Business Plan

A business plan is a written document that describes in detail how a business — usually a new one — is going to achieve its goals. A business plan lays out a written plan from a marketing, financial and operational viewpoint. Business plans are important to allow a company to lay out its goals and attract investment. They are also a way for companies to keep themselves on track going forward. Although they're especially useful for new companies, every company should have a business plan. Ideally, a company would revisit the plan periodically to see if goals have been met or have changed and evolved. Sometimes, a new business plan is prepared for an established business that is moving in a new direction.[1]

Elements of A Business Plan[2]

There are four common elements to an excellent business plan.

- 1. Company Overview

- An explanation of why your company is relevant and the need are you addressing

- A description of corporate priorities and the processes to achieve them.

- An overview of the various resources, including the people that will be needed, to deliver what’s expected by the customer.

- 2. Market Overview

- A description of the state of your market and its important trends.

- A detailed description of your customers.

- A description of your current competitors and their advantages. Which ones will you displace?

- 3. Product/Service Overview

- A description of your products, how they compete with other brands, and why they are needed.

- An explanation of why customers will pay a fair economic value for your product or service. This element is conspicuously absent from some of today’s most expensive unicorns. Companies such as Uber and Tesla are losing massive amounts of money on rapidly growing sales because these companies may not be selling their services/products for fair economic value. Of course, sales grow rapidly when customers can buy your services/products for far less than their fair economic values!

- 4. Financial Projections

- Three thorough financial plans:

- Conservative

- Moderate

- Optimistic

- Each scenario should have realistic and achievable sales, margins, expenses, and profits on monthly, quarterly, and annual bases. Again, these elements appear to be conspicuously absent from some of today’s most expensive unicorns.

- Three thorough financial plans:

Types of Business Plans[3]

- One-Page Business Plan: A one-page business plan is exactly what it sounds like: a quick summary of your business delivered on a single page. No, this doesn’t mean a very small font size and cramming tons of information onto a single page — it means that the business is described in very concise language that is direct and to-the-point. A one-page business plan can serve two purposes. First, it can be a great tool to introduce the business to outsiders, such as potential investors. Since investors have very little time to read detailed business plans, a simple one-page plan is often a better approach to get that first meeting. Later in the process, a more detailed plan will be needed, but the one-page plan is great for getting in the door. This simple plan format is also great for early-stage companies that just want to sketch out their idea in broad strokes. Think of the one-page business plan as an expanded version of jotting your idea down on a napkin. Keeping the business idea on one page makes it easy to see the entire concept at a glance and quickly refine concepts as new ideas come up. Learn more about how to create a one-page business plan.

- The Lean Business Plan: A Lean Plan is more detailed than a one-page plan and includes more financial information, but it’s not as long as a traditional business plan. Lean Plans are more likely to be used internally as tools for strategic planning and growth. The Lean Business Plan dispenses with the formalities that are needed when presenting a plan externally for a loan or investment and focuses almost exclusively on business strategy, tactics, milestones, metrics, budgets, and forecasts. These lean business plans skip sections like company history and management team since everyone in the company almost certainly knows this information. You don’t do an exit strategy section of your business plan if you’re not writing for investors and therefore you aren’t concerned with an exit. The simplest lean business plan uses bullet points to define strategy, tactics, concrete specific dates and tasks, and essential numbers including projected sales, spending, and cash flow. It’s just five to 10 pages when printed. And few Lean Plans need printing. Leave them on the computer. Review and revise them at least once a month. The first Lean Plan takes just a few hours to do (or less), and a monthly review and revision can take only an hour or two per month. Lean business plans are management tools used to guide the growth of both startups and existing businesses. They help business owners think through strategic decisions and measure progress towards goals.

- External Business Plan (a.k.a the standard business plan document): External business plans, the formal business plan documents, are designed to be read by outsiders to provide information about a business. The most common use of a full business plan is to convince investors to fund a business, and the second most common is to support a loan application. Occasionally this type of business plan is also used to recruit or train or absorb key employees, but that is much less common. A formal business plan document is an extension of the internal business plan, or the Lean Plan. It’s mostly a snapshot of the internal plan as it existed at a certain time. But while the an internal plan is short on polish and formality, a formal business plan document should be very well-presented, with more attention to detail in the language and format. See example business plans in our sample plan library to give you an idea of what the finished product might look like. In addition, an external plan details how potential funds are going to be used. Investors don’t just hand over cash with no strings attached—they want to understand how their funds will be used and what the expected return on their investment is. Finally, external plans put a strong emphasis on the team that is building the company. Investors invest in people rather than ideas, so it’s critical to include biographies of key team members and how their background and experience is going to help grow the company.

