Days Payable Outstanding

Days payable outstanding (DPO) is a financial ratio that indicates the average time (in days) that a company takes to pay its bills and invoices to its trade creditors, which may include suppliers, vendors, or financiers. The ratio is typically calculated on a quarterly or annual basis and indicates how well the company’s cash outflows are being managed. A company with a higher value of DPO takes longer to pay its bills, which means that it can retain available funds for a longer duration, allowing the company an opportunity to utilize those funds in a better way to maximize the benefits. A high DPO, however, may also be a red flag indicating an inability to pay its bills on time.[1]

DPO can also be used to compare one company's payment policies to another. Having fewer days of payables on the books than your competitors means they are getting better credit terms from their vendors than you are from yours. If a company is selling something to a customer, it can use that customer's DPO to judge when the customer will pay (and thus what payment terms to offer or expect). Having a greater days payables outstanding may indicate the Company's ability to delay payment and conserve cash. This could arise from better terms with vendors. DPO is also a critical part of the "Cash Cycle", which measures DPO and the related Days Sales Outstanding and Days In Inventory. When combined these three measurements tell us how long (in days) between a cash payment to a vendor into a cash receipt from a customer. This is useful because it indicates how much cash a business must have to sustain itself.[2]

Days Payable Outstanding Formula[3]

Days payable outstanding is calculated using the following formula:

DPO = accounts payable x number of days/cost of goods sold

Accounts payable is the company’s accounts payable balance. Some companies calculate DPO using the accounts payable balance at the end of the relevant period, while others may use the average accounts payable balance during the relevant period.

Number of days is the number of days within the accounting period – i.e. 365 days for one year or 90 days for a quarter.<

The cost of goods sold is the cost the company incurs in producing a product, including raw materials and transportation costs.

For example, if a company has average accounts payable of $100,000 over a 365-day period, and the cost of sales is $500,000, the DPO will be calculated as follows: DPO = 100,000 x 365 / 500,000 = 73 days

Applications in Financial Modeling and Analysis[4]

DPO and the average number of days it takes a company to pay its bills are important concepts in [financial modeling. When calculating a company’s free cash flow to the firm (FCFF), changes in net working capital impact cash flow, and, thus, the average number of days they take to pay bills can have an impact on valuation (especially in the short run).

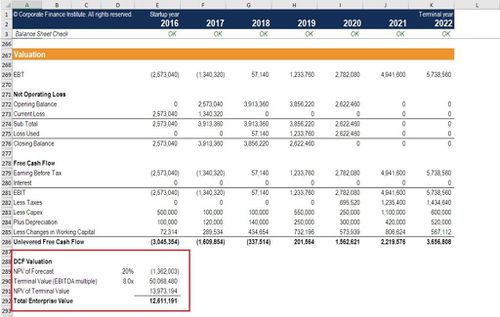

Below is a screenshot of a DCF model

Source: Corporate Finance Institute

See Also

- Accounts Payable - Both Accounts Payable and DPO deal directly with money owed by a company to its creditors. DPO is a specific metric calculated using Accounts Payable.

- Working Capital - DPO impacts working capital as it represents how long it takes for a company to pay off its creditors, thus affecting current liabilities.

- Liquidity Ratio - Both Liquidity Ratios and DPO measure a company's ability to meet short-term obligations, although from different angles.

- Days Sales Outstanding - DSO is the receivable counterpart to DPO, measuring how long it takes for a company to collect payment from customers.

- Days Inventory Outstanding - Similar to DPO and DSO, DIO is another component of the Cash Conversion Cycle but focuses on inventory.

- Financial Ratio - DPO is a type of financial ratio used in assessing a company's performance and financial health.

- Accounts Receivable - While not directly related to DPO, understanding Accounts Receivable helps provide a fuller picture of a company's cash flow and liquidity situation.

- Income Statement - DPO is often calculated using figures from the Income Statement, such as Cost of Goods Sold.

- Balance Sheet - DPO is calculated using figures primarily sourced from the Balance Sheet, such as Accounts Payable.

- Financial Analysis - DPO is a tool used in the broader activity of financial analysis to assess a company’s health and efficiency.

- Cash Flow - Understanding DPO can aid in interpreting the cash flow statement, particularly the cash flows from operating activities section.