Business Valuation

What is Business Valuation?

Business Valuation is a process and a set of procedures used to estimate the economic value of an owner's interest in a business. Valuation is used by financial market participants to determine the price they are willing to pay or receive to effect a sale of a business. In addition to estimating the selling price of a business, the same valuation tools are often used by business appraisers to resolve disputes related to estate and gift taxation, divorce litigation, allocate the business purchase price among business assets, establish a formula for estimating the value of partners' ownership interest for buy-sell agreements, and many other business and legal purposes such as in shareholders deadlock, divorce litigation, and estate contest. In some cases, the court would appoint a forensic accountant as the joint expert doing the business valuation. In these cases, attorneys should always be prepared to have their expert’s report withstand the scrutiny of cross-examination and criticism.[1]

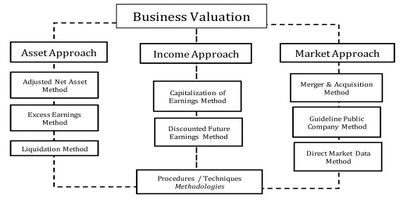

Business Valuation Approaches[2]

There are conceptually three broad approaches in business valuation

- Asset-Based Approaches (Asset Approach): Essentially, an asset-based business valuation will total up all the investments in the company. Asset-based business valuations can be done in one of two ways:

- A going concern asset-based approach takes a look at the company's balance sheet, lists the business's total assets, and subtracts its total liabilities. This is also called book value.

- A liquidation asset-based approach determines the liquidation value or the net cash that would be received if all assets were sold and liabilities paid off.

- Earning Value Approaches (Income Approach): An earning value approach is based on the idea that a business's value lies in its ability to produce wealth in the future.

- Capitalizing Past earnings determines an expected level of cash flow for the company using a company's record of past earnings, normalizes them for unusual revenue or expenses, and multiplies the expected normalized cash flows by a capitalization factor. The capitalization factor is a reflection of what rate of return a reasonable purchaser would expect on the investment, as well as a measure of the risk that the expected earnings will not be achieved.

- Discounted Future Earnings is another earning value approach to business valuation where instead of an average of past earnings, an average of the trend of predicted future earnings is used and divided by the capitalization factor.

- Market Value Approach (Market Approach): Market value approaches to business valuation attempt to establish the value of your business by comparing your company to similar ones that have recently sold. The idea is similar to using real estate comps, or comparables, to value a house. This method only works well if there are a sufficient number of similar businesses to compare.

source: American Business Appraisers

One of these methods is earnings driven; one is market driven; and the other utilizes the assets of the Company to determine value. The earnings-driven method is typically more appropriate because it accords primary consideration to the historical/future earnings potential of the Company. In concept, a market-driven method follows the goal of the appraisal process, which is to estimate what could reasonably be expected to occur in the market, as it is based on what has occurred in the market. Its limitations are the extent to which data is available on transactions and the imprecision associated with determining the extent to which the companies sold were sufficiently similar to be judged “equally desirable substitutes”. The asset-based method provides an alternative method, but one which is less appropriate for primarily two reasons:

(i) the business valuation community is in agreement that earnings should be pre-eminent; and

(ii) adjustments made to the balance sheet are less precise, particularly regarding valuing the fixed assets.

Methods of Business Valuation[3]

There are distinct differences between approaches and methods. Various methods are available under each approach mentioned above. There are numerous ways a company can be valued.

- Market Capitalization: Market capitalization is the simplest method of business valuation. It is calculated by multiplying the company’s share price by its total number of shares outstanding. For example, as of January 3, 2018, Microsoft Inc. traded at $86.35.1 With a total number of shares outstanding of 7.715 billion, the company could then be valued at $86.35 x 7.715 billion = $666.19 billion.

- Times Revenue Method: Under the time's revenue business valuation method, a stream of revenues generated over a certain period of time is applied to a multiplier that depends on the industry and economic environment. For example, a tech company may be valued at 3x revenue, while a service firm may be valued at 0.5x revenue.