Components of a Good Business Plan[4]

The 10 components of a business plan are as follows:

- Executive Summary: The executive summary should appear first in your business plan. It should summarize what you expect your business to accomplish. Since it’s meant to highlight what you intend to discuss in the rest of the plan, the Small Business Administration suggests that you write this section last. A good executive summary is compelling. It reveals the company’s mission statement, along with a short description of its products and services. It might also be a good idea to briefly explain why you’re starting your company and include details about your experience in the industry you’re entering.

- Company Description: The next section that should appear in your business plan is a company description. It’s best to include key information about your business, your goals and the customers you plan to serve. Your company description should also discuss how your business will stand out from others in the industry and how the products and services you’re providing will be helpful to your target audience.

- Market Analysis: Ideally, your market analysis will show that you know the ins and outs of the industry and the specific market you’re planning to enter. In that section, you’ll need to use data and statistics to talk about where the market has been, where it’s expected to go and how your company will fit into it. In addition, you’ll have to provide details about the consumers you’ll be marketing to, such as their income levels.

- Competitive Analysis: good business plan will present a clear comparison of your business to your direct and indirect competitors. You’ll need to show that you know their strengths and weaknesses and you know how your business will stack up. If there are any issues that could prevent you from jumping into the market, like high upfront costs, it’s best to say so. This information will go in your market analysis section.

- Description of Management and Organization: Following your market analysis, your business plan will outline the way that your organization will be set up. You’ll introduce your company managers and summarize their skills and primary job responsibilities. If you want to, you can create a diagram that maps out your chain of command. Don’t forget to indicate whether your business will operate as a partnership, a sole proprietorship or a business with a different ownership structure. If you have a board of directors, you’ll need to identify the members.

- Breakdown of Your Products and Services: If you didn’t incorporate enough facts about your products and services into your company description (since that section is meant to be an overview), it might be a good idea to include extra information about them in a separate section. Whoever’s reading this portion of your business plan should know exactly what you’re planning to create and sell, how long your products are supposed to last and how they’ll meet an existing need. It’s a good idea to mention your suppliers, too. If you know how much it’ll cost to make your products and how much money you’re hoping to bring in, those are great details to add. You’ll need to list anything related to patents and copyright concerns as well.

- Marketing Plan: In your business plan, it’s important to describe how you intend to get your products and services in front of potential clients. That’s what marketing is all about. As you pinpoint the steps you’re going to take to promote your products, you’ll need to mention the budget you’ll need to implement your strategies.

- Sales Strategy: How will you sell the products you’re building? That’s the most important question you’ll answer when you discuss your sales strategy. It’s best to be as specific as possible. It’s a good idea to throw in the number of sales reps you’re planning to hire and how you’ll go about finding them and bringing them on board. You can also include sales targets.

- Request for Funding: If you need funding, you can devote an entire section to talking about the amount of money you need and how you plan to use the capital you’re trying to raise. If you’ll need extra cash in a year or two to complete a certain project, that’s something that’s important to disclose.

- Financial Projections: In the final section of your business plan, you’ll reveal the financial goals and expectations that you’ve set based on market research. You’ll report your anticipated revenue for the first 12 months and your annual projected earnings for the second, third, fourth and fifth years of business.

The Need For A Business Plan[5]

A business plan is important in that it serves two core purposes; it provides 1) financial validation and 2) serves as a roadmap.

- Financial Validation: With regards to financial validation, your business plan gives a strong indication, to both you and outside funding sources, as to whether your venture will be financially successful. Your financial projections, if completed properly (more on this below), allow financing sources to calculate whether you’ll be able to repay your loan or provide an appropriate Return on Investment. Importantly, the written sections of your business plan support your financial projections. For instance, the Industry Analysis section must prove that your market size is large enough to support your success. And your Marketing Plan section must show that you’ll be employing promotional tactics that allow you to attract customers at a reasonable cost.

- Serves as a Roadmap: In particular, the Operations Plan section of your business plan lays out your action plan. It details the key accomplishments and milestones you have established and when you expect to complete this. The roadmap gives you and your team a clear path to follow. It keeps you focused and improves your odds of reaching the goals you’ve set.

