Difference between revisions of "Predictive Analytics"

(Predictive analytics is the practice of extracting information from existing data sets in order to determine patterns and predict future outcomes and trends.) |

|||

| (One intermediate revision by the same user not shown) | |||

| Line 1: | Line 1: | ||

| − | Predictive | + | '''Predictive Analytics''' is the practice of extracting information from existing data sets in order to determine patterns and predict future outcomes and trends. Predictive analytics does not tell you what will happen in the future. It forecasts what might happen in the future with an acceptable level of reliability, and includes what-if scenarios and risk assessment.<ref>Definition of Predictive Analysis [http://www.webopedia.com/TERM/P/predictive_analytics.html Webopedia]</ref> |

| Line 5: | Line 5: | ||

| − | '''The Importance of Predictive Analytics'''<ref>Why is predictive analytics important? [https://www.sas.com/en_us/insights/analytics/predictive-analytics.html# SAS]</ref> | + | '''The Importance of Predictive Analytics'''<ref>Why is predictive analytics important? [https://www.sas.com/en_us/insights/analytics/predictive-analytics.html# SAS]</ref><br /> |

Organizations are turning to predictive analytics to help solve difficult problems and uncover new opportunities. Common uses include: | Organizations are turning to predictive analytics to help solve difficult problems and uncover new opportunities. Common uses include: | ||

*Detecting fraud. Combining multiple analytics methods can improve pattern detection and prevent criminal behavior. As cybersecurity becomes a growing concern, high-performance behavioral analytics examines all actions on a network in real time to spot abnormalities that may indicate fraud, zero-day vulnerabilities and advanced persistent threats. | *Detecting fraud. Combining multiple analytics methods can improve pattern detection and prevent criminal behavior. As cybersecurity becomes a growing concern, high-performance behavioral analytics examines all actions on a network in real time to spot abnormalities that may indicate fraud, zero-day vulnerabilities and advanced persistent threats. | ||

| Line 27: | Line 27: | ||

| − | '''Types of Predictive Analytics'''<ref>What are the main types of predictive analytics? [http://www.fico.com/en/predictive-analytics/understanding-predictive-analytics/what-are-the-main-types-of-predictive-analytics|FICO]</ref> | + | '''Types of Predictive Analytics'''<ref>What are the main types of predictive analytics? [http://www.fico.com/en/predictive-analytics/understanding-predictive-analytics/what-are-the-main-types-of-predictive-analytics|FICO]</ref><br /> |

Predictive analytics is often used to mean predictive models. Increasingly, people are using the term to describe related analytic disciplines used to improve customer decisions. Since different forms of predictive analytics tackle slightly different customer decisions, they are commonly used together. | Predictive analytics is often used to mean predictive models. Increasingly, people are using the term to describe related analytic disciplines used to improve customer decisions. Since different forms of predictive analytics tackle slightly different customer decisions, they are commonly used together. | ||

*[[Predictive_Modeling|PREDICTIVE MODELS]]: Predictive models analyze past performance to “predict” how likely a customer is to exhibit a specific behavior in the future—for example, likelihood of a consumer to attrite or churn. This category also encompasses models that “detect” subtle data patterns to answer questions about customer behavior, such as fraud detection models. Predictive models are often embedded in operational processes and activated during live transactions. The models analyze historical and transactional data to isolate patterns: what a fraudulent transaction looks like, what a risky customer looks like, what characterizes a customer likely to switch providers. These analyses weigh the relationship between hundreds of data elements to isolate each customer’s risk or potential, which guides the action on that customer. | *[[Predictive_Modeling|PREDICTIVE MODELS]]: Predictive models analyze past performance to “predict” how likely a customer is to exhibit a specific behavior in the future—for example, likelihood of a consumer to attrite or churn. This category also encompasses models that “detect” subtle data patterns to answer questions about customer behavior, such as fraud detection models. Predictive models are often embedded in operational processes and activated during live transactions. The models analyze historical and transactional data to isolate patterns: what a fraudulent transaction looks like, what a risky customer looks like, what characterizes a customer likely to switch providers. These analyses weigh the relationship between hundreds of data elements to isolate each customer’s risk or potential, which guides the action on that customer. | ||

