Bottom Line

The Bottom Line refers to a company's earnings, profit, net income, or earnings per share (EPS). The reference to bottom line describes the relative location of the net income figure on a company's income statement. Bottom line is commonly used in reference to any actions that may increase or decrease net earnings or a company's overall profit. A company that is growing its earnings or reducing its costs is said to be improving its bottom line. Most companies aim to improve their bottom lines through two simultaneous methods: increasing revenues (i.e., generate top line growth) and improving efficiency (or cutting costs).[1]

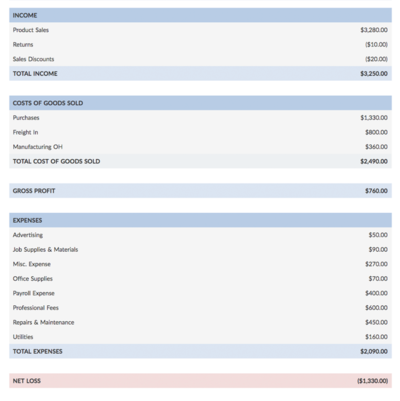

The bottom line in business is the amount of money left after you pay all expenses. You need to know your company’s bottom line to figure out if your business is profiting or losing money. A business’s bottom line is also called the net profit or net income. The number is either positive or negative and tells you how much money your business has left. If negative, it is referred to as net loss. It is the last line on an income statement, aka the bottom line.[2]

Increasing the Bottom Line[3]

The bottom line can be a positive or negative percentage. If it’s positive, companies can invest in new talent, product development, or expanding operations. They can also pay stakeholders dividends or repurchase stock. Increasing the bottom line is simple. Increase revenue and efficiency while cutting costs. Here are some ways to do that:

1. Decrease your expenses: Consider moving to a less expensive operating facility. You can also investigate less expensive suppliers, reduce advertising, or consider reductions in payroll. For example, when some companies are struggling to make profits, they enable hiring freezes. When employees leave the company or retire, those positions are not filled until the company can better afford them.

2. Increase pricing: Determine whether the price for the product or service you are offering is fair and beneficial to your business. Calculate costs to make the product and then add a markup percentage. In some industries, the markup percentage is small, ranging from five to 10%, while in other industries, the markup is higher.

3. Adjust your existing finances

Ask your bank if your business will qualify for a lower interest rate on your loan. If you’re established and have good credit, you may be able to lower your interest rate. Ask your accountant to investigate additional tax benefits.

4. Find your ideal buyer: Buyer personas guide the best marketing strategies. This term refers to a business’s ideal buyers—the people who will buy your product or service. A good buyer persona strategy lowers costs because it keeps your focus on high-value customers. To find your buyer personas:

- Understand your existing customers’ demographics, preferred media outlets, locations and other information

- Use social media and analytics to track trends

- Evaluate your competition’s marketing, who they target and how

- Analyze customer complaints to learn more about their needs

5. Hire the right talent: Attract the best hires by evaluating and improving your Employer Value Proposition (EVP). EVP refers to the things that make employees want to work for certain companies. Your company culture, values, compensation packages and benefits all contribute to your EVP.

The Bottom Line as an Indicator of Business Performance[4]

The bottom line numbers are an important component of the scorecard for management.

Positive and growing profitability over time is a testament to a variety of factors including:

- Good market and customer selection

- The creation and delivery of products and services valued by customers

- Effective allocation of investment dollars in support of targeted customers

- Efficient control of costs across the organization

- Positive marketplace and macroeconomic factors

Alternatively, declining or low bottom line numbers over time is an indication of challenges in one or more of the areas mentioned above and should be examined by management. Shareholders, the board of directors, and employees all rely on the bottom line numbers after each accounting period (usually quarterly) to assess the effectiveness of the company's marketplace strategy and internal management. Of course, when bonuses or annual salary increases are tied to bottom-line results, employees naturally pay more attentive to these numbers.

The Limitation of Bottom Line Numbers as an Indicator of Performance

Although profitability numbers are important measures of a company's current success (and are used to compare previous time frames), they are not a tell-all. They do not tell management, directors, shareholders, or employees what worked or what failed.

Poor profitability numbers are an indication that something is wrong, ranging from strong competition to adverse economic circumstances to a failed strategy to runaway costs.

Likewise, positive numbers do not highlight what part of the company's overall approach is working. It is possible for strong economic conditions (or competitor failure) to lift revenues and improve profits, in spite of poor cost control or a weak long-term strategy.

In financial reporting for publicly listed and traded firms, it is important to look at the detailed notes including footnotes. It helps management (and other stakeholders) understand the assumptions, accounting approaches, and final derivation of the bottom line number.

Top Line Vs. Bottom Line

The top line and bottom line are two of the most important lines on the income statement for a company. Investors and analysts pay particular attention to them for signs of any changes from quarter to quarter and year to year.

The top line refers to a company's revenues or gross sales. Therefore, when a company has "top-line growth," the company is experiencing an increase in gross sales or revenues. The bottom line is a company's net income, or the "bottom" figure on a company's income statement. More specifically, the bottom line is a company's income after all expenses have been deducted from revenues. These expenses include interest charges paid on loans, general and administrative costs, and income taxes. A company's bottom line can also be referred to as net earnings or net profits.

References

- ↑ Definition - What Does Bottom Line Mean? [https://www.investopedia.com/terms/b/bottomline.asp Invetopedia]

- ↑ What is Bottom Line? Patriot

- ↑ How to increase your bottom line Indeed

- ↑ The Bottom Line and Limitations of Bottom Line as an Indicator of Business Performance the balanace