The Audience for Business Plans[6]

Business plans may be internally or externally focused. Externally-focused plans draft goals that are important to outside stakeholders, particularly financial stakeholders. These plans typically have detailed information about the organization or the team making effort to reach its goals. With for-profit entities, external stakeholders include investors and customers, for non-profits, external stakeholders refer to donors and clients, for government agencies, external stakeholders are the tax-payers, higher-level government agencies, and international lending bodies such as the International Monetary Fund, the World Bank, various economic agencies of the United Nations, and development banks. Internally-focused business plans target intermediate goals required to reach the external goals. They may cover the development of a new product, a new service, a new IT system, a restructuring of finance, the refurbishing of a factory or a restructuring of the organization. An internally-focused business plan is often developed in conjunction with a balanced scorecard or a list of critical success factors. This allows success of the plan to be measured using non-financial measures. Business plans that identify and target internal goals, but provide only general guidance on how they will be met are called strategic plans. Operational plans describe the goals of an internal organization, working group or department. Project plans, sometimes known as project frameworks, describe the goals of a particular project. They may also address the project's place within the organization's larger strategic goals.

Who Needs a Business Plan[7]

About the only person who doesn't need a business plan is one who's not going into business. You don't need a plan to start a hobby or to moonlight from your regular job. But anybody beginning or extending a venture that will consume significant resources of money, energy or time, and that is expected to return a profit, should take the time to draft some kind of plan.

- Startups: The classic business plan writer is an entrepreneur seeking funds to help start a new venture. Many, many great companies had their starts on paper, in the form of a plan that was used to convince investors to put up the capital necessary to get them under way. Most books on business planning seem to be aimed at these startup business owners. There's one good reason for that: As the least experienced of the potential plan writers, they're probably most appreciative of the guidance. However, it's a mistake to think that only cash-starved startups need business plans. Business owners find plans useful at all stages of their companies' existence, whether they're seeking financing or trying to figure out how to invest a surplus.

- Established firms seeking help: Not all business plans are written by starry-eyed entrepreneurs. Many are written by and for companies that are long past the startup stage. WalkerGroup/Designs, for instance, was already well-established as a designer of stores for major retailers when founder Ken Walker got the idea of trademarking and licensing to apparel makers and others the symbols 01-01-00 as a sort of numeric shorthand for the approaching millennium. Before beginning the arduous and costly task of trademarking it worldwide, Walker used a business plan complete with sales forecasts to convince big retailers it would be a good idea to promise to carry the 01-01-00 goods. It helped make the new venture a winner long before the big day arrived. "As a result of the retail support up front," Walker says, "we had over 45 licensees running the gamut of product lines almost from the beginning." These middle-stage enterprises may draft plans to help them find funding for growth just as the startups do, although the amounts they seek may be larger and the investors more willing. They may feel the need for a written plan to help manage an already rapidly growing business. Or a plan may be seen as a valuable tool to be used to convey the mission and prospects of the business to customers, suppliers or others.

Common Business Plan Mistakes[8]

- Not bothering to write one: This is far and away the most common error. Entrepreneurs are doers so it's natural that they want to get on with things and get them done – especially when they have an idea that they’re excited about buzzing around in their heads. But who hasn’t heard the adage "He who fails to plan plans to fail?" And that's the fate of almost every business someone starts without a business plan; failure. So yes, you need to write a business plan.

- Not being clear about the purpose of your business plan: A business plan is essentially a solution to a problem, the problem being how you are going to turn your vision of a successful business into a reality. So why are you preparing a business plan? Is it to persuade a potential lender to give you a business loan? Attract investors? Figure out if your new business idea could actually be turned into a viable business? Serve as a blueprint for your successful startup? The purpose of your business plan will affect everything from the amount of research you have to go through what the form of the finished plan will look like. If all you want to do is find out if a business idea is a good one that might be worth working up a business plan about, use these five questions to tell if your business plan idea is worth it.

- Not having a clear business model: A successful business has to make a profit. It's astonishing how many people who start small businesses don't seem to grasp this basic fact or are incredibly skilled at ignoring it. lanning to sell something is not a business model; a business model is a plan for generating revenue over and above your expenses. You can make the best mousetrap in the world, but if it costs you $90 to make each one and people are only willing to pay $10 for one, there’s no point to doing it as a business. By all means, if it provides you with personal satisfaction and you feel the cost is fair, do it. Otherwise, forget about it and move on to a business idea that does have profit potential. Professional and service businesses can be real dead-end traps if you don't have a clear business model set up.