Revision as of 18:49, 28 May 2020

Predictive Analytics is the practice of extracting information from existing data sets in order to determine patterns and predict future outcomes and trends. Predictive analytics does not tell you what will happen in the future. It forecasts what might happen in the future with an acceptable level of reliability, and includes what-if scenarios and risk assessment.[1]

Analytics gives your business the data it needs to isolate and identify particular trends and characteristics that either contribute to its goals or detract from them. Predictive analytics applies that data to a model of the future, to help you do more than speculate about the extent of the impacts these trends will have. Anybody who’s used a spreadsheet more than twice has used a forecasting formula to spot a trend in a series of numbers, or apply a trend line or curve to a scatter plot. Those same formulas applied to the weather would have us all burn or freeze to death by the end of the season. Truly predictive analytics is far more sophisticated than a geometric trend line, and can model the repercussions of decisions you haven’t made yet.[2]

The Importance of Predictive Analytics[3]

Organizations are turning to predictive analytics to help solve difficult problems and uncover new opportunities. Common uses include:

- Detecting fraud. Combining multiple analytics methods can improve pattern detection and prevent criminal behavior. As cybersecurity becomes a growing concern, high-performance behavioral analytics examines all actions on a network in real time to spot abnormalities that may indicate fraud, zero-day vulnerabilities and advanced persistent threats.

- Optimizing marketing campaigns. Predictive analytics are used to determine customer responses or purchases, as well as promote cross-sell opportunities. Predictive models help businesses attract, retain and grow their most profitable customers.

- Improving operations. Many companies use predictive models to forecast inventory and manage resources. Airlines use predictive analytics to set ticket prices. Hotels try to predict the number of guests for any given night to maximize occupancy and increase revenue. Predictive analytics enables organizations to function more efficiently.

- Reducing risk. Credit scores are used to assess a buyer’s likelihood of default for purchases and are a well-known example of predictive analytics. A credit score is a number generated by a predictive model that incorporates all data relevant to a person’s creditworthiness. Other risk-related uses include insurance claims and collections.

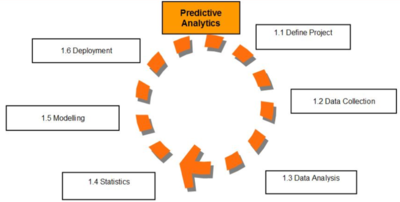

Predictive Analytics Process (Figure 1.)[4]

1.Define Project: Define the project outcomes, deliverables, scoping of the effort, business objectives, identify the data sets which are going to be used.

2.Data Collection: Data Mining for predictive analytics prepares data from multiple sources for analysis. This provides a complete view of the customer interactions.

3. Data Analysis: Data Analysis is the process of inspecting, cleaning, transforming, and modeling data with the objective of discovering useful information, arriving at conclusions.

4.Statistics: Statistical Analysis enables to validate the assumptions, hypotheses and test them with using standard statistical models.

5.Modeling: Predictive Modeling provides the ability to automatically create accurate predictive models about future. There are also options to choose the best solution with multi model evaluation.

6.Deployment: Predictive Model Deployment provides the option to deploy the analytical results in to the every day decision making process to get results, reports and output by automating the decisions based on the modeling.

7.Model Monitoring: Models are managed and monitored to review the model performance to ensure that it is providing the results expected.

Figure 1. source: Predictive Analytics Today

Types of Predictive Analytics[5]

Predictive analytics is often used to mean predictive models. Increasingly, people are using the term to describe related analytic disciplines used to improve customer decisions. Since different forms of predictive analytics tackle slightly different customer decisions, they are commonly used together.

