IT Chargeback

What is IT Chargeback?

IT chargeback is a method of charging internal consumers (e.g., departments, functional units) for the IT services they used. Instead of bundling all IT costs under the IT department, a chargeback program allocates the various costs of delivering IT (e.g., services, hardware, software, maintenance) to the business units that consume them. [1]

An organization's IT Strategic Plan (Information Technology Strategic Plan)|IT Strategy identifies both IT Services/Solutions to be created, their cost, and ways they will be funded. IT Chargeback thus connects with IT Strategy.

In an IT chargeback situation, instead of simply charging all IT costs to one central department, the company charges individual costs to the user groups or centers that most directly consume the goods or services that were purchased. This principle can make things clearer for administrators who have to manage costs and can also help to provide a clearer contrast for various options, such as Outsourcing|outsourcing. With so many types of Cloud Computing|cloud and Software as a Service (SaaS)|SaaS services proliferating across the business world, IT chargeback can be a useful way of ordering information and assessing value for cost. IT chargeback is sometimes contrasted with other options for keeping track of costs, such as showback. In showback accounting, costs are presented in a decentralized way, without being actually cross-charged to the different accounts.[2]

Why do IT Departments Need IT Chargebacks?

IT chargebacks play a crucial role in organizations for several reasons. By implementing IT chargebacks, organizations can achieve greater cost visibility, financial transparency, and accountability in their IT operations. This section explores the importance of IT chargebacks and highlights the key benefits they bring to organizations. From cost control and optimization to demand management and resource planning, understanding the advantages of IT chargebacks helps organizations make informed decisions regarding resource allocation, technology investments, and overall financial performance. Let's delve into the significant reasons why IT chargebacks are essential in today's dynamic business landscape.

Here are some of the reasons why IT chargebacks are important for organizations:

- Cost Allocation: IT chargebacks ensure that the costs of IT services, hardware, or software are allocated to the business units or individuals using them. This promotes fairness and accountability by making users responsible for the resources they consume. It helps organizations understand the true cost of IT services and enables better financial planning and decision-making.

- Cost Transparency: IT chargebacks provide transparency into the costs associated with IT services. They help users and stakeholders understand the financial impact of their technology usage and make informed decisions about resource allocation and consumption. Cost transparency fosters a culture of cost-consciousness and encourages users to consider the value and necessity of the IT services they request.

- Cost Control and Optimization: By attributing costs to specific business units or individuals, IT chargebacks enable organizations to track and manage IT expenses more effectively. It allows for better cost control and facilitates optimization by identifying areas of excessive spending or inefficient resource utilization. This insight enables organizations to make informed decisions to reduce costs, streamline operations, and improve overall financial performance.

- Resource Planning and Budgeting: IT chargebacks provide valuable data on resource consumption and cost patterns. This information helps IT departments and business units plan and budget for future technology investments and initiatives. Organizations can allocate resources more effectively by understanding the costs associated with different services and projects and ensure that investments align with strategic goals and priorities.

- Demand Management: IT chargebacks influence user behavior and encourage responsible IT service usage. When users know the costs associated with their IT consumption, they tend to be more mindful of their resource utilization. This promotes demand management and helps prevent unnecessary or excessive requests for IT services, leading to more efficient resource allocation and cost savings.

- Service Valuation: IT chargebacks enable organizations to assess the value of their IT services. By attributing costs to specific services or projects, organizations can evaluate the return on investment (ROI) and assess the cost-effectiveness of various IT initiatives. This information helps prioritize projects, allocate resources based on value, and justify investments in technology.

- Performance Evaluation: IT chargebacks provide a means to evaluate the performance and efficiency of IT services. By analyzing costs and resource utilization, organizations can identify opportunities for improvement, address inefficiencies, and optimize service delivery. It enables IT departments to track their performance and demonstrate the value they bring to the organization.

IT chargebacks are important because they promote cost transparency, accountability, efficient resource allocation, and informed decision-making. They enable organizations to better manage their IT costs, optimize service delivery, and align technology investments with strategic objectives.

