Five Forces Model

What is Michael Porter's Five Forces Model?

The Five Forces Model is a framework for understanding the competitive forces in an industry, which drive the way economic value is divided among industry actors. A Five Forces analysis can help companies assess industry attractiveness, how trends will affect industry competition, which industries a company should compete in—and how companies can position themselves for success.[1]

This model helps marketers and business managers to look at the ‘balance of power’ in a market between different types of organizations and to analyze the attractiveness and potential profitability of an industry sector. It’s a strategic tool designed to give a global overview rather than a detailed business analysis technique. It helps review the strengths of a market position based on five key forces.[2]

Porter's Five Forces is a model of analysis that helps to explain why different industries are able to sustain different levels of profitability. This model was originally published in Porter's book, "Competitive Strategy: Techniques for Analyzing Industries and Competitors," in 1980. The model is widely used worldwide to analyze the industry structure of a company as well as its corporate strategy. Porter identified five undeniable forces that play a part in shaping every market and industry in the world. The forces are frequently used to measure competition intensity, attractiveness, and profitability of an industry or market.[3]

Porter refers to these forces as the microenvironment to contrast it with the more general term macroenvironment. They consist of those forces close to a company that affects its ability to serve its customers and make a profit. A change in any of the forces normally requires a business unit to re-assess the marketplace, given the overall change in industry information. The overall industry attractiveness does not imply that every firm in the industry will return the same profitability. Firms are able to apply their core competencies, business model, or network to achieve a profit above the industry average. A clear example of this is the airline industry. As an industry, profitability is low because the industry's underlying structure of high fixed costs and low variable costs afford enormous latitude in the price of airline travel. Airlines tend to compete on cost, and that drives down the profitability of individual carriers as well as the industry itself because it simplifies the decision by a customer to buy or not buy a ticket. A few carriers - Richard Branson's Virgin Atlantic is one - have tried, with limited success, to use sources of differentiation in order to increase profitability. Porter's five forces include three forces from 'horizontal' competition - the threat of substitute products or services, the threat of established rivals, and the threat of new entrants - and two others from 'vertical' competition - the bargaining power of suppliers and the bargaining power of customers. Porter developed his five forces framework in reaction to the then-popular SWOT analysis, which he found both lacking rigor and ad hoc. Porter's five-forces framework is based on the structure–conduct–performance paradigm in industrial organizational economics. It has been applied to try to address a diverse range of problems, from helping businesses become more profitable to helping governments stabilize industries. Other Porter's strategy tools include the value chain and generic competitive strategies.[4]

The Five Factors of the Five Forces Model (Figure 1.)[5]

Porter identified five factors that act together to determine the nature of competition within an industry. These are:

- Threat of new entrants to a market: If new entrants move into an industry, they will gain market share & rivalry will intensify. The position of existing firms is stronger if there are barriers to entering the market. If barriers to entry are low then the threat of new entrants will be high, and vice versa. Barriers to entry are, therefore, very important in determining the threat of new entrants. An industry can have one or more barriers. The threat of new entrants is high when:

- Low amount of capital is required to enter a market;

- Existing companies can do little to retaliate;

- Existing firms do not possess patents, trademarks or do not have established brand reputation;

- There is no government regulation;

- Customer switching costs are low (it doesn’t cost a lot of money for a firm to switch to other industries);

- There is low customer loyalty;

- Products are nearly identical;

- Economies of scale can be easily achieved.

- Bargaining power of suppliers: If a firm's suppliers have bargaining power, they will:

- Exercise that power

- Sell their products at a higher price

- Squeeze industry profits<be />If the supplier forces up the price paid for inputs, profits will be reduced. It follows that the more powerful the customer (buyer), the lower the price that can be achieved by buying from them. Suppliers find themselves in a powerful position when:

- There are only a few large suppliers

- The resource they supply is scarce

- The cost of switching to an alternative supplier is high

- The product is easy to distinguish, and loyal customers are reluctant to switch