- PREDICTIVE MODELS: Predictive models analyze past performance to “predict” how likely a customer is to exhibit a specific behavior in the future—for example, likelihood of a consumer to attrite or churn. This category also encompasses models that “detect” subtle data patterns to answer questions about customer behavior, such as fraud detection models. Predictive models are often embedded in operational processes and activated during live transactions. The models analyze historical and transactional data to isolate patterns: what a fraudulent transaction looks like, what a risky customer looks like, what characterizes a customer likely to switch providers. These analyses weigh the relationship between hundreds of data elements to isolate each customer’s risk or potential, which guides the action on that customer.

- DESCRIPTIVE MODELS: Unlike predictive models that predict a single customer behavior (such as attrition risk), descriptive models identify many different relationships between customers or products. Descriptive models “describe” relationships in data in a way that is often used to classify customers or prospects into groups. For example, a descriptive model may categorize customers into various groups with different buying patterns. This may be useful in applying marketing strategies or determining price sensitivity.

- DECISION MODELS: Decision models predict the outcomes of complex decisions in much the same way predictive models predict customer behavior. By mapping the relationships between all the elements of a decision—the known data, the decision and the forecast results of the decision—decision models predict what will happen if a given action is taken. For example, a decision model could determine the appropriate number of drug samples to send to each physician that would result in a written prescription. A decision model considers economic and business drivers and constraints that a predictive model would not.

Applications of Predictive Analytics[6]

Although predictive analytics can be put to use in many applications, we outline a few examples where predictive analytics has shown positive impact in recent years.

- Analytical Customer Relationship Management (CRM): Analytical customer relationship management (Analytical CRM) is a frequent commercial application of predictive analysis. Methods of predictive analysis are applied to customer data to pursue CRM objectives, which involve constructing a holistic view of the customer no matter where their information resides in the company or the department involved. CRM uses predictive analysis in applications for marketing campaigns, sales, and customer services to name a few. These tools are required in order for a company to posture and focus their efforts effectively across the breadth of their customer base. They must analyze and understand the products in demand or have the potential for high demand, predict customers' buying habits in order to promote relevant products at multiple touch points, and proactively identify and mitigate issues that have the potential to lose customers or reduce their ability to gain new ones. Analytical customer relationship management can be applied throughout the customers lifecycle (acquisition, relationship growth, retention, and win-back). Several of the application areas described below (direct marketing, cross-sell, customer retention) are part of customer relationship management.

- Child Protection: Over the last 5 years, some child welfare agencies have started using predictive analytics to flag high risk cases.The approach has been called "innovative" by the Commission to Eliminate Child Abuse and Neglect Fatalities (CECANF), and in Hillsborough County, Florida, where the lead child welfare agency uses a predictive modeling tool, there have been no abuse-related child deaths in the target population as of this writing.

- Clinical Decision Support Systems: Experts use predictive analysis in health care primarily to determine which patients are at risk of developing certain conditions, like diabetes, asthma, heart disease, and other lifetime illnesses. Additionally, sophisticated clinical decision support systems incorporate predictive analytics to support medical decision making at the point of care. A working definition has been proposed by Jerome A. Osheroff and colleagues: Clinical decision support (CDS) provides clinicians, staff, patients, or other individuals with knowledge and person-specific information, intelligently filtered or presented at appropriate times, to enhance health and health care. It encompasses a variety of tools and interventions such as computerized alerts and reminders, clinical guidelines, order sets, patient data reports and dashboards, documentation templates, diagnostic support, and clinical workflow tools.

- Collection Analytics: Many portfolios have a set of delinquent customers who do not make their payments on time. The financial institution has to undertake collection activities on these customers to recover the amounts due. A lot of collection resources are wasted on customers who are difficult or impossible to recover. Predictive analytics can help optimize the allocation of collection resources by identifying the most effective collection agencies, contact strategies, legal actions and other strategies to each customer, thus significantly increasing recovery at the same time reducing collection costs.

- Cross-Sell: Often corporate organizations collect and maintain abundant data (e.g. customer records, sale transactions) as exploiting hidden relationships in the data can provide a competitive advantage. For an organization that offers multiple products, predictive analytics can help analyze customers' spending, usage and other behavior, leading to efficient cross sales, or selling additional products to current customers. This directly leads to higher profitability per customer and stronger customer relationships.