The Purpose of IT Chargeback[3]

The need to understand the components of the costs of IT, and to fund the IT organization in the face of unexpected demands from user departments, led to the development of chargeback mechanisms, in which a requesting department gets an internal bill (or "cross-charge") for the costs that are directly associated to the infrastructure, data transfer, application licenses, training, etc., which they generate. The purpose of chargeback includes:

- Making departments responsible in their usage, e.g., refrain from asking for resources they are not going to use

- Providing visibility to the head of IT and to senior management on the reasons behind the costs of IT

- Allowing the IT department to respond to unexpected customer demand by saying "yes, we can do it, but you will have to pay for it" instead of saying "no, we cannot do this because it's not in the budget."

As of 2011, the chargeback mechanisms are often controversial in organizations. Departments rarely pay directly for their own electricity bill, janitorial services, etc. -- these are allocated to departments on the basis of the number of employees or the square footage they occupy. Similarly, departments may expect to pay a fixed allocation for IT and get a flexible set of services that meet their needs in return. While the discussion on such an allocation are always difficult, seeing actual variable charges arrive on a monthly basis for specific levels of usage can create conflict both between IT and its internal customers, and between a department manager and the users who caused resource consumption to increase and therefore costs to rise. The rise of subscription-based computing services (cloud computing) may make chargeback mechanisms more palatable.

Chargeback Methods[4]

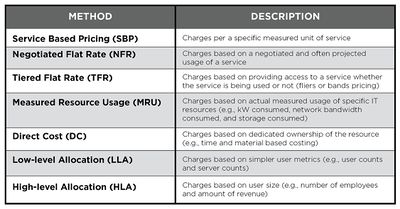

A range of approaches have been developed for implementing chargeback in an organization, as summarized in Figure 1. The degree of complexity, degree of difficulty, and cost to implement decreases from the top of the chart [service-based pricing (SBP)], to the bottom [high-level allocation (HLA)]. HLA is the simplest method; it uses a straight division of IT costs based on a generic metric such as headcount. Slightly more effort to implement is low-level allocation (LLA), which bases consumer costs on something more related to IT activity such as the number of users or servers. Direct cost (DC) more closely resembles a time and materials charge but is often tied to headcount as well.

Measured resource usage (MRU) focuses on the amount of actual resource usage of each department, using metrics such as power (in kilowatts), network bandwidth and terabytes of storage. Tiered flat rate (TFR), negotiated flat rate (NFR), and service based pricing (SBP) are all increasingly sophisticated applications of measuring actual usage by service.

Implementing IT Chargeback[5]

- Step 1: Selling the chargeback Idea: Chargeback success relies on IT, business units (BUs), and corporate functions (CFs) working together. When IT budgets are centralized and owned by IT, the BUs and CFs don’t see the IT cost. For them, IT feels like a free and unlimited resource. Moving to a model where the BUs and CFs will be charged for the IT products and services they use is a big change requiring collaboration. Imagine receiving a surprise electricity bill when you have never paid for electricity before. Surprise chargeback won’t work and initiating chargeback as a surprise won’t help to establish trust and partnership. The BU and CF budget holders need to understand the reasons and benefits of chargeback—like freeing more IT budget for innovation and better alignment with business needs. There will be detractors, but it will not be a surprise to them when chargeback happens.

- Step 2: Organizing for chargeback: Many IT organizations don’t have the people or skills needed for an effective chargeback. Finance skills will be important. IT will need to do new things like model the costs of products and services, set rates, and calculate bills. All with the goal of recovering costs. Chargeback also creates the need for product and service owners. People who design, deliver, market, and recover costs for IT products and services to IT’s new paying customers. To organize for chargeback, accountability and responsibility will need to be assigned for (not exhaustive):

- Defining a portfolio of products and services

- Calculating the total cost of ownership (TCO) for products and services

- Marketing products and services

- Defining and implementing chargeback strategy

- Recovering costs

- Step 3: Putting the right systems and processes in place: Can you use spreadsheets for chargeback? Yes. Should you? No. With those questions answered, let's move on to discuss some of the right systems and processes successful organizations use to implement chargeback. The systems and processes will need to do the jobs of (not exhaustive):

- Defining product and service offerings

- Tracking actual costs

- Managing demand

- Planning rates

- Calculating bills

- Transferring money to IT

- Marketing and selling products and services

- Sharing chargeback bills and reports with customers

- The corporate finance system is critical. The corporate finance system must process the chargeback bill (also referred to as the bill of IT) to enable transfer of money to IT.

