Profitability

Profitability is a situation in which an entity is generating a profit. Profitability arises when the aggregate amount of revenue is greater than the aggregate amount of expenses in a reporting period. If an entity is recording its business transactions under the accrual basis of accounting, it is quite possible that the profitability condition will not be matched by the cash flows generated by the organization, since some accrual-basis transactions (such as depreciation) do not involve cash flows.

Profitability can be achieved in the short term through the sale of assets that garner immediate gains. However, this type of profitability is not sustainable. An organization must have a business model that allows its ongoing operations to generate a profit, or else it will eventually fail. Profitability is one of the measures that can be used to derive the valuation of a business, usually as a multiple of the annual amount of profitability. A better approach to business valuation is a multiple of annual cash flows, since this better reflects the stream of net cash receipts that a buyer can expect to receive. Profitability is measured with the net profit ratio and the earnings per share ratio.[1]

Profitability Examples[2]

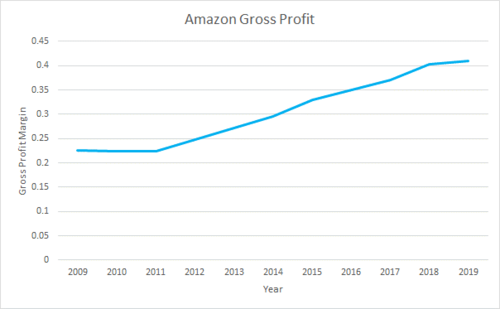

The next article in this series will go into detail about a plethora of ratios that you can use to analyze profitability. However, to illustrate profitability we are going to look at the Gross Profit Margin of Amazon using data from Amazon’s Income Statements. Firstly, what is the gross profit margin?

Equation: Gross profit margin = Gross Profit / Revenue

Gross profit is calculated by subtracting Cost Of Goods Sold (All the variable costs including direct labour, materials, packaging, and others) from Revenue. Luckily Income Statements show gross profit on them so you won’t have to calculate it.

What we see is that Amazon’s gross profit margin has grown steadily over the last 10 years. This is driven by Amazon’s disruption in the retail industry by their innovative business model. They have driven revenue growth by offering next day delivery (and same day delivery in some places) of almost any good you need and branching into live streamed entertainment with Prime Video. Amazon has cut costs at the same time by automating many services (such as warehouse picking) and manufacturing a lot of their own goods at a lower price than they could buy them for. From an investment perspective, they are becoming more monopolistic in the industries they serve which gives an investor confidence in their ability to keep growing as a company.

Reasons for Computing Profitability[3]

Whether you are recording profitability for the past period or projecting profitability for the coming period, measuring profitability is the most important measure of the success of the business. A business that is not profitable cannot survive. Conversely, a business that is highly profitable has the ability to reward its owners with a large return on their investment.

Increasing profitability is one of the most important tasks of business managers. Managers constantly look for ways to change the business to improve profitability. These potential changes can be analyzed with a pro forma income statement or a Partial Budget. Partial budgeting allows you to assess the impact on profitability of a small or incremental change in the business before it is implemented.

A variety of Profitability Ratios (Decision Tool) can be used to assess the financial health of a business. These ratios, created from the income statement, can be compared with industry benchmarks. Also, Five-Year Trend for Farm Financial Measures (Decision Tool) can be tracked over a period of years to identify emerging problems.

Profitability Vs. Profit[4]

Profit is an absolute number determined by the amount of income or revenue above and beyond the costs or expenses a company incurs. It is calculated as total revenue minus total expenses and appears on a company's income statement. No matter the size or scope of the business or the industry in which it operates, a company's objective is always to make a profit.

Profitability is closely related to profit – but with one key difference. While profit is an absolute amount, profitability is a relative one. It is the metric used to determine the scope of a company's profit in relation to the size of the business. Profitability is a measurement of efficiency – and ultimately its success or failure. A further definition of profitability is a business's ability to produce a return on an investment based on its resources in comparison with an alternative investment. Although a company can realize a profit, this does not necessarily mean that the company is profitable.

See Also

References

- ↑ What Does Profitability Mean? Accounting Tools

- ↑ Profitability Examples FMP

- ↑ Reasons for Computing Profitability Iowa State

- ↑ The Difference between Profitability and Profit Investopedia