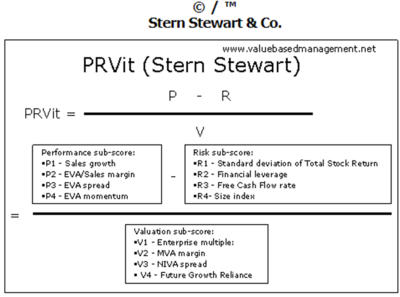

Performance-Risk-Valuation Investment Technology (PRVit)

PRVit stands for Performance-Risk-Valuation investment technology. It is an index of what a firm is worth, based on its risk-adjusted EVA performance relative to its current market valuation. The higher the score, the better the buy. The lower the score, the better the sell.

PRVit Express Page 1PRVit uses a total of 24 measures to size up a firm’s Performance (P) in terms of earning and increasing EVA, to quantify Risk (R) in terms of the volatility of stock price and EVA and weakness in cash flow and credit, and to develop a composite Valuation (V) score based on market multiples to book value, earnings, cash flow, and EVA, all expressed on a percentile scale. The PRVit score is the percentile of (P-R)/V, so that a higher score indicates an investor can buy a greater and surer economic performance track record at a lower per unit price. We call it VARP® for Value-at-a-Reasonable-Price®. And it applies almost as well to growth stocks as value stocks, and to finding overpriced stocks to short as well as bargains to buy.[1]

The PRVit Syemtem is Stem Stewart's proprietary Performance Risk Valuation investment Technology System

source: Value Based Management

The PRVit Matrix: depicts a company’s PRVit score by plotting its “intrinsic” value score – what PRVit rates the firm is truly worth based on its risk-adjusted performance, i.e., its comparative P-R score – against its actual valuation score – which reflects the company’s current trading multiples. Companies rated “Hold” plot along the diagonal, which is where the firms’ actual valuation multiples align with their intrinsic values. “Buys” plot in the upper right green zone, which is where PRVit rates the firms as worth more than their current share values, and “Sells” appear in the lower left red zone, where the firms’ P-R scores fall short of their V scores. The top grid rates the firms against the entire market, and the lower one ranks them against

industry peers (which is the basis for the official “PRVit” score).

References

- ↑ What is Performance-Risk-Valuation Investment Technology (PRVit)? EVA Dimensions?

Further Reading

How The PRVit System Ranks Stocks Forbes