Chief Financial Officer (CFO)

Business Dictionary defines the Chief Financial Officer (CFO) as the "Senior-most executive responsible for financial control and planning of a firm or project. He or she is in charge of all accounting functions including

(1) credit control,

(2) preparing budgets and financial statements,

(3) coordinating financing and fund raising,

(4) monitoring expenditure and liquidity,

(5) managing investment and taxation issues,

(6) reporting financial performance to the board, and

(7) providing timely financial data to the CEO. Also called chief finance officer, comptroller, controller, or finance controller.[1]

The CFO reports to the chief executive officer (CEO) but has significant input in the company's investments, capital structure and how the company manages its income and expenses. The CFO works with other senior managers and plays a key role in a company's overall success, especially in the long run.he CFO may assist the CEO with forecasting, cost–benefit analysis and obtaining funding for various initiatives. In the financial industry, a CFO is the highest-ranking position, and in other industries, it is usually the third-highest position in a company. The CFO must report accurate information because many decisions are based on the data he provides. The CFO is responsible for managing the fiscal activities of a company and adhering to generally accepted accounting principles (GAAP) established by the Securities and Exchange Commission (SEC) and other regulatory entities. CFOs must also adhere to regulations such as the Sarbanes-Oxley Act that include provisions such as fraud prevention and disclosing financial information. Local, state and federal governments hire CFOs to oversee taxation issues. Typically, the CFO is the liaison between local residents and elected officials on accounting and other spending matters. The CFO sets financial policy and is responsible for managing government funds.A CFO can become a CEO, chief operating officer or president of a company.[2]

CFO Job Responsibilities[3]

The chief financial officer position is accountable for the administrative, financial, and risk management operations of the company, to include the development of a financial and operational strategy, metrics tied to that strategy, and the ongoing development and monitoring of control systems designed to preserve company assets and report accurate financial results. Principal accountabilities are:

- Planning

- Assist in formulating the company's future direction and supporting tactical initiatives

- Monitor and direct the implementation of strategic business plans

- Develop financial and tax strategies

- Manage the capital request and budgeting processes

- Develop performance measures that support the company's strategic direction

- Operations

- Participate in key decisions as a member of the executive management team

- Maintain in-depth relations with all members of the management team

- Manage the accounting, human resources, investor relations, legal, tax, and treasury departments

- Oversee the financial operations of subsidiary companies and foreign operations

- Manage any third parties to which functions have been outsourced

- Oversee the company's transaction processing systems

- Implement operational best practices

- Oversee employee benefit plans, with particular emphasis on maximizing a cost-effective benefits package

- Supervise acquisition due diligence and negotiate acquisitions

- Financial Information

- Oversee the issuance of financial information

- Personally review and approve all Form 8-K, 10-K, and 10-Q filings with the Securities and Exchange Commission

- Report financial results to the board of directors

- Risk Management

- Understand and mitigate key elements of the company's risk profile

- Monitor all open legal issues involving the company, and legal issues affecting the industry

- Construct and monitor reliable control systems

- Maintain appropriate insurance coverage

- Ensure that the company complies with all legal and regulatory requirements

- Ensure that record keeping meets the requirements of auditors and government agencies

- Report risk issues to the audit committee of the board of directors

- Maintain relations with external auditors and investigate their findings and recommendations

- Funding

- Monitor cash balances and cash forecasts

- Arrange for debt and equity financing

- Invest funds

- Invest pension funds

- Third Parties

- Participate in conference calls with the investment community

- Maintain banking relationships

- Represent the company with investment bankers and investors

Changing Role of the CFO[4]