The systems must be multi-user systems that provide auditing capability and scalability. This is why spreadsheets are not a good choice.

- Step 4: Baseline the current state: Capture the current state and include:

- Total IT costs

- Total Cost of Ownership (TCO)|Total cost of ownership for each product or service

- Total IT cost by BU and CF

- To capture the current state, the following information is also needed (not exhaustive):

- Portfolio of products, services, applications, technologies

- Asset inventories

- Capacity, usage, and utilization

- Projects

This is a great opportunity to use and validate the systems and processes from Step 3, above. Store the baseline current state in the systems and use them both for defining and pricing products and services for chargeback.

- Step 5: Transfer the IT budget to the business: IT needs to transfer its budget to their customers. IT can’t have a full budget and do chargeback. There are many strategies for transferring the budget, including:

- The big bang – The whole budget all at once.

- Staged transfer – Break the transfer down into smaller batches.

- Never 100% – Some organizations choose to keep some IT budget for management, Innovation|innovation, or more.

Transferring the IT budget is a fundamental change for an Organization|organization and requires support and commitment from corporate finance and senior leadership. Some organizations can take advantage of tax optimization opportunities by charging legal foreign entities for IT products and services. We mean real big dollars, like one Digital Fuel customer that has used chargeback to support $90million in annual tax deductions.

- Step 6: Market and sell products and services: IT is not known for marketing and sales. Chargeback forces the CIO’s organization to market and sell their products and services—and also themselves. When IT has all the budget, they are the only option in town. When BUs and CFs own the budget, they have choice. IT needs to be an attractive option for their customers. Maximize likelihood of BUs and CFs buying from you by clearly defining and communicating:

- What IT sells

- What value IT delivers

- How IT is better than other options

- Step 7: Continue to learn: An essential component of all implementations is ongoing learning and process improvement.

Guiding Principles and Considerations for a Chargeback Model Design[6]

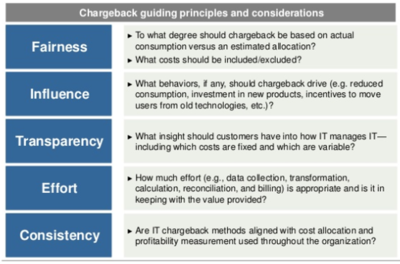

- Fairness

► To what degree should chargeback be based on actual consumption versus an estimated allocation?

► What costs should be included/excluded?

- Influence

► What behaviors, if any, should chargeback drive (e.g. reduced consumption, investment in new products, incentives to move users from old technologies, etc.)?

- Transparency

► What insight should customers have into how IT manages IT— including which costs are fixed and which are variable?

- Effort

► How much effort (e.g., data collection, transformation, calculation, reconciliation, and billing) is appropriate and is it in keeping with the value provided?

- Consistency

► Are IT chargeback methods aligned with cost allocation and profitability measurement used throughout the organization?

Building a Chargeback Model[7]

If you are proposing moving to a chargeback system, you will also need to propose what costs should be covered by the chargeback and which will still be funded through a shared services model. Some of this might be dictated by corporate financial guidelines, but here’s a list of costs that may be included, starting with the most obvious:

- Materials and external costs—all the out of pocket costs associated with the project

- Creative and production, fully burdened labor

- Account management/project management/traffic, fully burdened labor

- Department management and administration

- Hardware and software costs

- Overhead (e.g., space and associated facility costs)

- Training and team events

Your chargeback model may be an internal service organization that is allocating variable costs, or, a self-supporting internal agency that is truly operating with little or no associated corporate funding. Either answer, or something in between, is okay, but you need work with finance and define your model before you start. You also need to track these charges very carefully, evaluate your chargeback strategy for accuracy, and then fine tune your model. There are a few more questions to consider prior to implementing a chargeback model. Again, there are many correct answers, but you need to ask the questions.