- The supplier can threaten to integrate vertically

- The customer is small and unimportant

- There are no or few substitute resources available

- Bargaining power of customers ("buyers"): Powerful customers are able to exert pressure to drive down prices or increase the required quality for the same price, and therefore reduce profits in an industry. A great example in the UK currently is the dominant grocery supermarkets which exert great power over supplier firms. Customers tend to enjoy strong bargaining power when:

- There are only a few of them

- The customer purchases a significant proportion of the output of an industry

- They possess a credible backward integration threat – that is, they threaten to buy the producing firm or its rivals

- They can choose from a wide range of supply firms

- They find it easy and inexpensive to switch to alternative suppliers

- Threat of substitute products: A substitute product can be regarded as meeting the same need. Substitute products are produced in a different industry –but crucially satisfy the same customer need. If there are many credible substitutes for a firm's product, they will limit the price that can be charged and reduce industry profits. The extent of the threat depends upon

- extent to which the price and performance of the substitute can match the industry's product

- The willingness of customers to switch

- Customer loyalty and switching costs<be />If there is a threat from a rival product the firm will have to improve the performance of their products by reducing costs and, therefore, prices and differentiation.

- Degree of competitive rivalry: If there is intense rivalry in an industry, it will encourage businesses to engage in

- Price wars (competitive price reductions),

- Investment in innovation & new products

- Intensive promotion (sales promotion and higher spending on advertising)

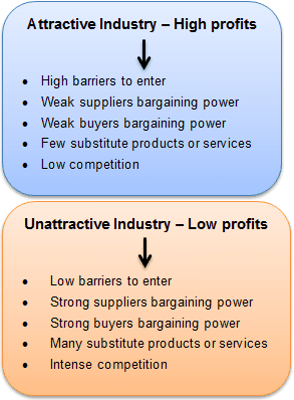

All these activities are likely to increase costs and lower profits. (Figure 2.)These forces determine an industry structure and the level of competition in that industry. The stronger the competitive forces in the industry are, the less profitable it is. An industry with low barriers to entry, having few buyers and suppliers but many substitute products and competitors, will be seen as very competitive and, thus, not so attractive due to its low profitability. It is every strategist’s job to evaluate the company’s competitive position in the industry and to identify what strengths or weaknesses can be exploited to strengthen that position. The tool is very useful in formulating a firm’s strategy as it reveals how powerful each of the five key forces is in a particular industry.

Figure 2. source: Strategic Management Insight

Using the Five Forces Model[6]

We now understand that Porter’s five forces framework is used to analyze the industry’s competitive forces and to shape an organization’s strategy according to the results of the analysis. But how to use this tool? We have identified the following steps:

- Step 1. Gather the information on each of the five forces: Gather the information on each of the five forces. What managers should do during this step is to gather information about their industry and to check it against each of the factors (such as the “number of competitors in the industry”) influencing the force.

- Step 2. Analyze the results and display them on a diagram: After gathering all the information, you should analyze it and determine how each force affects an industry. For example, if there are many companies of equal size operating in the slow-growth industry, it means that rivalry between existing companies is strong. Remember that five forces affect different industries differently, so don’t use the same analysis results for even similar industries!

- Step 3. Formulate strategies based on the conclusions: At this stage, managers should formulate the firm’s strategies using the analysis results. For example, if it is hard to achieve economies of scale in the market, the company should pursue a cost leadership strategy. A product development strategy should be used if the current market growth is slow and the market is saturated. Although Porter’s five forces are a great tool to analyze an industry’s structure and use the results to formulate a firm’s strategy, they have limitations. It requires further analysis to be done, such as SWOT, PEST, or Value Chain analysis.

Example of Porter's Five Forces[7]

There are several examples of how Porter's Five Forces can be applied to various industries online. For example, stock analysis firm Trefis looked at how Under Armour fits into the athletic footwear and apparel industry.

- Competitive rivalry: Under Armour faces intense competition from Nike, Adidas, and newer players. Nike and Adidas, which have considerably larger resources at their disposal, are making a play within the performance apparel market to gain market share in this up-and-coming product category. Under Armour does not hold any fabric or process patents, and hence its product portfolio could be copied in the future.

