Resource-Based View (RBV)

The Resource-Based View (RBV) (aka Resource-Based Theory) of the organization is a strategy for achieving competitive advantage that emerged during the 1980s and 1990s, following the works of academics and businessmen such as Birger Wernerfelt, Prahalad and Hamel, Spender and Grant. The core idea of the theory is that instead of looking at the competitive business environment to get a niche in the market or an edge over competition and threats, the organization should instead look within at the resources and potential it already has available.[1]

Resource-based theory contends that the possession of strategic resources provides an organization with a golden opportunity to develop competitive advantages over its rivals. These competitive advantages in turn can help the organization enjoy strong profits. Resource-based theory also stresses the merit of an old saying: the whole is greater than the sum of its parts. Specifically, it is also important to recognize that strategic resources can be created by taking several strategies and resources that each could be copied and bundling them together in a way that cannot be copied.[2]

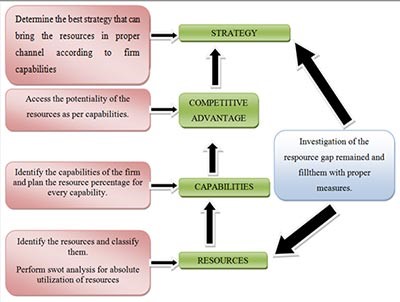

Resource-based theory, in other words, is regarded as one of the process which is based on inside-out strategy. The strategy focuses on the methods through which the firm collects resources (Das & Bing-Sheng 2000). The following diagram given below describes the formulation process of the resource based theory:

As per the Figure above there are two factors that are inter-dependent terms i.e. resource and capability and are integrated simultaneously (Das & Bing-Sheng 2000). The definition of the factors is given below:

- Resources are the inputs without which the production process will end up to a limit. As per the current situation, the major resources used in an organization are technology capacity, human resources, raw materials, the loyalty of the customers, financial supports etc (Hart 1995). Along with this, brands and patents can also be considered important resources.

- Capabilities are regarded as the capacity of the available resources with the firm and the techniques through which tasks of the firm are performed (Kozlenkova et al. 2014).

Both the factors are responsible for deciding the competitive advantages availed by the firm from the market.[3]

Developing an RBV Strategy[4]

The scope of strategy integration in the current business functions results in a competitive advantage. Managers should develop a plan in the RBV-centered organization to leverage internal resources to external opportunities and competition. Here are the different steps to develop a strategy when utilizing a resource-based view of the organization:

- Identify key resources and competencies: Identifying essential resources and skillset is the first step towards forming an effective RBV strategy for the organization.

- Allocate competent workforce to projects: After analyzing different resource attributes (skill sets, cost rate, location, available capacity, etc.), the next step is resource scheduling. Thus, strategic resource allocation is an essential step that facilitates deploying the right resources with the desired skill set to suitable projects.

- Leverage resources to multiple projects: As mentioned earlier, deploying resources to varied projects facilitates the shared service model in a matrix organization. It encourages the utilization of resources across multiple projects instead of one high-priority project. It will empower the overall resource utilization against their available capacity and enhance its profitability and reduce resourcing costs.

- Implement succession planning for niche skills: The resource managers must ensure that the sudden resignation of critical or niche resources does not jeopardize a project delivery. Therefore, an appropriate succession planning and backup strategy should be in place to replicate competent resources. It can be done in advance by providing proper training and development opportunities such as shadowing or knowledge transfer techniques to create its niche skill set.

- Conduct regular training to upskill the resource pool: It is worthwhile to invest in multi-skill building practices (Individual Development Plans or IDP) like training, workshops, and certifications. Such initiatives help the resources to diversify their professional spectrum, giving you a competitive advantage, especially against new entrants who are building upon their skills and expertise.

Resource-Based View Model[5]

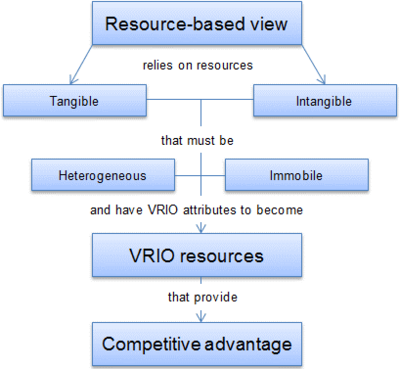

The following model explains RBV and emphasizes the key points of it.

source: Strategic Management Insights

According to RBV proponents, it is much more feasible to exploit external opportunities using existing resources in a new way rather than trying to acquire new skills for each different opportunity. In RBV model, resources are given the major role in helping companies to achieve higher organizational performance. There are two types of resources: tangible and intangible.