- Rate sheet or hourly charge? Many internal groups provide standardized deliverables. It may be better to develop standard costs for standard work, e.g., a new 3 page brochure will cost X dollars.

- If charging back based on hours, what rate will you use? You can track hours by function with a rate for each function, or use a blended rate. As a rule of thumb, the more “agency-like” your model, the more appropriate to use actual rates for each function to calculate the total charge. This is especially important if some clients are using an inordinate amount of high-end creative, or require a lot of account manager time.

- Are you going to provide estimates? This is not necessary in the rate sheet model, but very important if charging based on project hours. This gives the client the ability to compare with outside agency prices and provides you with the opportunity to track estimate to actual metrics.

Finally, how do you implement your new chargeback model? We’ve seen some very good examples where costs were tracked and reported to the client for a full year before actually going to a chargeback plan. This gives you time to improve your costing strategy, provides the client with data for budgeting and gives your finance group the information they need to re-define their financial model. It is also very important to develop a change management communication plan. That plan needs to inform your clients and other key stakeholders of the changes you will be implementing and how it will affect them. This is your opportunity to sell the advantages of your plan to each stakeholder group and get their buy-in. Theoretically a chargeback model should decrease allocated costs to each business unit to free up funds for their new creative services chargeback budget, but you’ll want to speak with your finance department to understand how clients will be affected by this new line item in their budgets.

Implementing a chargeback model can have positive results for many internal creative organizations. If your organization moves to a chargeback model, it’s important to plan the transition, develop accurate rates and communicate changes to your clients. The results can include better service to your clients, more efficient operations and better recognition of the value of your organization.

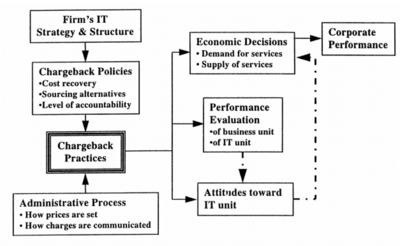

Below is an illustration of a model for IT Chargeback

Chargeback vs. Unattributed Accounting[8]

All costs are centralized in traditional IT accounting. One central department pays for all IT equipment and activities, typically out of the Chief Technology Officer (CTO)|CTO or Chief Information Officer (CIO)|CIO’s budget, and these costs are treated as corporate overhead shared evenly by multiple departments. In an IT chargeback accounting model, individual cost centers are charged for their IT service based on use and activity. As a result, all IT costs are “zeroed out” because they have all been assigned to user groups. Information Technology (IT)|IT is no longer considered overhead, instead it can be viewed as part of each department’s business and Operating Expenses|operating expenses (OpEx). With the adoption of IT chargeback, an organization can expect to see significant shifts in awareness, culture, and accountability, including:

- Increased transparency due to accurate allocation of IT costs and usage. Chargeback allows consumers to see their costs and understand how those costs are determined.

- Improved IT financial management, as groups become more aware of the cost of their IT usage and business choices. With chargeback, consumers become more interested and invested in the costs of delivering IT as a service.

- Increased awareness of how IT contributes to the business of the organization. IT is not just overhead but is seen as providing real Business Value|business value.

- Responsibility for controlling IT costs shifts to business units, which become accountable for their own use.

- Alignment of IT Operations (Information Technology Operations)|IT operations and expenditures with the Business|business. IT is no longer just an island of overhead costs but becomes integrated into business planning, strategy, and operations.

IT Chargeback - Pros and Cons[9]

IT Chargeback: PROS

Chargeback can be an effective governance mechanism in an organization. It can reveal the resource requirements of running different departments, develop managers into better decision makers, and ultimately improve the performance of the entire organization.

IT chargeback can result to a reduction in resource consumption by cutting off unnecessary demands from users, thus increasing the IT department’s ability of serving a larger clientele, as well as providing a wider variety of services. Furthermore, IT services will be streamlined to customer requirements and IT investment decisions will be more effective. It can also create a marketing mentality among the IT personnel, with them becoming more cost-efficient and customer service oriented. This will eventually raise the credibility of the IT department to a cost-conscious corporate management because all cost allocations will be supported by services requests and usage analysis.

