Difference between revisions of "ADL Matrix"

m (The LinkTitles extension automatically added links to existing pages (https://github.com/bovender/LinkTitles).) |

|||

| Line 1: | Line 1: | ||

| − | The ADL matrix by Arthur D. Little is a portfolio management matrix which helps managers discern their SBUs strategic position depending upon 2 dimensions- | + | The ADL matrix by Arthur D. Little is a [[portfolio]] [[management]] matrix which helps managers discern their SBUs strategic position depending upon 2 dimensions- |

*SBU’s life cycle and | *SBU’s life cycle and | ||

*Competitive position | *Competitive position | ||

| Line 12: | Line 12: | ||

Competitive position can also be either of the following | Competitive position can also be either of the following | ||

| − | *Dominant: The position of a company falls into this category if it is a clear market leader or has a monopoly position. Example , Intel in microprocessors. | + | *Dominant: The position of a company falls into this category if it is a clear [[market]] leader or has a monopoly position. Example , Intel in microprocessors. |

*Strong: In this case, the company might not be a monopoly but definitely has a strong presence and loyal customers. | *Strong: In this case, the company might not be a monopoly but definitely has a strong presence and loyal customers. | ||

*Favorable: Companies with favorable competitive position usually operate in fragmented markets and no single one controls all market share. | *Favorable: Companies with favorable competitive position usually operate in fragmented markets and no single one controls all market share. | ||

| − | *Tenable: Here each company caters to a niche segment defined by a product variety or segmented demographically. | + | *Tenable: Here each company caters to a niche segment defined by a [[product]] variety or segmented demographically. |

*Weak: In this scenario, the company financials are too weak to gain a strong hold in the market and is expected to die out within a short span of time.<ref>Definition: ADL Matrix [http://www.mbaskool.com/business-concepts/marketing-and-strategy-terms/4113-adl-matrix-arthur-d-little.html Arthur D. Little]</ref> | *Weak: In this scenario, the company financials are too weak to gain a strong hold in the market and is expected to die out within a short span of time.<ref>Definition: ADL Matrix [http://www.mbaskool.com/business-concepts/marketing-and-strategy-terms/4113-adl-matrix-arthur-d-little.html Arthur D. Little]</ref> | ||

Revision as of 13:25, 6 February 2021

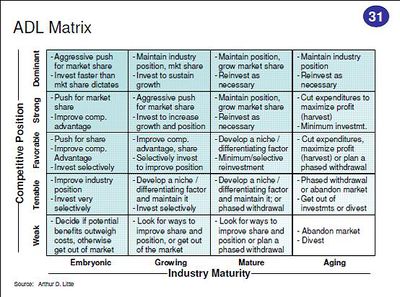

The ADL matrix by Arthur D. Little is a portfolio management matrix which helps managers discern their SBUs strategic position depending upon 2 dimensions-

- SBU’s life cycle and

- Competitive position

Each of these dimensions can be further split up into the following categories to better analyze a firm and accordingly determine the future strategic actions-

Life cycle stages can be:

- Embryonic

- Growth

- Maturity

- Ageing

Competitive position can also be either of the following

- Dominant: The position of a company falls into this category if it is a clear market leader or has a monopoly position. Example , Intel in microprocessors.

- Strong: In this case, the company might not be a monopoly but definitely has a strong presence and loyal customers.

- Favorable: Companies with favorable competitive position usually operate in fragmented markets and no single one controls all market share.

- Tenable: Here each company caters to a niche segment defined by a product variety or segmented demographically.

- Weak: In this scenario, the company financials are too weak to gain a strong hold in the market and is expected to die out within a short span of time.[1]

source: StrategyHub

References

- ↑ Definition: ADL Matrix Arthur D. Little

See Also

IT Strategic Planning

e-Business Strategic Planning

Governance of Information Technology (ICT)

What is Enterprise Architecture Planning

Information Technology Sourcing (IT Sourcing)

Information Technology Operations (IT Operations)

Chief Information Officer (CIO)

Leadership