Difference between revisions of "IT Cost Allocation"

| Line 6: | Line 6: | ||

A central question in management accounting is the allocation of support department costs. Support departments provide services to operating departments that directly add value to a product or service in the firm. The increasing use of information technology (IT) has resulted in the creation of another important cost category that contributes to overhead costs. Although increases in IT spending are expected to increase productivity and profitability, the results were typically mixed. This phenomenon has historically been labeled “the productivity paradox.” Recently, IT has more rapidly increased productivity and profitability in various organizations, but the productivity increase has been erratic and inconsistent. To remain competitive, managers have had to respond to these technological changes by investing heavily in IT. Hence, justifying IT expenses has been an increasing conundrum for CIOs of most organizations. The paper provides insight into cost allocation methods that can be used to distribute IT costs.<ref>Cost Allocation and Information Technology [https://ieeexplore.ieee.org/document/8653360 Jamshed Jal Mistry]</ref> | A central question in management accounting is the allocation of support department costs. Support departments provide services to operating departments that directly add value to a product or service in the firm. The increasing use of information technology (IT) has resulted in the creation of another important cost category that contributes to overhead costs. Although increases in IT spending are expected to increase productivity and profitability, the results were typically mixed. This phenomenon has historically been labeled “the productivity paradox.” Recently, IT has more rapidly increased productivity and profitability in various organizations, but the productivity increase has been erratic and inconsistent. To remain competitive, managers have had to respond to these technological changes by investing heavily in IT. Hence, justifying IT expenses has been an increasing conundrum for CIOs of most organizations. The paper provides insight into cost allocation methods that can be used to distribute IT costs.<ref>Cost Allocation and Information Technology [https://ieeexplore.ieee.org/document/8653360 Jamshed Jal Mistry]</ref> | ||

| + | |||

| + | |||

| + | == IT Cost Allocation Framework<ref> A Framework for IT Cost Allocation [https://www.recipeforit.com/leveraging-metrics-for-it/ting-consumption-to-cost/ Recipe for IT]</ref> == | ||

| + | If there is no cost associated with the usage of IT resources by different business unit, than each unit will utilize the the IT resources to maximize its potential benefit to the detriment of the corporate as a whole. Thus, to ensure effective use of the IT resources there must be some association of cost or allocation between the internal demand and consumption by each business unit. A best practice allocation approach enables business transparency of IT cost and business drivers of IT usage so that thoughtful business decisions for the company as a whole can be made with the minimum of allocation overhead and effort. A well-designed allocations framework will ensure this effective association as well as: | ||

| + | *provide transparency to IT costs and the particular business unit costs and profitability, | ||

| + | *avoid wasteful demand and alter overconsumption behaviors | ||

| + | *minimize pet projects and technology ‘hobbies’ | ||

| + | To implement an effective allocations framework there are several foundation steps.<br /> | ||

| + | 1. Ensure the corporate and business unit CFOs’ support and the finance team resources to implement and run the allocations process. Generally, CFOs look for greater clarity on what drives costs within the corporation. Allocations allow significant clarity on IT costs which are usually a good-sized chunk of the corporation’s costs. CFOs are usually highly supportive of a well-thought out allocations approach.<br /> | ||

| + | 2. Have a reasonably well-defined set of services and an adequately accurate IT asset inventory. If these are not in place, you must first set about defining your services (e.g. and end user laptop service that includes laptop, OS, productivity software, and remote access or a storage service of high performance Tier 1 storage by Terabyte) and ensuring your inventory of IT assets is minimally accurate (70 to 80 %). If there are some gaps, they can be addressed by leveraging a trial allocation period where numbers and assets are published, no monies are actually charged, but every business unit reviews its allocated assets with IT and ensures it is correctly aligned. The IT services defined should be as readily understandable as possible. The descriptions and missions should not be esoteric except where absolutely necessary. They should be easily associated with business drivers and volumes (such as number of employees, or branches, etc) wherever possible. In essence, all major categories of IT expenditure should have an associated service or set of services and the services should be granular enough so that each service or component can be easily understood and each one’s drivers should be easily distinguished and identified. | ||

