Equilibrium Price

The Equilibrium Price is where the supply of goods matches demand. When a major index experiences a period of consolidation or sideways momentum, it can be said that the forces of supply and demand are relatively equal and the market is in a state of equilibrium.[1]

The equilibrium price is the only price where the desires of consumers and the desires of producers agree—that is, where the amount of the product that consumers want to buy (quantity demanded) is equal to the amount producers want to sell (quantity supplied). This mutually desired amount is called the equilibrium quantity. At any other price, the quantity demanded does not equal the quantity supplied, so the market is not in equilibrium at that price. It should be clear from the previous discussions of surpluses and shortages, that if a market is not in equilibrium, market forces will push the market to the equilibrium.[2]

You can visualize the equilibrium price as a ball in bowl. The bowl can can be tipped and the ball will move, but it will find its way back to a stable place. The equilibrium price works that same way. At any other price, forces are put into play that will push the price back towards equilibrium. The first thing you need to understand about this process is how the competition works. Buyers are competing against other buyers and sellers are competing against other sellers. Buyers are not competing sellers.

Let’s examine how this works with oil. If oil is $50 per barrel, but the equilibrium price is $30 per barrel, what happens? Well, the quantity demanded is lower than the quantity supplied – there’s a surplus. Sellers can’t sell as much as they’d like at $50 per barrel, so they lower the price. And what happens to demand? It goes up! Eventually, the price reaches equilibrium and the quantity demanded equals the quantity supplied. When the price of oil is too low and the quantity demanded is higher than the quantity supplied, there’s a shortage. The correction process in this case works much the same way. Buyers compete by bidding up the price so that they can get more oil. Sellers have an incentive to raise the price so that, once again, price and quantity reaches equilibrium.

To recap, the only stable price is the equilibrium price. If the price is not at equilibrium, the actions of buyers and sellers will push the price back towards equilibrium.[3]

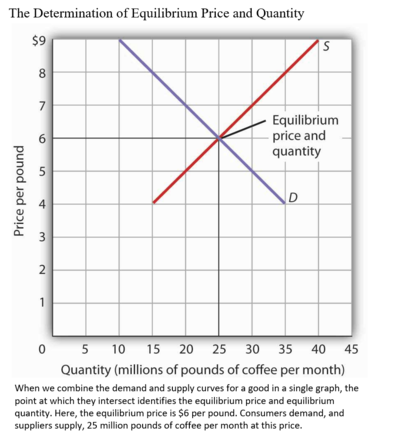

The Determination of Price and Quantity[4]

The logic of the model of demand and supply is simple. The demand curve shows the quantities of a particular good or service that buyers will be willing and able to purchase at each price during a specified period. The supply curve shows the quantities that sellers will offer for sale at each price during that same period. By putting the two curves together, we should be able to find a price at which the quantity buyers are willing and able to purchase equals the quantity sellers will offer for sale.

source: University of Minnesota

In the figure above notice that the two curves intersect at a price of $6 per pound—at this price the quantities demanded and supplied are equal. Buyers want to purchase, and sellers are willing to offer for sale, 25 million pounds of coffee per month. The market for coffee is in equilibrium. Unless the demand or supply curve shifts, there will be no tendency for price to change. The equilibrium price in any market is the price at which quantity demanded equals quantity supplied. The equilibrium price in the market for coffee is thus $6 per pound. The equilibrium quantity is the quantity demanded and supplied at the equilibrium price.

References

- ↑ Definition - What Does Equilibrium Price Mean? Investopedia

- ↑ What is Equilibrium Price? Lumen Learning

- ↑ Understanding Equilibrium Price MRU.org

- ↑ The Determination of Price and Quantity umn.edu