- Customer Retention: With the number of competing services available, businesses need to focus efforts on maintaining continuous customer satisfaction, rewarding consumer loyalty and minimizing customer attrition. In addition, small increases in customer retention have been shown to increase profits disproportionately. One study concluded that a 5% increase in customer retention rates will increase profits by 25% to 95%. Businesses tend to respond to customer attrition on a reactive basis, acting only after the customer has initiated the process to terminate service. At this stage, the chance of changing the customer's decision is almost zero. Proper application of predictive analytics can lead to a more proactive retention strategy. By a frequent examination of a customer's past service usage, service performance, spending and other behavior patterns, predictive models can determine the likelihood of a customer terminating service sometime soon. An intervention with lucrative offers can increase the chance of retaining the customer. Silent attrition, the behavior of a customer to slowly but steadily reduce usage, is another problem that many companies face. Predictive analytics can also predict this behavior, so that the company can take proper actions to increase customer activity.

- Direct Marketing: When marketing consumer products and services, there is the challenge of keeping up with competing products and consumer behavior. Apart from identifying prospects, predictive analytics can also help to identify the most effective combination of product versions, marketing material, communication channels and timing that should be used to target a given consumer. The goal of predictive analytics is typically to lower the cost per order or cost per action.

- Fraud Detection: Fraud is a big problem for many businesses and can be of various types: inaccurate credit applications, fraudulent transactions (both offline and online), identity thefts and false insurance claims. These problems plague firms of all sizes in many industries. Some examples of likely victims are credit card issuers, insurance companies, retail merchants, manufacturers, business-to-business suppliers and even services providers. A predictive model can help weed out the "bads" and reduce a business's exposure to fraud. Predictive modeling can also be used to identify high-risk fraud candidates in business or the public sector. Mark Nigrini developed a risk-scoring method to identify audit targets. He describes the use of this approach to detect fraud in the franchisee sales reports of an international fast-food chain. Each location is scored using 10 predictors. The 10 scores are then weighted to give one final overall risk score for each location. The same scoring approach was also used to identify high-risk check kiting accounts, potentially fraudulent travel agents, and questionable vendors. A reasonably complex model was used to identify fraudulent monthly reports submitted by divisional controllers.The Internal Revenue Service (IRS) of the United States also uses predictive analytics to mine tax returns and identify tax fraud. Recent advancements in technology have also introduced predictive behavior analysis for web fraud detection. This type of solution utilizes heuristics in order to study normal web user behavior and detect anomalies indicating fraud attempts.

- Portfolio: Product or Economy-level Prediction: Often the focus of analysis is not the consumer but the product, portfolio, firm, industry or even the economy. For example, a retailer might be interested in predicting store-level demand for inventory management purposes. Or the Federal Reserve Board might be interested in predicting the unemployment rate for the next year. These types of problems can be addressed by predictive analytics using time series techniques. They can also be addressed via machine learning approaches which transform the original time series into a feature vector space, where the learning algorithm finds patterns that have predictive power.

- Project Risk Management: When employing risk management techniques, the results are always to predict and benefit from a future scenario. The capital asset pricing model (CAP-M) "predicts" the best portfolio to maximize return. Probabilistic risk assessment (PRA) when combined with mini-Delphi techniques and statistical approaches yields accurate forecasts. These are examples of approaches that can extend from project to market, and from near to long term. Underwriting (see below) and other business approaches identify risk management as a predictive method.