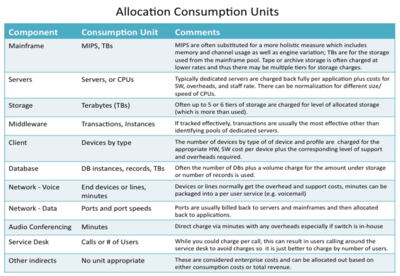

| + | Below are some examples of IT services and their consumption units. Note that you should orient your IT components and associated services into either ‘direct’ services, those easily identified as consumable by the business or by applications and those that are indirect services, which would then be billed through other direct services (a good example of an indirect service would be data center, which is then billed through servers, storage, etc). | ||

| + | |||

| + | [[File:IT_Cost_Allocation.png|400px|IT Cost Allocation Consumption Units]]<br /> | ||

| + | source: Jim Ditmore | ||

| + | |||

| + | 3. Finance team must identify which costs are associated with which services once the service has been defined, the assets inventoried and consumption unit identified. They should work closely with your management team to identify a ‘cost pool’ for each service or asset component. Again, these costs pools should be at least reasonably accurate but do not need to be perfect to begin a successful allocation process. The structure of the financial allocation framework should allow you to drive to both holistic unit costs for each defined service (e.g., cost per Terabyte for Storage) as well as accommodate indirect services and overhead costs. Below is a diagram demonstrating how this financial framework could be defined: | ||

| + | |||

| + | [[File:IT_Cost_Allocation_Structure.jpg|400px|Example of IT Cost Allocation Structure]]<br /> | ||

| + | source: Jim Ditmore | ||

| + | |||

| + | 4. The allocations framework must have an overall IT owner and a senior Finance sponsor (preferably the CFO). CFOs want to implement systems that encourage effective corporate use of resources so they are a natural advocate for a sensible allocation framework. There should also be a council to oversee the allocation effort and provide feedback and direction where majors users and the CFO or designate are on the council. This will ensure both adequate feedback as well as buy-in and support for successful implementation and appropriate methodology revisions as the program grows. As the allocations process and systems mature, ensure that any significant methodology changes are reviewed and approved by the allocation council with sufficient advance notice to the Business Unit CFOs. | ||

| + | 5. Once the allocations are started, even if during a pilot or trial period, make sure there is transparent reporting. The leads team and leads should have a monthly meeting with each business area with good clear reports. The finance lead and the business unit finance lead must be included in the meeting to ensure everyone is on the same financial page. Remember, a key outcome is to enable the business users to understand their overall costs, what the cost is for each services and, what business drivers impact which services and thus what costs they will bear. By establishing this linkage clearly the business users will then look to modify business demand so as to optimize their costs. Further, most business leaders will also use this allocations data and new found linkage to correct poor over-consumption behavior (such as users with two or three PCs or phones) within their organizations. However, for them to do this they must be provided usable reporting with accurate inventories. The best option is to enable managers to peruse their costs through an intranet interface for such end-user services such as mobile phones, PCs, etc . There should be readily accessible usage and cost reports to enable them to understand their team’s demand and how much each unit costs. They should have the option right on the same screens to discontinue, update or start services. | ||

Revision as of 15:53, 14 August 2019

What is IT Cost Allocation

Cost allocation is the process of identifying, aggregating, and assigning costs to cost objects. A cost object is any activity or item for which you want to separately measure costs. Examples of cost objects are a product, a research project, a customer, a sales region, and a department.

Cost allocation is used for financial reporting purposes, to spread costs among departments or inventory items. Cost allocation is also used in the calculation of profitability at the department or subsidiary level, which in turn may be used as the basis for bonuses or the funding of additional activities. Cost allocations can also be used in the derivation of transfer prices between subsidiaries.[1]

A central question in management accounting is the allocation of support department costs. Support departments provide services to operating departments that directly add value to a product or service in the firm. The increasing use of information technology (IT) has resulted in the creation of another important cost category that contributes to overhead costs. Although increases in IT spending are expected to increase productivity and profitability, the results were typically mixed. This phenomenon has historically been labeled “the productivity paradox.” Recently, IT has more rapidly increased productivity and profitability in various organizations, but the productivity increase has been erratic and inconsistent. To remain competitive, managers have had to respond to these technological changes by investing heavily in IT. Hence, justifying IT expenses has been an increasing conundrum for CIOs of most organizations. The paper provides insight into cost allocation methods that can be used to distribute IT costs.[2]

IT Cost Allocation Framework[3]

If there is no cost associated with the usage of IT resources by different business unit, than each unit will utilize the the IT resources to maximize its potential benefit to the detriment of the corporate as a whole. Thus, to ensure effective use of the IT resources there must be some association of cost or allocation between the internal demand and consumption by each business unit. A best practice allocation approach enables business transparency of IT cost and business drivers of IT usage so that thoughtful business decisions for the company as a whole can be made with the minimum of allocation overhead and effort. A well-designed allocations framework will ensure this effective association as well as:

- provide transparency to IT costs and the particular business unit costs and profitability,

- avoid wasteful demand and alter overconsumption behaviors

- minimize pet projects and technology ‘hobbies’

To implement an effective allocations framework there are several foundation steps.

