Management Accounting

Definition of Management Accounting

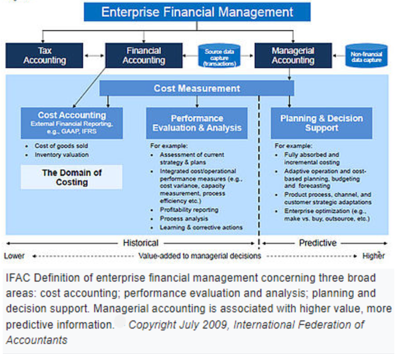

Management Accounting (aka Managerial Accounting) is the process of identification, measurement, accumulation, analysis, preparation, interpretation, and communication of information that assists executives in fulfilling organizational objectives. Management accounting creates value and ensures sustainable success by contributing to sound decision making through the comprehensive analysis and provision of information that enables and supports organisations to plan, implement and control the execution of their strategy.

Managerial accounting can be used in short-term and long-term decisions involving the financial health of a company. Managerial accounting helps managers make operational decisions–intended to help increase the company's operational efficiency – while also helps in making long-term investment decisions. Forecasting, monitoring, and tracking performance is a critical aspect of managerial accounting to ensure actual results meet the budgets and forecasts outlined at the onset.[1]

Management accounting provides financial information for the organization's internal management, its employees, managers and executives, in order to inform decision-making and improve performance. In other words, management accountants are strategic partners. They work to ensure future success by identifying ways to create value for their organization and its products or services. They do so by using numbers, data and research to help leadership make informed decisions to minimize risk and maximize profit in behalf of the business. Management accountants analyze and explain the "why" behind reporting the numbers.[2]

Management accounting helps managers within a company make decisions. Also known as cost accounting, management accounting is the process of identifying, analyzing, interpreting and communicating information to managers to help achieve business goals. The data collected encompasses all fields of accounting that informs the management of business operations relating to the costs of products or services purchased by the company. Management accountants use budgets to quantify the business’ plan of operations. Performance reports are used to note the deviation of actual results compared what was budgeted.[3]

Management Accounting - Scope, Practice, and Application[4]

The Association of International Certified Professional Accountants (AICPA) states that management accounting as practice extends to the following three areas:

- Strategic Management — advancing the role of the management accountant as a strategic partner in the organization

- Performance Management — developing the practice of business decision-making and managing the performance of the organization

- Risk Management — contributing to frameworks and practices for identifying, measuring, managing and reporting risks to the achievement of the objectives of the organization

The Institute of Certified Management Accountants (CMA) states, "A management accountant applies his or her professional knowledge and skill in the preparation and presentation of financial and other decision oriented information in such a way as to assist management in the formulation of policies and in the planning and control of the operation undertaking".

Management accountants are seen as the "value-creators" amongst the accountants. They are more concerned with forward-looking and taking decisions that will affect the future of the organization, than in the historical recording and compliance (score keeping) aspects of the profession. Management accounting knowledge and experience can be obtained from varied fields and functions within an organization, such as information management, treasury, efficiency auditing, marketing, valuation, pricing, and logistics. In 2014 CIMA created the Global Management Accounting Principles (GMAPs). The result of research from across 20 countries in five continents, the principles aim to guide best practice in the discipline.

Characteristics and Nature of Management Accounting[5]

The nature and characteristics of management accounting may be summarized as:

- Management accounting is a technique of selective nature. It does not use the whole data provided by financial records. It selects and picks up only that information form different financial records (such as profit and loss account or balance sheet), which are relevant and useful to the management to arrive at important decisions on different aspects of the business.

- Management accounting is concerned with the future. It collects and analyses data to plan the future. The primary function of management is to decide bout the future course of action. Management accounting, with the help of different techniques, formats the future course of action.

- Management Accounting makes available useful information which helps the management in planning and decision-making. It can only provide information but cannot proscribe. It is up to management to what extent it. It can make use of the information depending upon its efficiency and wisdom.

- Management accounting studies the relation between causes and effects. Financial accounting does and analyses the causes responsible for profits or losses. *Management accounting attempts to study the cause-and-effect relationship by analyzing the different variables affecting the profits and profitability of the business.

- Management accounting is not bound by the rules of financial accounting. Financial accounting procedures are designed based on GAAPs.

Techniques in Managerial Accounting[6]

In order to achieve its goals, managerial accounting relies on a variety of different techniques, including the following:

- Margin Analysis: Margin analysis is primarily concerned with the incremental benefits of optimizing production. Margin analysis is one of the most fundamental and essential techniques in managerial accounting. It includes the calculation of the breakeven point that determines the optimal sales mix for the company’s products.

- Constraint Analysis: The analysis of the production lines of a business identifies principal bottlenecks, the inefficiencies created by these bottlenecks, and their impact on the company’s ability to generate revenues and profits.

- Capital Budgeting: Capital budgeting is concerned with the analysis of information required to make the necessary decisions related to capital expenditures. In capital budgeting analysis, managerial accountants calculate the net present value (NPV) and the internal rate of return (IRR) to help managers to decide on new capital budgeting decisions.

- Inventory Valuation and Product Costing: Inventory valuation involves the identification and analysis of the actual costs associated with the company’s products and inventory. The process generally implies the calculation and allocation of overhead charges, as well as the assessment of the direct costs related to the cost of goods sold (COGS).

- Trend Analysis and Forecasting: Trend analysis and forecasting are primarily concerned with the identification of patterns and trends of product costs, as well as with recognition of unusual variances from the forecasted values and the reasons for such variances.

The Field of Management Accounting[7]

The field of Management Accounting, often referred to as Managerial Accounting or Corporate Accounting, includes the financial and accounting tasks required to operate a business. Managerial accountants work within companies and organizations to direct internal financial processes; monitor costs, sales, spending and budgets; conduct audits; identify past trends and predict future needs; and assist company leaders with financial decisions.

Management accountants are often confused with financial accountants; while both provide valuable services to an organization, there are key differences between the two roles. Managerial accounting primarily involves completing tasks and producing reports that inform company leadership about financial decisions related to general company operations. Financial accounting’s central focus is informing external groups – such as banks, boards of directors, stockholders and tax agencies – about the company’s financial status.

Someone entering the managerial accounting field should be skilled in risk management, budget planning, strategic planning and financial data analysis. These accountants also have a detailed knowledge of generally accepted accounting principles (GAAP), strong communication skills and a forward thinking approach to their work.

source: Investopedia

Management Accounting Vs. Financial Accounting

Management accounting differs from financial accounting information in several ways:

- While shareholders, creditors, and public regulators use publicly reported financial accounting information, only managers within the organization use the normally confidential management accounting information;

- While financial accounting information is historical, management accounting information is primarily forward-looking;

- While financial accounting information is case-based, management accounting information is model-based with a degree of abstraction in order to support generic decision making;

- While financial accounting information is computed by reference to general financial accounting standards, management accounting information is computed by reference to the needs of managers, often using management information systems

See Also

Management

Management Buy-Out

Management Consulting

Management Development

Management Metaphors

Management Model

Management Style

14 Principles Of Management

Management Succession Planning

Management by Exception (MBE)

Management by Objectives (MBO)

Management by Wandering Around (MBWA)

References

- ↑ Explaining Managerial Accounting Investopedia

- ↑ What is Management Accounting? SNHU

- ↑ What Is the Role of Management Accounting? Freshbooks

- ↑ The Scope, Practice, and Application of Managerial Accounting Wikipedia

- ↑ Characteristics and Nature of Management Accounting iedunote

- ↑ What are the Functions of Management Accounting? CFI

- ↑ An Overview of Management Accounting Accounting.com