For other business units that avail IT services, IT chargeback will give them the chance to establish priorities. Chargeback may ensure that only the projects with utmost importance are given top priority. It also allows other business units and the IT department to put a value on each of the IT services provided. Furthermore, IT chargeback may allow the potential to improve the relationship between the IT department and other business units by giving both sides the opportunity to learn more about how the other side works and what challenges they are facing. This awareness will lead to better appreciation of the services that either side provides.

Costs will be reduced and there will be a greater, more intimate relationship between IT and other business units. IT chargeback, in general, can provide more accountability and controllability on IT assets and services, as well as timeliness and congruence with the general goals of the organization.

IT Chargeback: CONS

If not properly implemented, however, chargeback may worsen the relationship between IT and other business units, primarily due to concerns about the fairness of applied charges. It may be difficult for users to evaluate the benefit of IT chargeback if the billing and charging process is not clear to them. Seeing the actual cost of each IT service may also discourage IT initiatives among business units, especially if the IT service rates are high and they fail to understand why these rates are high.

To properly implement IT chargeback and reap its numerous benefits, organizations need a reliable usage monitoring system that is capable of easily generating a wide range of simple and readable reports that any user will be able to understand and appreciate.

IT Chargeback Challenges[10]

While IT chargeback systems can bring several benefits, they can also encounter challenges that may lead to failure or limited success. Here are some common reasons why IT chargeback systems may fail:

- Establishing a fair and practical chargeback policy: Defining a chargeback policy that balances fairness and practicality can be a complex task, requiring careful consideration of factors such as service complexity, value to business units, and cost control.

- Partnering with business units for buy-in: Gaining buy-in from business units can be a hurdle as the chargeback system may be perceived as a threat to their autonomy or budgets. Building strong partnerships and effectively communicating the system's benefits is crucial to overcome resistance and fostering collaboration.

- Collecting usage metrics: Accurately collecting them poses a significant challenge, requiring reliable data sources and mechanisms. Obtaining precise information on IT service consumption, such as user counts or application usage, may necessitate implementing automated monitoring tools or establishing user reporting mechanisms.

- Allocating IT costs efficiently: Efficiently allocating IT costs involves determining appropriate methods that accurately reflect the value and impact of services. Striking a balance between simplicity and accuracy is vital, ensuring that costs are allocated to satisfy business units while aligning with organizational objectives.

- Pricing IT services: Setting fair and competitive prices for IT services can be challenging. Finding the right balance between cost recovery and affordability for business units requires considering internal cost structures, market rates, and the organization's financial goals.

- Providing detailed billing reports: Generating comprehensive billing reports that transparently convey IT expenses can be complex. Creating reports that effectively communicate itemized details, costs, and other relevant information necessitates robust reporting mechanisms and accurate data collection for transparency and accountability.

- Understanding the cost of an IT chargeback system: Evaluating the cost of implementing and maintaining it can be intricate. Accounting for direct and indirect costs, such as administrative overhead and ongoing monitoring efforts, is crucial for assessing the system's cost-effectiveness and feasibility.

- Recovering IT expenses based on business services: Accurately attributing costs to specific business services and ensuring equitable distribution among units presents a challenge. Determining allocation methods, especially when costs are shared among multiple units, requires careful consideration to avoid conflicts and promote fair cost recovery.

- Lack of Clarity in Cost Allocation Methodology: If the cost allocation methodology used in the chargeback system is not well-defined or lacks clarity, it can lead to confusion and stakeholder disputes. If the allocation rules are perceived as unfair or arbitrary, it can create dissatisfaction and resistance, ultimately undermining the system's effectiveness.

- Inaccurate or Incomplete Data: IT chargeback systems heavily rely on accurate and comprehensive data to allocate costs correctly. If the data used for cost calculations is incomplete, inconsistent, or outdated, it can result in inaccurate cost allocations. This can lead to a loss of credibility and trust in the system.

- Complexity and Administrative Burden: Complex chargeback models that require extensive tracking, data collection, and reporting can be challenging to implement and maintain. The administrative burden of managing and reconciling the data can be significant, consuming resources and time. This complexity can hinder the successful implementation and sustainability of the chargeback system.