1. Ensure the corporate and business unit CFOs’ support and the finance team resources to implement and run the allocations process. Generally, CFOs look for greater clarity on what drives costs within the corporation. Allocations allow significant clarity on IT costs which are usually a good-sized chunk of the corporation’s costs. CFOs are usually highly supportive of a well-thought out allocations approach.

2. Have a reasonably well-defined set of services and an adequately accurate IT asset inventory. If these are not in place, you must first set about defining your services (e.g. and end user laptop service that includes laptop, OS, productivity software, and remote access or a storage service of high performance Tier 1 storage by Terabyte) and ensuring your inventory of IT assets is minimally accurate (70 to 80 %). If there are some gaps, they can be addressed by leveraging a trial allocation period where numbers and assets are published, no monies are actually charged, but every business unit reviews its allocated assets with IT and ensures it is correctly aligned. The IT services defined should be as readily understandable as possible. The descriptions and missions should not be esoteric except where absolutely necessary. They should be easily associated with business drivers and volumes (such as number of employees, or branches, etc) wherever possible. In essence, all major categories of IT expenditure should have an associated service or set of services and the services should be granular enough so that each service or component can be easily understood and each one’s drivers should be easily distinguished and identified.

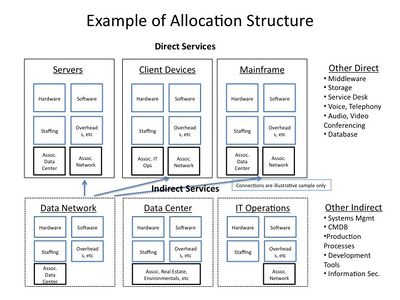

Below are some examples of IT services and their consumption units. Note that you should orient your IT components and associated services into either ‘direct’ services, those easily identified as consumable by the business or by applications and those that are indirect services, which would then be billed through other direct services (a good example of an indirect service would be data center, which is then billed through servers, storage, etc).

3. Finance team must identify which costs are associated with which services once the service has been defined, the assets inventoried and consumption unit identified. They should work closely with your management team to identify a ‘cost pool’ for each service or asset component. Again, these costs pools should be at least reasonably accurate but do not need to be perfect to begin a successful allocation process. The structure of the financial allocation framework should allow you to drive to both holistic unit costs for each defined service (e.g., cost per Terabyte for Storage) as well as accommodate indirect services and overhead costs. Below is a diagram demonstrating how this financial framework could be defined:

4. The allocations framework must have an overall IT owner and a senior Finance sponsor (preferably the CFO). CFOs want to implement systems that encourage effective corporate use of resources so they are a natural advocate for a sensible allocation framework. There should also be a council to oversee the allocation effort and provide feedback and direction where majors users and the CFO or designate are on the council. This will ensure both adequate feedback as well as buy-in and support for successful implementation and appropriate methodology revisions as the program grows. As the allocations process and systems mature, ensure that any significant methodology changes are reviewed and approved by the allocation council with sufficient advance notice to the Business Unit CFOs. 5. Once the allocations are started, even if during a pilot or trial period, make sure there is transparent reporting. The leads team and leads should have a monthly meeting with each business area with good clear reports. The finance lead and the business unit finance lead must be included in the meeting to ensure everyone is on the same financial page. Remember, a key outcome is to enable the business users to understand their overall costs, what the cost is for each services and, what business drivers impact which services and thus what costs they will bear. By establishing this linkage clearly the business users will then look to modify business demand so as to optimize their costs. Further, most business leaders will also use this allocations data and new found linkage to correct poor over-consumption behavior (such as users with two or three PCs or phones) within their organizations. However, for them to do this they must be provided usable reporting with accurate inventories. The best option is to enable managers to peruse their costs through an intranet interface for such end-user services such as mobile phones, PCs, etc . There should be readily accessible usage and cost reports to enable them to understand their team’s demand and how much each unit costs. They should have the option right on the same screens to discontinue, update or start services.

See Also

IT Financial Management (ITFM)

Technology Business Management (TBM)

IT Chargeback

IT Cost Optimization

Federal IT Acquisition Reform Act (FITARA)

Total Cost of Ownership (TCO)

References

- ↑ Accounting Tools

- ↑ Cost Allocation and Information Technology Jamshed Jal Mistry

- ↑ A Framework for IT Cost Allocation Recipe for IT