- Tangible assets are physical things. Land, buildings, machinery, equipment and [[Capital|capital[[ – all these assets are tangible. Physical resources can easily be bought in the market so they confer little advantage to the companies in the long run because rivals can soon acquire the identical assets.

- Intangible assets are everything else that has no physical presence but can still be owned by the company. Brand reputation, trademarks, intellectual property are all intangible assets. Unlike physical resources, brand reputation is built over a long time and is something that other companies cannot buy from the market. Intangible resources usually stay within a company and are the main source of sustainable competitive advantage.

The two critical assumptions of RBV are that resources must also be heterogeneous and immobile.

- Heterogeneous. The first assumption is that skills, capabilities and other resources that organizations possess differ from one company to another. If organizations would have the same amount and mix of resources, they could not employ different strategies to outcompete each other. What one company would do, the other could simply follow and no competitive advantage could be achieved. This is the scenario of perfect competition, yet real world markets are far from perfectly competitive and some companies, which are exposed to the same external and competitive forces (same external conditions), are able to implement different strategies and outperform each other. Therefore, RBV assumes that companies achieve competitive advantage by using their different bundles of resources.

The competition between Apple Inc. and Samsung Electronics is a good example of how two companies that operate in the same industry and thus, are exposed to the same external forces, can achieve different organizational performance due to the difference in resources. Apple competes with Samsung in tablets and smartphones markets, where Apple sells its products at much higher prices and, as a result, reaps higher profit margins. Why Samsung does not follow the same strategy? Simply because Samsung does not have the same brand reputation or is capable to design user-friendly products like Apple does. (heterogeneous resources)

- Immobile. The second assumption of RBV is that resources are not mobile and do not move from company to company, at least in short-run. Due to this immobility, companies cannot replicate rivals’ resources and implement the same strategies. Intangible resources, such as brand equity, processes, knowledge or intellectual property are usually immobile.

What Resources Drive Competitive Advantage[6]

The resource-based view has been widely applied to numerous areas of strategic management. According to this theory, each firm has different resources and thus may use different strategies to accomplish its goals. The extent to which these resources can be substituted or imitated determines whether or not your business can achieve sustainable competitive advantage.

Furthermore, the RBV assumes that a company's strategic resources are difficult to identify through formal analysis and thus, its competitors may find it difficult to replicate them. If, say, you have a creative genius on your team, your competitors may not be able to find and hire someone with similar skills and competencies. If you develop a proprietary software program, they may have a hard time creating a product that's just as good as yours or better than yours.

According to the RBV, not all resources have the potential to drive competitive advantage. In order to do so, they must be valuable, rare, inimitable and nonsubstitutable. The VRIO Framework, an integral component of this theory, emphasizes the same qualities except for "nonsubstitutable," which is replaced with "organization-wide supported".

Resources that enable a company to identify and leverage opportunities while protecting itself against threats are considered valuable. Those resources also need to be rare and inimitable, meaning that other companies don't have access to them or cannot easily imitate them. If your competitors use the same resources as you, your business cannot achieve superior performance. For example, resources derived from a company's history or culture may be difficult to imitate.

Organizations also need to focus on using resources that cannot be substituted. If other companies can develop software programs that are similar to yours, then you no longer hold a competitive advantage. According to the VRIO framework, a firm's resources must be supported by its organizational culture, structure and process. Without these elements, your business would not be able to leverage its assets and exploit the competitive advantage.

As a leader, you need to define your resources and determine which ones meet these criteria. These resources can be classified into three categories: human capital, physical capital and organizational capital. Make a list based on this classification and then try to figure out which resources are rare, inimitable or costly to imitate, valuable and nonsubstitutable.

Resource-Based View (RBV) - Origins and Background[7]

During the 1990s, the resource-based view (also known as the resource-advantage theory) of the firm became the dominant paradigm in strategic planning. RBV can be seen as a reaction against the positioning school and its somewhat prescriptive approach which focused managerial attention on external considerations, notably industry structure. The so-called positioning school had dominated the discipline throughout the 1980s. In contrast, the resource-based view argued that sustainable competitive advantage derives from developing superior capabilities and resources. Jay Barney's 1991 article, "Firm Resources and Sustained Competitive Advantage," is seen as pivotal in the emergence of the resource-based view.[2]

A number of scholars point out that a fragmentary resource-based perspective was evident from the 1930s, noting that Barney was heavily influenced by Wernerfelt's earlier work which introduced the idea of resource position barriers being roughly analogous to entry barriers in the positioning school. Other scholars suggest that the resource-based view represents a new paradigm, albeit with roots in "Ricardian and Penrosian economic theories according to which firms can earn sustainable supranormal returns if, and only if, they have superior resources and those resources are protected by some form of isolating mechanism precluding their diffusion throughout the industry." While its exact influence is debated, Edith Penrose's 1959 book The Theory of the Growth of the Firm is held by two scholars of strategy to state many concepts that would later influence the modern, resource-based theory of the firm.