- Not doing enough research: Not doing enough research to do the job is another common business plan mistake. Your business plan is only going to be as good as the research you put into it. To answer the central question of "Will this work?" you have to find the answers to a whole cluster of other questions, from "What are the current trends in this industry?" to "How will this business counter what its competitors are doing?" And the more complete the answers to the questions, the better prepared you'll be to either start your new business or shelve the idea and move on. Every section of the business plan will need research except for the Executive Summary. Fortunately, a lot of the required research can be done online, but there’s no getting around the fact that writing a business plan is a lot of work.

- Ignoring market realities: You and what you want to do are only one half of the equation of starting a successful business. The market is the other. You can have the best product or service in the entire world for sale but it doesn't matter if no one is willing to buy it. That is one bedrock, non-negotiable market reality. So it's crucial that you market test your product or service before you try to base a business on selling it. If you want to sell products, try selling them at local venues, such as farmers’ or flea markets and local trade shows, selling small batches online through eBay or Etsy, using focus groups to gauge interest, or giving out free samples and gathering people's feedback about them. If you want to sell services, surveys of potential interest or focus groups can work well. Do-It-Yourself Market Research explains how you can do your own market research, including tips for designing surveys and questionnaires. The competition is another market reality that has to be adequately dealt with in your business plan. It's not enough to just point out who they are; you need to examine what the competition is doing and explain specifically how you’re going to counter what they're doing to win market share. You have to make sure you take into account all the competition. Don't just think of those competitors operating exactly the same kind of businesses; think laterally, too, to be sure you identify all competitors. For instance, a prospective flower shop is not just competing against other flower shops in a particular area; it’s also competing with all the other local businesses that sell flowers, including grocery stores and big-box retailers and online flower sellers. That doesn't mean you have to list every potential competitor in your business plan and explain how you’re going to win the contest with them, but you do have to list and explain how you’re going to deal with the potential threat of each type of competition at least.

- Not doing a thorough preparation of financials: When you look at Writing the Financial Plan Section of the Business Plan, you'll see that you need to put together three financial statements:

- the income statement

- the cash flow projection

- the balance sheet

To do this, you need to figure out how much money you need to start and operate your business and make educated guesses about how much money your new business will bring during its first year of operation. There are two common mistakes people make when they're tackling this section of the business plan.

- The first is not being realistic about their expenses. People often leave out expenses entirely or underestimate the cost of particular expenses. Meticulous research will prevent this mistake.

- The second is being overly optimistic about your new business's prospects. You're hoping your new business will do well. You wouldn't choose to start it otherwise, but you mustn't let your optimism lead you to create overly rosy cash flow projections.

- Setting your business plan aside after you've written it: If you write a business plan, use it to get a loan and never look at it again, you're wasting most of its value. A business plan is just that; a plan for how your new business is going to succeed. Treat it as your new business's first planning document and as you move through the startup period and beyond, edit and add to it as necessary. A pair of good first additions to your business plan is the Vision Statement and the Mission Statement; creating these will solidify your goals and make sure you don't get sidetracked. Your original business plan will also be a useful reference document when you’re doing the ongoing business planning running a successful business requires. For instance, see Quick-Start Planning for Small Businesses for instructions on how to create an action plan for your small business.

- Not Every Business Plan is Worth Finishing: When you're writing a business plan, the answer to the central question, "Will this work?" is not always positive. And that's fine. It means the business plan is doing its job of showing you whether or not a business idea is worth doing and saving you potentially huge amounts of money and time. Usually, this discovery occurs during the course of working through a business plan, not at the end. And that's the time to quit developing that particular plan. If you discover, for instance, that the market for your proposed product is saturated while you're working on the Competitive Analysis section of the business plan, there's no point in carrying on and going to the trouble of preparing financials – your time is much better spent coming up with another business idea that may be more workable. Perseverance and determination are great traits for entrepreneurs to possess – until they turn into foolish persistence and keep you from accomplishing what you could be accomplishing. That can be the worst business plan mistake of all.

Business Plan Vs. Strategic Plan[9]

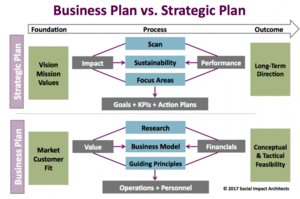

The truth is that strategic plans and business plans are more alike than different and can be combined together to create social sector genius. Business plans and pitches are more popular in the social sector than ever before, but this does not mean that strategic plans are not equally needed. In fact, a strategic business plan is a nice hybrid between the two. As the graphic below suggests, they have very similar recipes.