- Lack of Stakeholder Engagement and Communication: For IT chargeback systems to be successful, it is crucial to involve and engage stakeholders from the beginning. If stakeholders, including business units and IT teams, are not adequately involved in the design and implementation process, they may feel disconnected or resistant to the system. Insufficient communication and education about the chargeback system's purpose, benefits, and processes can lead to misunderstanding and non-acceptance.

- Organizational Culture and Politics: Organizational culture and politics can significantly impact the success of IT chargeback systems. Resistance from departments or individuals who perceive the chargeback system as threatening their autonomy or budgets can hinder its adoption. The presence of silos, competing priorities, or a lack of collaboration within the organization can also create challenges for effective implementation.

- Unrealistic Cost Expectations: IT chargeback systems may not always achieve the intended cost reduction or recovery goals. Unrealistic expectations about the cost savings or revenue generation potential of the chargeback system can lead to disappointment and frustration. Setting realistic expectations and continuously evaluating and adjusting the system based on actual outcomes is essential.

- Lack of Executive Sponsorship and Support: IT chargeback systems may struggle to gain traction and sustain momentum without strong executive sponsorship and support. The absence of leadership endorsement can result in limited resources, inadequate funding, or a lack of organizational commitment to the system's success.

Organizations should carefully plan and design their IT chargeback systems to overcome these challenges, ensuring clear and fair cost allocation methodologies, accurate data management, stakeholder engagement, effective communication, and ongoing monitoring and adjustment. Flexibility, transparency, and a focus on shared objectives can contribute to successfully implementing and utilizing IT chargeback systems.

IT Chargeback Best Practices

Several best practices can contribute to its effectiveness and success when implementing an IT chargeback system. Here are some top IT chargeback best practices:

- Clear and Transparent Communication: Communicate the purpose, objectives, and benefits of the chargeback system to all stakeholders, including business units and IT teams. Ensure the rationale behind cost allocation methodologies and pricing models is clearly explained. Transparent communication fosters understanding, buy-in, and collaboration.

- Collaborative Governance: Establish a governance structure that includes representatives from business units and IT teams. Involve stakeholders in decision-making regarding chargeback policies, cost allocation methods, and pricing strategies. Collaborative governance ensures that the system aligns with business needs and promotes fairness.

- Accurate and Reliable Data: Implement robust mechanisms to collect accurate and reliable data on IT service usage and costs. To gather precise information, use automated monitoring tools, user surveys, or other data collection methods. Ensure data integrity and quality to support accurate cost allocations and billing.

- Fair and Equitable Cost Allocation: Develop cost allocation methods that business units perceive as fair and equitable. Consider service complexity, value derived, and ability to influence costs when determining allocation rules. Regularly review and refine the allocation methods to maintain fairness and relevance.

- Collaborative Pricing Model: Work with business units to establish pricing models that balance cost recovery and affordability. When setting prices, consider market rates, internal cost structures, and business unit budgets. Encourage feedback and involve business units in pricing discussions to ensure transparency and acceptability.

- Detailed and Transparent Billing Reports: Provide comprehensive billing reports outlining IT costs, services consumed, and allocation details. Make the reports easily accessible to business units and stakeholders. Transparency in billing reports enhances trust, promotes accountability, and facilitates informed decision-making.

- Continuous Monitoring and Review: Regularly monitor and review the chargeback system to ensure its ongoing relevance and effectiveness. Evaluate the system's impact on cost control, resource utilization, and overall business objectives. Seek feedback from stakeholders and make necessary adjustments based on changing business needs.

- Education and Training: Offer education and training sessions to help business units, and IT teams understand the chargeback system, its objectives, and its roles and responsibilities within the system. Promote awareness of cost-consciousness and the value of IT services to encourage responsible resource utilization.

- Performance Measurement: Establish performance metrics to evaluate the effectiveness of the chargeback system. Measure cost recovery rates, customer satisfaction, and resource optimization. Regularly assess the system's performance and use the insights to drive improvements and address any identified issues.