In recent years, the role of the CFO has evolved significantly. Traditionally being viewed as a financial gatekeeper, the role of the CFO has expanded and evolved to a strategic partner and advisor to the Chief Executive Officer (CEO). In fact, in a report released by McKinsey, 88 percent of 164 CFOs surveyed reported that CEOs expect them to be more active participants in shaping the strategy of their organizations. Half of them also indicated that CEOs counted on them to challenge the company’s strategy. However a 2016 survey of CFOs suggests that their new role has been overhyped with 52% of CFOs still finding themselves bogged down in the basics of traditional accounting practices such as transaction reporting and unable to make time for business partnering. The rise of digital technologies and a focus on data analytics to support decision making impacting almost every industry and organization will only add more pressure for CFOs to address this tension on finding the time to make the time to meet the expectations of their C-Suite colleagues. Many organizations have embarked on the journey to help achieve this by creating a finance function based on 4 distinct pillars - An Accounting organization structured as a shared service, an FP&A organization responsible to drive financial planning processes as well as driving increased insight into financial and non financial KPIs that drive business performance, a Finance Business Partnering organization that supports the leadership of divisions, regions, functions to drive performance improvement and, last but not least, expertise centers around the areas of Tax, Treasury, Internal Audit, M&A etc. According to one source, "The CFO of tomorrow should be a big-picture thinker, rather than detail-oriented, outspoken rather than reserved, prefer to delegate rather than be hands-on, emphasize what gets done rather than how things are done, and make collaborative rather than unilateral decisions. The CFO must serve as the financial authority in the organization, ensuring the integrity of fiscal data and modeling transparency and accountability. The CFO is as much a part of governance and oversight as the Chief Executive Officer (CEO), playing a fundamental role in the development and critique of strategic choices. The CFO is now expected to be a key player in stockholder education and communication and is clearly seen as a leader and team builder who sets the financial agenda for the organization, supports the CEO directly and provides timely advice to the board of directors." The uneven pace of recovery worldwide has made it more challenging for many companies. CFOs are increasingly playing a more critical role in shaping their company’s strategies today, especially in light of the highly uncertain macroeconomic environments, where managing financial volatilities is becoming a centerpiece for many companies' strategies, based on a survey held by Clariden Global. CFOs are increasingly being relied upon as the owners of business information, reporting and financial data within organizations and assisting in decision support operations to enable the company to operate more effectively and efficiently. The duties of a modern CFO now straddle the traditional areas of financial stewardship and the more progressive areas of strategic and business leadership with direct responsibility and oversight of operations (which often includes procurement) expanding exponentially. This significant role-based transformation, which is well underway, is best-evidenced by the "CEO-in-Waiting" status that many CFOs now hold. Additionally, many CFOs have made the realization that an operating environment that values cash, profit margins, and risk mitigation is one that plays to the primary skills and capabilities of a procurement organization, and become increasingly involved (directly via oversight or indirectly through improved collaboration) with the procurement function according to a recent research report that looks at the CFO's relationship with procurement.

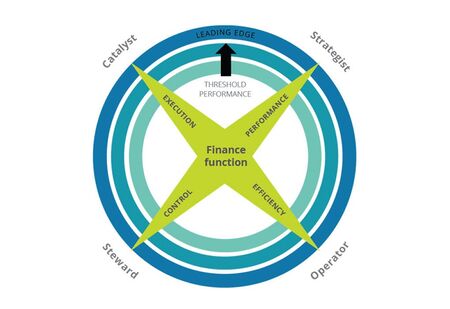

Four Faces of the CFO Framework[5]

According to the consulting firm Deloitte, today’s CFOs are expected to play four diverse and challenging roles. The two traditional roles are steward, preserving the assets of the organization by minimizing risk and getting the books right, and operator, running a tight finance operation that is efficient and effective. It’s increasingly important for CFOs to be strategists, helping to shape overall strategy and direction, and catalysts, instilling a financial approach and mind set throughout the organization to help other parts of the business perform better. These varied roles make a CFO’s job more complex than ever.

- Steward: CFOs work to protect the vital assets of the company, ensure compliance with financial regulations, close the books correctly, and communicate value and risk issues to investors and boards.

- Operator: CFOs have to operate an efficient and effective finance organization providing a variety of services to the business such as financial planning and analysis, treasury, tax, and other finance operations.

- Strategist: CFOs take a seat at the strategy planning table and help influence the future direction of the company. They are vital in providing financial leadership and aligning business and finance strategy to grow the business. In addition to M&A and capital market financing strategies, they can play an integral role in supporting other long-term investments of the company.

- Catalyst: CFOs can stimulate and drive the timely execution of change in the finance function or the enterprise. Using the power of their purse strings, they can selectively drive business improvement initiatives such as improved enterprise cost reduction, procurement, pricing execution, and other process improvements and innovations that add value to the company.

See Also

Chief Executive Officer (CEO)

Chief Information Officer (CIO)

Chief Digital Officer (CDO)

Chief Innovation Officer

Chief Operating Officer (COO)

Chief Procurement Officer (CPO)

Chief Risk Officer (CRO)

Chief Technology Officer (CTO)

CFO of IT Competency Model

Business Strategy

IT Strategy

e-Strategy

IT Governance

Enterprise Architecture

IT Sourcing

IT Operations

Business IT Alignment

References

- ↑ Chief Financial Officer (CFO) Definition Business Dictionary

- ↑ Breaking Down Chief Financial Officer Investopedia

- ↑ CFO Job Description - Basic and Broad Functions Accounting Tools

- ↑ Changing Role of the CFO Wikipedia

- ↑ Four Faces of the CFO Framework Deloitte

Further Reading

- The Changing Role of the Chief Financial Officer Boyden

- Four Faces of the CFO Deloitte

- 4 Key Functions of aChief Financial Officer Entrepreneur

- What Does it take to Become a CFO Journal of Accountancy

- The DNA of the CFO EY

- The Chief Financial Officer: What CFOs Do, the Influence they Have, and Why it Matters (Economist Books) Jason Karaian

- CFOs Are the New Digital Apostles Accenture

- The Imperial CFO Economist