source: Social Impact Architects

The foundation of a strategic plan is vision, mission and values of an organization – all of which can be directly connected to an organization’s market, customer and fit. Both of these foundations serve as the “true north” for the organization, but they can and should be modified as the environment changes. The process between creating a strategic plan and a business plan are also remarkably similar. You start with an internal and external scan, or research, to gather insights on the best direction for the organization. Those insights become the basis for an organization’s strategy, which is value creation for a business and impact for a social sector organization. In both cases, value and impact must be coupled with sustainability through a strong business model or fundraising plan. Then, strategy is followed by execution, which can be set via goals, KPIs (key performance indicators) and an action plan, which are often tracked in a dashboard. A business plan takes execution to the next level of detail and dictates the resources needed to be successful, e.g., personnel, operations. However, the outcome associated with each planning process is different. A strategic plan charts the long-term direction of an organization, while a business plan tests the feasibility of a business or organization and builds a roadmap for implementation. Taken together, a business plan and strategic plan communicate the same thing – confidence in the future direction. So, the hybrid strategic business plan communicates not only your vision for the future, but also how you plan to get there. It combines hopes and dreams with reality.

Benefits of a Good Business Plan[10]

Here are the top ten benefits of a good business plan.

- See the Whole Business: Business planning done right connects the dots in your business so you get a better picture of the whole. Strategy is supposed to relate to tactics with strategic alignment. Does that show up in your plan? Do your sales connect to your sales and marketing expenses? Are your products right for your target market? Are you covering costs including long-term fixed costs, product development, and working capital needs as well? Take a step back and look at the larger picture.

- Strategic Focus: Startups and small business need to focus on their special identities, their target markets, and their products or services tailored to match.

- Set Priorities: You can’t do everything. Business planning helps you keep track of the right things, and the most important things. Allocate your time, effort, and resources strategically.

- Manage Change: With good planning process you regularly review assumptions, track progress, and catch new developments so you can adjust. Plan vs. actual analysis is a dashboard, and adjusting the plan is steering.

- Develop Accountability: Good planning process sets expectations and tracks results. It’s a tool for regular review of what’s expected and what happened. Good work shows up. Disappointments show up too. A well-run monthly plan review with plan vs. actual included becomes an impromptu review of tasks and accomplishments.

- Manage Cash: Good business planning connects the dots in cash flow. Sometimes just watching profits is enough. But when sales on account, physical products, purchasing assets, or repaying debts are involved, cash flow takes planning and management. Profitable businesses suffer when slow-paying clients or too much inventory constipate cash flow. A plan helps you see the problem and adjust to it.

- Strategic Alignment: Does your day-to-day work fit with your main business tactics? Do those tactics match your strategy? If so, you have strategic alignment. If not, the business planning will bring up the hidden mismatches. For example, if you run a gourmet restaurant that has a drive-through window, you’re out of alignment.

- Milestones: Good business planning sets milestones you can work towards. These are key goals you want to achieve, like reaching a defined sales level, hiring that sales manager, or opening the new location. We’re human. We work better when we have visible goals we can work towards.

- Metrics: Put your performance indicators and numbers to track into a business plan where you can see them monthly in the plan review meeting. Figure out the numbers that matter. Sales and expenses usually do, but there are also calls, trips, seminars, web traffic, conversion rates, returns, and so forth. Use your business planning to define and track the key metrics.

- Realistic Regular Reminders to Keep onTtrack: We all want to do everything for our customers, but sometimes we need to push back to maintain quality and strategic focus. It’s hard, during the heat of the everyday routine, to remember the priorities and focus. The business planning process becomes a regular reminder.

See Also

References

- ↑ Definition - What Does Business Plan Mean? Investopedia

- ↑ Four Key Elements of A Business Plan Toptal

- ↑ Overview of Three Common Types of Business Plans bplans.com

- ↑ What are the 10 components of a business plan? SmartAsset

- ↑ Why do you need a business plan? GrowThink

- ↑ The Audience for Business Plans Wikipedia

- ↑ Who Needs a Business Plan? Entrepreneur

- ↑ The Most Common Business Plan Mistakes the balance

- ↑ Business Plan Vs. Strategic Plan Social Impact Architects

- ↑ What are the Benefits of a Good Business Plan? Tim Berry

Further Reading

- How To Build A Billion Dollar Business Plan: 10 Top Points Alan Hall

- The Undeniable Importance of a Business Plan SEAN HEBERLING, CFA

- 10 Benefits of Business Planning for all Businesses Evanston Chamber of Commerce

- If You Can Write a Grant, You CAN Write a Business Plan Suzanne Smith