Difference between revisions of "Stewardship Theory"

m |

|||

| (One intermediate revision by the same user not shown) | |||

| Line 1: | Line 1: | ||

| − | '''Stewardship Theory''' is a | + | == What is Stewardship Theory? == |

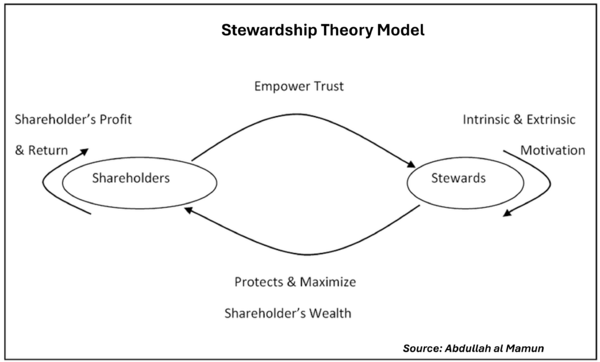

| + | '''Stewardship Theory''' is a theory in corporate governance that contrasts with the traditional agency theory. It suggests that managers entrusted with the care and control of an organization are motivated to act in the best interests of the shareholders or stakeholders due to their professional ethics, intrinsic motivation, and commitment to the organization. Unlike agency theory, which views the relationship between managers and shareholders as potentially adversarial due to conflicting interests, stewardship theory posits that managers are stewards whose motives align with the objectives of their principals (the shareholders). | ||

| + | [[File:Stewardship Theory Model.png|600px|Stewardship Theory Model]] | ||

| − | == | + | |

| − | * | + | __TOC__ |

| − | * | + | |

| − | * | + | |

| − | * | + | == Role and Purpose of Stewardship Theory == |

| − | * | + | The role of stewardship theory is to provide a framework for understanding leadership and governance practices that cultivate trust, empowerment, and organizational effectiveness. Its purposes include: |

| − | * | + | *Promoting Cooperative Relationships: Encouraging a cooperative model between managers and shareholders based on mutual benefits and shared goals. |

| − | * | + | *Enhancing Organizational Performance: By aligning the interests of managers and shareholders, the theory proposes that this congruence will lead to better decision-making and improved company performance. |

| − | * | + | *Building Trust in Corporate Governance: Suggesting that managers can be trusted to act as responsible stewards for the organization, thereby reducing the need for costly monitoring and control mechanisms. |

| − | * | + | |

| − | + | ||

| + | == Usage of Stewardship Theory == | ||

| + | Stewardship theory is applied in various aspects of organizational governance and management: | ||

| + | *Corporate Governance: In shaping governance structures that empower executives rather than tightly control them, fostering an environment of trust and ethical responsibility. | ||

| + | *Leadership Development: Developing leaders who see their role as stewards of the organization’s resources, focusing on long-term success over short-term gains. | ||

| + | *Organizational Culture: Creating a culture that values responsibility, accountability, and the collective rather than individual performance. | ||

| + | |||

| + | |||

| + | == Importance of Stewardship Theory == | ||

| + | Stewardship theory is important because it offers an alternative approach to managing organizations that is based on trust and intrinsic motivation rather than control and oversight. It is particularly valuable in: | ||

| + | *Non-profit organizations: The goals of these organizations often align closely with the personal values and missions of the managers. | ||

| + | *Family Businesses: Where personal relationships and lifelong commitment to the business can lead managers to act in its best interests naturally. | ||

| + | *Knowledge-Based Firms: Their performance depends heavily on the creativity and commitment of their employees. | ||

| + | |||

| + | |||

| + | == Benefits of Stewardship Theory == | ||

| + | Adopting stewardship theory can lead to several benefits: | ||

| + | *Reduced Monitoring Costs: Lowering the costs associated with supervising and controlling managers’ actions. | ||

| + | *Increased Job Satisfaction and Motivation: Managers may feel more motivated and committed when trusted and empowered. | ||

| + | *Enhanced Long-term Planning: Encourages managers to focus on long-term growth and sustainability rather than short-term metrics. | ||

| + | |||

| + | |||

| + | == Examples of Stewardship Theory in Practice == | ||

| + | *CEO Reporting to a Nonprofit Board: A nonprofit CEO might work closely with the board, freely sharing information and collaboratively achieving the organization's goals without the need for restrictive controls or incentives. | ||

| + | *Family-Owned Business: In family-owned businesses, leaders often naturally adopt stewardship behaviors, prioritizing the health and longevity of the company over personal gain. | ||

| + | *Employee-Owned Companies: Where employees are shareholders, they are likely to act in the company's best interests, aligning with stewardship theory’s predictions. | ||

| + | Stewardship theory offers a positive, integrative framework for understanding organizational governance that emphasizes the alignment of interests between managers and shareholders, promoting trust, engagement, and long-term thinking. This theory challenges traditional notions of oversight and control and suggests that a collaborative approach can be highly effective under the right conditions. | ||

| + | ==See Also== | ||

| + | *[[Corporate Governance]]: An overview of the broader concept of corporate governance, explaining various theories and models, including stewardship theory. | ||

| + | *[[Agency Theory]]: Discussing agency theory as a counterpoint to stewardship theory, where agency theory assumes that managers may act in their interests rather than those of shareholders. | ||

| + | *[[Shareholder Theory]] vs. [[Stakeholder Theory]]: Detailing the differences between focusing on shareholder interests (as stewardship theory often does) versus considering broader stakeholder interests. | ||