- Executive Sponsorship and Support: Secure executive sponsorship and support for the chargeback system. Executives should champion the system, communicate its importance, and allocate necessary resources for its implementation and maintenance. Executive support ensures the system's visibility and demonstrates its strategic value.

By following these best practices, organizations can enhance the implementation and effectiveness of their IT chargeback systems. It promotes transparency, accountability, and collaboration, improving cost management, resource allocation, and overall financial governance.

Alternative IT Funding Models

While IT chargebacks can be effective in certain organizational contexts, they may not suit every situation. Here are some alternatives to IT chargebacks that organizations can consider:

- Cost Allocation: Organizations can opt for cost allocation models instead of implementing full-fledged chargeback systems. This involves assigning IT costs to departments or business units based on predefined allocation rules, such as headcount, revenue, or usage metrics. This approach provides cost visibility and accountability without the complexity of chargeback systems.

- Showback: Showback is a transparent cost reporting approach where IT departments share the cost information with business units or users without charging them. It provides cost visibility and promotes awareness of IT expenses but does not involve directly transferring costs. Showback helps educate users about the value of IT services and encourages them to make informed decisions about resource utilization.

- Fixed Budgeting: Organizations can establish fixed IT budgets for different departments or business units instead of allocating costs based on usage or consumption. IT services are provided within the allocated budget, and departments have the flexibility to manage their resources accordingly. Fixed budgeting allows for cost control and predictability while providing autonomy to business units in managing their IT needs.

- Subsidization: In certain cases, organizations may subsidize IT costs for specific business units or projects. This involves allocating a portion of IT costs centrally or distributing them unevenly to support strategic initiatives or areas that require additional resources. Subsidization helps promote innovation, investment in critical projects, or specific business objectives without burdening individual units with full cost responsibility.

- Internal Service Provider Model: Organizations can adopt an internal service provider model where the IT department functions as an internal business unit, offering services to other departments. In this model, costs are tracked, but they are treated as internal transactions rather than direct chargebacks. This approach fosters service-oriented thinking, encourages collaboration, and allows for efficient resource allocation within the organization.

- Shared Services: Organizations can establish shared services models where centralized IT teams provide services to multiple business units or departments. Costs are shared among the beneficiaries based on predefined allocation methodologies, such as headcount or revenue percentages. Shared services promote resource pooling, standardization, and economies of scale while ensuring cost transparency and equitable distribution.

- Cost-Center Reporting: Another alternative is implementing cost-center reporting, where IT costs are tracked and reported separately for each department or business unit. This approach provides cost visibility and accountability without the direct transfer of costs. Departments can monitor and manage their IT expenses based on the reported information.

It's important for organizations to carefully evaluate their specific needs, organizational structure, and culture when considering alternatives to IT chargebacks. Each alternative has its advantages and challenges, and the choice should align with the organization's objectives, cost management goals, and the desired level of transparency and accountability.

See Also

- IT Financial Management (ITFM)

- Technology Business Management (TBM)

- IT Cost Allocation

- IT Cost Optimization

- Federal IT Acquisition Reform Act (FITARA)

- Total Cost of Ownership (TCO)

- Transfer Pricing

References

- ↑ Defining IT Chargeback Uptime Institute

- ↑ Explaining IT Chargeback Techopedia

- ↑ The Purpose of IT Chargeback Wikipedia

- ↑ Chargeback Methods Kevin Heslin

- ↑ How can my organization successfully implement IT chargeback? Apptio

- ↑ Guiding Principles for a Chargeback Model Design Pete Hidalgo

- ↑ Building a Chargeback Model Cella Consulting

- ↑ Chargeback vs. Unattributed Accounting UI Journal

- ↑ Advantages and Disadvantages of IT Chargeback Open IT

- ↑ IT Chargeback Challenges Help Systems

Further Reading

- Accounting and Technology: IT Chargeback and its True Costs SEI level

- Chargeback and Showback Grow in IT’s Quest for Greater Transparency Computer Economics

- Cloud Computing: Why You Can't Ignore Chargeback cio.com

- Best Practices: Defining the Right Chargeback Methodology IBM

- When--and How--to Implement Chargebacks N Dean Meyer