- Earnings Multiplier: Instead of the times revenue method, the earnings multiplier may be used to get a more accurate picture of the real value of a company, since a company’s profits are a more reliable indicator of its financial success than its sales revenue. The earnings multiplier adjusts future profits against cash flow that could be invested at the current interest rate over the same period of time. In other words, it adjusts the current P/E ratio to account for current interest rates.

- Discounted Cash Flow (DCF) Method: The DCF method of business valuation is similar to the earnings multiplier. This method is based on projections of future cash flows, which are adjusted to get the current market value of the company. The main difference between the discounted cash flow method and the profit multiplier method is that it takes inflation into consideration to calculate the present value.

- Book Value: This is the value of shareholders’ equity of a business as shown on the balance sheet statement. The book value is derived by subtracting the total liabilities of a company from its total assets.

- Liquidation Value: Liquidation value is the net cash that a business will receive if its assets were liquidated and liabilities were paid off today.

This is by no means an exhaustive list of the business valuation methods in use today. Other methods include replacement value, breakup value, asset-based valuation, and still many more.

The Importance of Business Valuation[4]

The perceived worth of a business valuation varies from person to person and is highly dependent on why the valuation is being calculated in the first place. Zach Reece, COO of Colony Roofers and certified public accountant, says a business valuation can act as a roadmap to a business's future. "It's important for business owners to understand the value of what they are building, so they can make sure they're spending their time on something that aligns with their long-term financial goals,". "Businesses in different industries are valued at different 'multiples,' so it's important to know what the norms are for your industry."

One of the biggest reasons to get a valuation for your business is that it's going on the market to be sold. With an estimate of how much your business is worth, you can more easily determine your preferred asking price on the market. For many experts, a business valuation is the first step in the negotiation process. "A business valuation is imperative to understand the true value of the business so that owners don't settle for less than fair value or give up more equity than they should," says Dave Bookbinder, senior director at CFGI.

As for how frequently you should conduct a business valuation, it depends on your business. Most experts will tell you that an annual valuation is unnecessary for the vast majority of small businesses since valuations can be costly and time-consuming. "Unless a business owner is actively planning on a sale in the next few years and wants to know how to increase the value of the business, or the business has been sold to an employee stock ownership plan (ESOP), most business owners do not need to have their business appraised every year," says Shawn Hyde, executive director of the International Society of Business Appraisers. "However, if the business is your largest investment, it may not be a bad idea to check on its health every so often, and a detailed valuation analysis can do that."

== Why Perform a Business Valuation?[5]

Business valuation to a company is an important exercise since it can help in improving the company. Here are some of the reasons to perform a business valuation.

- Litigation: During a court case such as an injury case, divorce, or where there is an issue with the value of the business, you may need to provide proof of your company’s worth so that in case of any damages, they are based on the actual worth of your businesses and not inflated figures estimated by a lawyer.

- Exit strategy planning: In instances where there is a plan to sell a business, it is wise to come up with a base value for the company and then come up with a strategy to enhance the company’s profitability so as to increase its value as an exit strategy. Your business exit strategy needs to start early enough before the exit, addressing both involuntary and voluntary transfers. A valuation with annual updates will keep the business ready for unexpected and expected sale. It will also ensure that you have correct information on the company's fair market value and prevent capital loss due to a lack of clarity or inaccuracies.

- Buying a business: Even though sellers and buyers usually have diverse opinions on the worth of the business, the real business value is what the buyers are willing to pay. A good business valuation will look at market conditions, potential income, and other similar concerns to ensure that the investment you are making is viable. It may be prudent to hire a business broker who can help you with the process.

- Selling a business: When you want to sell your business or company to a third party, you need to make certain that you get what it is worth. The asking price should be attractive to prospective purchasers, but you should not leave money on the table.