- Underwriting: Many businesses have to account for risk exposure due to their different services and determine the cost needed to cover the risk. For example, auto insurance providers need to accurately determine the amount of premium to charge to cover each automobile and driver. A financial company needs to assess a borrower's potential and ability to pay before granting a loan. For a health insurance provider, predictive analytics can analyze a few years of past medical claims data, as well as lab, pharmacy and other records where available, to predict how expensive an enrollee is likely to be in the future. Predictive analytics can help underwrite these quantities by predicting the chances of illness, default, bankruptcy, etc. Predictive analytics can streamline the process of customer acquisition by predicting the future risk behavior of a customer using application level data. Predictive analytics in the form of credit scores have reduced the amount of time it takes for loan approvals, especially in the mortgage market where lending decisions are now made in a matter of hours rather than days or even weeks. Proper predictive analytics can lead to proper pricing decisions, which can help mitigate future risk of default.

Predictive Analytics vs. Forecasting[7]

Predictive analytics is something else entirely, going beyond standard forecasting by producing a predictive score for each customer or other organizational element. In contrast, forecasting provides overall aggregate estimates, such as the total number of purchases next quarter. For example, forecasting might estimate the total number of ice cream cones to be purchased in a certain region, while predictive analytics tells you which individual customers are likely to buy an ice cream cone.

Benefits of Predictive Analytics[8]

Beyond data, predictive analytics can result in a positive impact across the entire organization. The immediate benefits of apply predictive analytics are usually realized first by marketers but eventually it can transform the entire organization into data-driven and customer-centric culture.

1. Boost Confidence: In business, as in life, the more you know about a likely outcome, the more confident you will be that the decision you are about to make is the right one. Predictive analytics can give you an idea of every possible probability so your team and your organization can assess the risks, the pursuant actions and the potential ROI to better manage results.

2. Gain a Competitive Advantage: Predictive analytics can enable speed and agility for your organization, which in turn can translate into a competitive advantage. How? The faster you can gain insight, the quicker you take action which then enables you to learn, innovate and pull ahead of the competition. Not to mention that using predictive analytics to create intent-based personalization can improve customer retention and increase revenue opportunities, moving your company to the top.

3. Quell Uncertainties: Uncertainty, the unknown, or fear of flying blind – regardless of the adjective, this is something keeping executives up at night. Whether it’s uncertainty over customer retention or products it can translate into a huge organizational problem – when business leaders are facing uncertainty then decision-making can be overwhelming. Predictive analytics can provide enough insight to solve a lot of business uncertainty and encourage swift decisions based on data.

4. Influence Cross-Functional Collaboration: Organizations that map the customer journey and optimize touchpoints usually rely on inputs from other areas of the organization – as data should not be siloed, neither should departments. As organizations experience the impact of using predictive analytics in marketing, the scope and applicability of enterprise data widens, essentially creating a customer-centric organization where cross-functional collaboration becomes the norm not the exception. And as the organization transforms itself into an advanced analytics culture, the insights generated through predictive analytics can eventually be distributed throughout the organization to one-day influence design or production.

5. Optimize Marketing Productivity: Marketers are under pressure to drive effectiveness as well as efficiency – the two products that define marketing productivity. With predictive analytics, marketers have the ability to see trends and outliers, inform key insights and enable better decision-making. Predictive analytics empowers marketers to be better at what they are already doing, to identify individuals who have the highest propensity to buy and to give marketers an advantage in optimizing campaigns, lowering the costs and generating better ROI.

See Also

Business Intelligence

Big Data

Data Analysis

Data Analytics

References

- ↑ Definition of Predictive Analysis Webopedia

- ↑ What is Predictive Analytics? TomsITPro

- ↑ Why is predictive analytics important? SAS

- ↑ Predictive Analytics Process PredictiveAnalyticsToday.com

- ↑ What are the main types of predictive analytics? [1]

- ↑ What are the Applications of Predictive Analytics? Wikipedia

- ↑ How is predictive analytics different from forecasting? predictiveanalyticsworld.com

- ↑ 5 Benefits of Predictive Analytics Canopy Labs

Further Reading

- The Shortcomings of Predictive Analytics TDWI

- Love or Hate It, Why Predictive Analytics Is The Next Big Thing Inc

- The Promise and Peril of Predictive Analytics in Higher Education Manuela Ekowo, Iris Palmer

- Limitations of Predictive Analytics: Lessons for Data Scientists Dataversity