general trust in the currency.

- Fiscal Policy: The use of government spending and taxation to influence the economy, often used to moderate the economic cycles and provide counter-cyclical measures during downturns.

- External Environment

References

- ↑ What is a Business Cycle? Investopedia

- ↑ What are the phases of Business Cycle? about.com

Further Reading

- Explanation of the Business Cycle & Its Stages Chron

- Causes of Business Cycle Economics Help

- International Business Cycle Dates BusinessCycle