The RBV is an interdisciplinary approach that represents a substantial shift in thinking. The resource-based view is interdisciplinary in that it was developed within the disciplines of economics, ethics, law, management, marketing, supply chain management and general business.

RBV focuses attention on an organization's internal resources as a means of organizing processes and obtaining a competitive advantage. Barney stated that for resources to hold potential as sources of sustainable competitive advantage, they should be valuable, rare, imperfectly imitable and not substitutable (now generally known as VRIN criteria). The resource-based view suggests that organizations must develop unique, firm-specific core competencies that will allow them to outperform competitors by doing things differently.

Although the literature presents many different ideas around the concept of the resource-advantage perspective, at its heart, the common theme is that the firm's resources are financial, legal, human, organizational, informational and relational; resources are heterogeneous and imperfectly mobile and that management's key task is to understand and organize resources for sustainable competitive advantage.[10] Key theorists who have contributed to the development of a coherent body of literature include Jay B. Barney, George S. Day, Gary Hamel, Shelby D. Hunt, G. Hooley and C.K. Prahalad.

Importance of Resource-based View Strategy

The resource-based view strategy aims to gain a sustainable competitive advantage. But how can an organization achieve this advantage? It is through extensive resource analysis, resource allocation, and cross-functional usage of resources. Only when a firm unleashes its workforce’s true potential can they innovate better and out-stand in the industry. Here is how an RBV strategy helps them achieve the same:

- Visibility for efficient resource allocation: The comprehensive view of all the resource pools facilitates managers to gain insight into resource skills and competencies. This, in turn, allows managers to allocate resources as per the scope and demand of the project. Real-time information helps them make data-driven decisions, leverage talent to the maximum potential, and maximize profitability.

- Maintains the competitive advantage: The rise in market volatility propels extensive ad hoc project demands, which often becomes the deciding factor for your company’s growth and success. In these situations, resource managers can utilize both their primary and secondary workforce skills to execute critical multi-faceted projects. A Resource-based view strategy on a centralized platform enables demand fulfillment to sustain their competitive advantage.

- Cross-functional usage of resources: In a matrix organization, the resource-based strategy model facilitates enterprise-wide visibility of the workforce and its expertise. It helps in allocating appropriate resources from different departments and form a cross-functional team to execute the project. It reduces hiring cycle costs and also helps to leverage the diversified workforce. Besides, employees are also given multi-faceted projects to work on enhancing their professional portfolio.

Criticisms of Resource-based View Strategy[8]

The RBV of the firm is a contemporary theory that provides insights on both strategic and organizational issues. An often-recurring critique on the RBV is that its core logic contains circular reasoning in the specification of the relationship between rents and resources (Truijens, 2003). It resulted based on the assumptions of firm heterogeneity and economists’ preference (Truijens, 2003). Rents are frequently used as firm’s critical resources which acknowledged by comparing successful firms with unsuccessful firms (Truijens, 2003; Mosakowski et al., 1997, p.2).

The RBV also emphasises on the role of human capital in the creation of CA, which at the same time caused issues for accountants in terms of total business and intangible asset valuation (Toms, 2010). Accountants equally are concerned with controls which prevent misappropriation of resources that ultimately are shareholders’ property. Thus, a theory of value also needs to be accountability (Toms, 2010).

See Also

VRIO Framework

Contingency Theory

Disruptive Innovation

Disruptive Technology

First-Mover Advantage (FMA)

X-Efficiency

Upper Echelons Theory

Stewardship Theory

Agency Theory

Five Case Model

Five Disciplines

Five Forces CRM Model

Five Forces Model

Five Whys

Five W's

Resource Scarcity Theory

Resource Dependence Theory

Resource Access Control Facility (RACF)

Resource Allocation

Resource Description Framework (RDF)

Resource Management

References

- ↑ Definition - What Does Resource-Based View Mean? Business Balls

- ↑ Definition: What is Resource-Based Theory? Saylordotorg

- ↑ Understanding the Resource-based Theory Project Guru

- ↑ How to Develop a Full-Proof RBV Strategy? Saviom

- ↑ Explaining the Resource-Based View Model SMI

- ↑ What Resources Drive Competitive Advantage? Bizfluent

- ↑ Resource-Based View (RBV) - Origins and Background Wikipedia

- ↑ Criticisms of Resource-based View Strategy UKessays