- Bargaining power of suppliers: A diverse supplier base limits bargaining power. Under Armour's products are produced by dozens of manufacturers across multiple countries.

- Bargaining power of customers: Under Armour's customers include both wholesale customers as well as end customers. Wholesale customers, like Dick's Sporting Goods and Sports Authority, hold a certain degree of bargaining leverage. They could substitute Under Armour's products with competitors' products for higher margins. The bargaining power of end customers is lower as Under Armour enjoys strong brand recognition.

- Threat of new entrants: Large capital costs are required for branding, advertising, and creating product demand, limiting the entry of newer players in the sports apparel market. However, existing companies in the sports apparel industry could enter the performance apparel market in the future.

- Threat of substitute products: The demand for performance apparel, sports footwear, and accessories is expected to continue, and hence we think this force does not threaten Under Armour in the foreseeable future.

Five Forces - Critique[8]

Porter’s model of Five Competitive Forces has been the subject of much critique. Its main weakness results from the historical context in which it was developed. In the early eighties, cyclical growth characterized the global economy. Thus, primary corporate objectives consisted of profitability and survival. A major prerequisite for achieving these objectives has been optimizing strategy in relation to the external environment. At that time, development in most industries has been fairly stable and predictable compared with today’s dynamics. In general, the meaningfulness of this model is reduced by the following factors:

- In the economic sense, the model assumes a classic perfect market. The more an industry is regulated, the less meaningful insights the model can deliver.

- The model is best applicable for the analysis of simple market structures. A comprehensive description and analysis of all five forces get very difficult in complex industries with multiple interrelations, product groups, by-products, and segments. A too-narrow focus on particular segments of such industries, however, bears the risk of missing important elements.

- The model assumes relatively static market structures. This is hardly the case in today’s dynamic markets. Technological breakthroughs and dynamic market entrants from start-ups or other industries may completely change business models, entry barriers, and relationships along the supply chain within a short time. The Five Forces model may have some use for later analysis of the new situation, but it will hardly provide much meaningful advice for preventive actions.

- The model is based on the idea of competition. It assumes that companies try to achieve a competitive advantage over other market players and suppliers or customers. With this focus, it does not really consider strategies like strategic alliances, electronic linking of information systems of all companies along a value chain, virtual enterprise networks, or others.

Overall, Porter's Five Forces Model has major limitations in today’s market environment. It is not able to take into account new business models and the dynamics of markets. The value of Porter's model is that it enables managers to think about the current situation of their industry in a structured, easy-to-understand way – as a starting point for further analysis.

See Also

- Competitive Advantage - The attributes that allow an organization to outperform its competitors, often the goal of understanding competitive forces.

- SWOT Analysis - A framework for identifying Strengths, Weaknesses, Opportunities, and Threats, which can help companies understand competitive forces.

- Business Model - The plan for how a company creates, delivers, and captures value, affected by competitive forces in the marketplace.

- Oligopoly - A market structure characterized by a small number of firms, where understanding competitive forces is critical.

- Barriers to Entry - Factors that prevent new competitors from easily entering an industry or market, thereby shaping competitive forces.

References

- ↑ Definition - What is Porter's Five Forces Model?

- ↑ Explaining Five Forces Model

- ↑ Breaking Down Porter's Five Forces

- ↑ An Overview of the Five Forces Model

- ↑ The Five Factors of the Five Forces Model

- ↑ Ovidijus Using the Five Forces Model

- ↑ Example of Porter's Five Forces

- ↑ Criticism of the Five Forces

Further Reading

- Guidelines for applying Porter's five forces framework: a set of industry analysis templates

- The Five Competitive Forces That Shape Strategy

- The Application of Porter’s Five Forces Model on Organization Performance: A Case of Cooperative Bank of Kenya Ltd

- Using Porter’s Five Forces Model for Analysing the Competitive Environment of Thailand’s Sweet Corn Industry

- How Competitive Forces Shape Strategy