- Strategic planning: The true value of assets may not be shown with a depreciation schedule, and if there has been no adjustment of the balance sheet for various possible changes, it may be risky. Having a current valuation of the business will give you good information that will help you make better business decisions.

- Funding: An objective valuation is usually needed when you need to negotiate with banks or any other potential investors for funding. Professional documentation of your company’s worth is usually required since it enhances your credibility with the lenders.

- Selling a share in a business: For business owners, proper business valuation enables you to know the worth of your shares and be ready when you want to sell them. Just like during the sale of the business, you ought to ensure no money is left on the table and that you get good value from your share.

Benefits of Business Valuation[6]

- Knowing the true value: A person may have a general idea of how much his/her company is worth by calculating the general facts of the market value, total asset value, and bank account balances. Even though these numbers might give a general idea, they do not reflect their real value. By knowing the correct value, it is easier to gauge the potential buyer’s interest in purchasing the company and aids the owner in securing a better deal.

- Better knowledge: Obtaining specific numbers of assets helps in getting the proper amount of insurance coverage, knowing the reinvestment requirements, and what is the amount of profit a person gains even after the sale of the company.

- Company resale value: Being aware of the company resale value aids in negotiations and in getting a profitable deal. This process of valuation should be the first step before marketing the company. It helps in solidifying the company’s stance in getting the best price.

- Mergers and acquisitions: Mergers and acquisitions are common in a business cycle. By conducting a business valuation, the company owners can show how much the business has grown in the past years, its asset holdings, and its potential. When major corporations attempt a merger or acquisition, they will start only at the lowest price; but a proper valuation will help the company to assert its position.

- Lure investors: The ultimate aim of any investor is to gain substantial profits from their investments. Whether to save the company from financial problems or fund company growth, the investors require a full valuation report with projections and charts giving a detailed view. That is where a business valuation helps, and the investors can see how their fund will help the business grow and generate returns in the future.

See Also

Business Valuation is the process of determining the economic value of a whole business or company unit. Business valuation can be used for various purposes, including merger and acquisition transactions, establishing partner ownership, taxation, and even divorce proceedings. It involves analyzing the company's management, the composition of its capital structure, its future earnings prospects, or the market value of its assets, among other factors. The valuation process may include reviewing financial statements, evaluating market competition, assessing future revenue streams, and understanding economic conditions that may affect the company’s performance.

- Financial Analysis: Discussing the evaluation of a company's financial statements to understand its financial health and performance, a fundamental part of the valuation process.

- Discounted Cash Flow (DCF): Explaining a valuation method based on projecting future cash flows and discounting them to the present value, often used in business valuation.

- Market Capitalization: Covering the total market value of a company's outstanding shares, a straightforward valuation metric for publicly traded companies.

- Comparable Company Analysis (CCA): Discussing a method that involves comparing the company being valued with similar businesses in the same industry to estimate its value.

- Asset Valuation: Explaining the process of determining the fair market value of a company's assets, used in situations where a company is being liquidated or when valuing tangible assets is necessary.

- Goodwill and Intangible Assets: Covering the valuation of non-physical assets that contribute to a company's value, such as brand reputation, intellectual property, and customer relationships.

- Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA): Discussing a measure of a company's operating performance as an alternative to net income, often used in valuation.

- Mergers and Acquisitions (M&A): Explaining the process of consolidating companies or assets, where business valuation is crucial for negotiating prices.

- Initial Public Offering (IPO): Covering the process of offering shares of a private corporation to the public in a new stock issuance, requiring a comprehensive valuation.

- Capital Structure: Discussing the mix of debt and equity financing a company uses to fund its operations and growth, important for understanding risk and value.

- Risk Management: Explaining the process of identifying, assessing, and controlling threats to an organization's capital and earnings, including how risk affects valuation.

- Succession Planning: Covering the process of identifying and developing new leaders who can replace old leaders when they leave, retire, or die, which may involve valuation for buy-sell agreements.

- Adjusted Book Value

- Tangible Book Value