Activity Based Costing (ABC)

Activity-based costing (ABC) is an accounting method that identifies the activities that a firm performs and then assigns indirect costs to products. An activity-based costing (ABC) system recognizes the relationship between costs, activities and products, and through this relationship, it assigns indirect costs to products less arbitrarily than traditional methods.

Some costs are difficult to assign through this method of cost accounting. Indirect costs, such as management and office staff salaries are sometimes difficult to assign to a particular product produced. For this reason, this method has found its niche in the manufacturing sector.[1]

ABC was first defined in the late 1980s by Kaplan and Bruns. It can be considered as the modern alternative to absorption costing, allowing managers to better understand product and customer net profitability. This provides the business with better information to make value-based and therefore more effective decisions.

ABC focuses attention on cost drivers, the activities that cause costs to increase. Traditional absorption costing tends to focus on volume-related drivers, such as labour hours, while activity-based costing also uses transaction-based drivers, such as number of orders received. In this way, long-term variable overheads, traditionally considered fixed costs, can be traced to products.[2]

The concept of ABC is illustrated in the enlarged graphic below. Another way to express the idea is to say that activities consume resources and products consume activities. Essentially, an attempt is made to treat all costs as variable, recognizing that all costs vary with something, whether it is production volume or some non-production volume related phenomenon. Both manufacturing costs and selling and administrative costs are traced to products in an ABC system. Note that treating selling and administrative costs in this way is not acceptable for external reporting.

source: MAAW

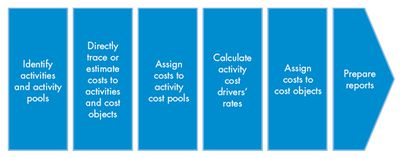

The Activity Based Costing Process Flow[3]

Activity-based costing is best explained by walking through its various steps. They are:

- Identify costs. The first step in ABC is to identify those costs that we want to allocate. This is the most critical step in the entire process, since we do not want to waste time with an excessively broad project scope. For example, if we want to determine the full cost of a distribution channel, we will identify advertising and warehousing costs related to that channel, but will ignore research costs, since they are related to products, not channels.

- Load secondary cost pools. Create cost pools for those costs incurred to provide services to other parts of the company, rather than directly supporting a company’s products or services. The contents of secondary cost pools typically include computer services and administrative salaries, and similar costs. These costs are later allocated to other cost pools that more directly relate to products and services. There may be several of these secondary cost pools, depending upon the nature of the costs and how they will be allocated.

- Load primary cost pools. Create a set of cost pools for those costs more closely aligned with the production of goods or services. It is very common to have separate cost pools for each product line, since costs tend to occur at this level. Such costs can include research and development, advertising, procurement, and distribution. Similarly, you might consider creating cost pools for each distribution channel, or for each facility. If production batches are of greatly varying lengths, then consider creating cost pools at the batch level, so that you can adequately assign costs based on batch size.

- Measure activity drivers. Use a data collection system to collect information about the activity drivers that are used to allocate the costs in secondary cost pools to primary cost pools, as well as to allocate the costs in primary cost pools to cost objects. It can be expensive to accumulate activity driver information, so use activity drivers for which information is already being collected, where possible.

- Allocate costs in secondary pools to primary pools. Use activity drivers to apportion the costs in the secondary cost pools to the primary cost pools.

- Charge costs to cost objects. Use an activity driver to allocate the contents of each primary cost pool to cost objects. There will be a separate activity driver for each cost pool. To allocate the costs, divide the total cost in each cost pool by the total amount of activity in the activity driver, to establish the cost per unit of activity. Then allocate the cost per unit to the cost objects, based on their use of the activity driver.

- Formulate reports. Convert the results of the ABC system into reports for management consumption. For example, if the system was originally designed to accumulate overhead information by geographical sales region, then report on revenues earned in each region, all direct costs, and the overhead derived from the ABC system. This gives management a full cost view of the results generated by each region.

- Act on the information. The most common management reaction to an ABC report is to reduce the quantity of activity drivers used by each cost object. Doing so should reduce the amount of overhead cost being used.

source: CGMA

We have now arrived at a complete ABC allocation of overhead costs to those cost objects that deserve to be charged with overhead costs. By doing so, managers can see which activity drivers need to be reduced in order to shrink a corresponding amount of overhead cost. For example, if the cost of a single purchase order is $100, managers can focus on letting the production system automatically place purchase orders, or on using procurement cards as a way to avoid purchase orders. Either solution results in fewer purchase orders and therefore lower purchasing department costs.

Let's discuss activity based costing by looking at two products manufactured by the same company. Product 124 is a low volume item which requires certain activities such as special engineering, additional testing, and many machine setups because it is ordered in small quantities. A similar product, Product 366, is a high volume product—running continuously—and requires little attention and no special activities. If this company used traditional costing, it might allocate or "spread" all of its overhead to products based on the number of machine hours. This will result in little overhead cost allocated to Product 124, because it did not have many machine hours. However, it did demand lots of engineering, testing, and setup activities. In contrast, Product 366 will be allocated an enormous amount of overhead (due to all those machine hours), but it demanded little overhead activity. The result will be a miscalculation of each product's true cost of manufacturing overhead. Activity based costing will overcome this shortcoming by assigning overhead on more than the one activity, running the machine.[4]

See Also

Activity-Based Management (ABM)

Absorption Costing

Cost Analysis

Cost Accounting Standards (CAS)

IT Cost Allocation

IT Cost Optimization

Management Accounting

Accounting

Accounting Equation

Accounting Valuation

Accounts Receivable Factoring (FACTORING)

Accounts Receivable Financing

References

- ↑ What is 'Activity-Based Costing - ABC'? Investopedia

- ↑ The Focus of Activity-Based Costing CGMA

- ↑ Activity Based Costing Process Flow Accounting Tools

- ↑ Introduction to Activity Based Costing Accounting Coach

Further Reading

- 3 Minutes! Activity Based Costing Managerial Accounting Example (ABC Super Simplified) MBABull

- Activity Based Costing Explained with Examples Accounting Coach