| + | *[[Board of Directors]]: Explaining the board's role in fostering a stewardship culture within an organization, including oversight and strategic guidance. | ||

| + | *[[Organizational Behavior]]: How stewardship theory influences organizational behavior, leadership styles, and management practices. | ||

| + | *Ethical Leadership: Discussing the implications of stewardship theory on ethical leadership and corporate ethics, emphasizing the responsibility of managers to act in the best interests of shareholders. | ||

| + | *Motivation Theories: Covering theories of motivation that support stewardship theory, such as intrinsic motivation, which posits that stewards are motivated by non-financial factors like job satisfaction and organizational commitment. | ||

| + | *[[Performance Management]]: Detailing how stewardship theory impacts performance management systems and managerial performance evaluation. | ||

| + | *[[Corporate Social Responsibility (CSR)]]: Exploring how stewardship can be extended beyond shareholder wealth to include responsible practices towards society and the environment. | ||

==References== | ==References== | ||

<references /> | <references /> | ||

Latest revision as of 17:41, 8 May 2024

What is Stewardship Theory?

Stewardship Theory is a theory in corporate governance that contrasts with the traditional agency theory. It suggests that managers entrusted with the care and control of an organization are motivated to act in the best interests of the shareholders or stakeholders due to their professional ethics, intrinsic motivation, and commitment to the organization. Unlike agency theory, which views the relationship between managers and shareholders as potentially adversarial due to conflicting interests, stewardship theory posits that managers are stewards whose motives align with the objectives of their principals (the shareholders).

Role and Purpose of Stewardship Theory

The role of stewardship theory is to provide a framework for understanding leadership and governance practices that cultivate trust, empowerment, and organizational effectiveness. Its purposes include:

- Promoting Cooperative Relationships: Encouraging a cooperative model between managers and shareholders based on mutual benefits and shared goals.

- Enhancing Organizational Performance: By aligning the interests of managers and shareholders, the theory proposes that this congruence will lead to better decision-making and improved company performance.

- Building Trust in Corporate Governance: Suggesting that managers can be trusted to act as responsible stewards for the organization, thereby reducing the need for costly monitoring and control mechanisms.

Usage of Stewardship Theory

Stewardship theory is applied in various aspects of organizational governance and management:

- Corporate Governance: In shaping governance structures that empower executives rather than tightly control them, fostering an environment of trust and ethical responsibility.

- Leadership Development: Developing leaders who see their role as stewards of the organization’s resources, focusing on long-term success over short-term gains.

- Organizational Culture: Creating a culture that values responsibility, accountability, and the collective rather than individual performance.

Importance of Stewardship Theory

Stewardship theory is important because it offers an alternative approach to managing organizations that is based on trust and intrinsic motivation rather than control and oversight. It is particularly valuable in:

- Non-profit organizations: The goals of these organizations often align closely with the personal values and missions of the managers.

- Family Businesses: Where personal relationships and lifelong commitment to the business can lead managers to act in its best interests naturally.

- Knowledge-Based Firms: Their performance depends heavily on the creativity and commitment of their employees.

Benefits of Stewardship Theory

Adopting stewardship theory can lead to several benefits:

- Reduced Monitoring Costs: Lowering the costs associated with supervising and controlling managers’ actions.

- Increased Job Satisfaction and Motivation: Managers may feel more motivated and committed when trusted and empowered.

- Enhanced Long-term Planning: Encourages managers to focus on long-term growth and sustainability rather than short-term metrics.

Examples of Stewardship Theory in Practice

- CEO Reporting to a Nonprofit Board: A nonprofit CEO might work closely with the board, freely sharing information and collaboratively achieving the organization's goals without the need for restrictive controls or incentives.

- Family-Owned Business: In family-owned businesses, leaders often naturally adopt stewardship behaviors, prioritizing the health and longevity of the company over personal gain.

- Employee-Owned Companies: Where employees are shareholders, they are likely to act in the company's best interests, aligning with stewardship theory’s predictions.

Stewardship theory offers a positive, integrative framework for understanding organizational governance that emphasizes the alignment of interests between managers and shareholders, promoting trust, engagement, and long-term thinking. This theory challenges traditional notions of oversight and control and suggests that a collaborative approach can be highly effective under the right conditions.

See Also

- Corporate Governance: An overview of the broader concept of corporate governance, explaining various theories and models, including stewardship theory.

- Agency Theory: Discussing agency theory as a counterpoint to stewardship theory, where agency theory assumes that managers may act in their interests rather than those of shareholders.

- Shareholder Theory vs. Stakeholder Theory: Detailing the differences between focusing on shareholder interests (as stewardship theory often does) versus considering broader stakeholder interests.

- Board of Directors: Explaining the board's role in fostering a stewardship culture within an organization, including oversight and strategic guidance.

- Organizational Behavior: How stewardship theory influences organizational behavior, leadership styles, and management practices.

- Ethical Leadership: Discussing the implications of stewardship theory on ethical leadership and corporate ethics, emphasizing the responsibility of managers to act in the best interests of shareholders.

- Motivation Theories: Covering theories of motivation that support stewardship theory, such as intrinsic motivation, which posits that stewards are motivated by non-financial factors like job satisfaction and organizational commitment.

- Performance Management: Detailing how stewardship theory impacts performance management systems and managerial performance evaluation.

- Corporate Social Responsibility (CSR): Exploring how stewardship can be extended beyond shareholder wealth to include responsible practices towards society and the environment.